|

|

HSBC Climate Paris Aligned UCITS ETFs

Aligned with the world’s efforts to reverse climate change

The Paris Agreement: a unified commitment to tackle global warming

Set during the 21st Conference of the Parties (COP21) in December 2015, the Paris Agreement is an international accord to address climate change concerns, aiming to reduce greenhouse gas emissions and ultimately limit global temperature rises to 1.5°C by 2050.

Investors are becoming increasingly aware of the threat climate change poses to their long-term objectives, and are endeavouring to limit global warming in line with the Paris Agreement by ensuring portfolios achieve net zero emissions by 2050.

Our Global and Regional Equity Exposures – MSCI Climate Paris Aligned Indices

The MSCI Climate Paris Aligned Indices provide investors with a pathway to support the decarbonisation of the economy while being compatible with the Paris Agreement requirements. The indices incorporate the recommendations of the Task Force on Climate Related Financial Disclosures (TCFD) and are designed to exceed the minimum requirements for the EU Paris Aligned Benchmark.

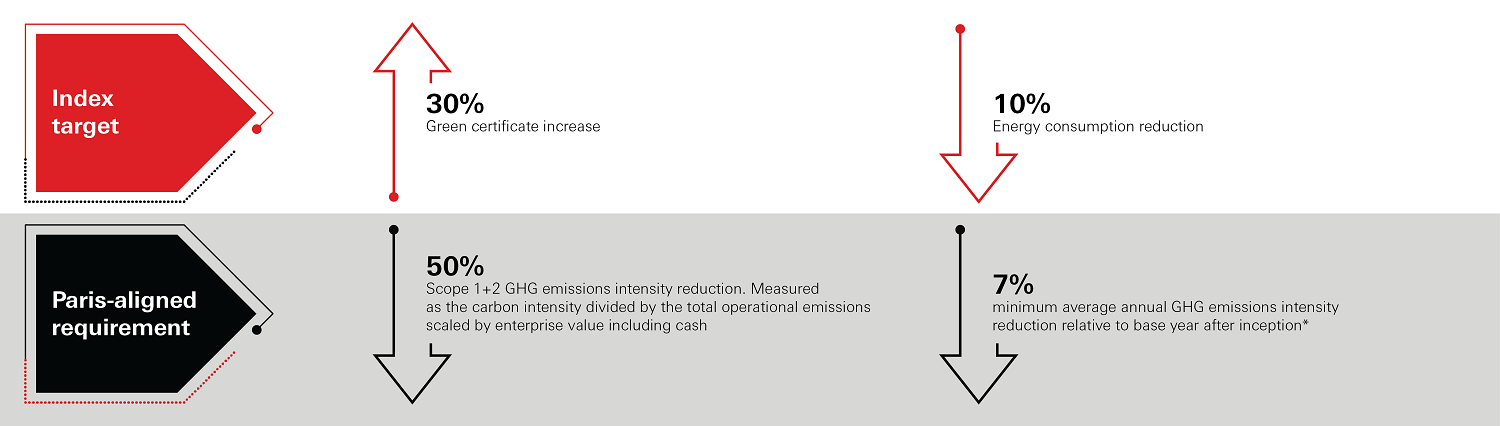

Objectives and constraints

Source: HSBC Asset Management, MSCI

1. Green revenue is defined as revenue from goods and services including alternative energy, energy efficiency, green building, pollution prevention and sustainable water.

2. Brown revenue is defined as the revenue generated from thermal coal extraction, unconventional and conventional oil and gas extraction, oil refining, thermal coal based power generation, liquid fuel based power generation or natural gas based power generation.

3. Climate Value-at-Risk (Climate VaR) is designed to provide a forward-looking and return-based valuation assessment to measure climate related risks and opportunities in an investment portfolio. The fully quantitative model offers deep insights into how climate change could affect company valuations.

Our Listed Real Estate Exposure – FTSE EPRA Nareit Developed Green EU PAB Index

HSBC Climate Paris Aligned UCITS ETF

The FTSE Climate Paris Aligned Property Index provides investors with exposure to listed-real estate with clear decarbonisation objectives built in. The index has been designed in line with the Paris agreement to enable investors mitigate transition risk in their portfolios.

Target exposure framework

|

At each index review, constraints and targets may be relaxed if delivering all constraints and targets are not achievable. EU Paris-aligned benchmark requirements will not be relaxed |

Source: HSBC Asset Management and FTSE February 2024

*The average GHG emission intensity reduction relative to base year of the index is calculated as the weighted average operational emission over the previous year’s level, adjusted for inflation by the average of stock enterprise value including cash

The opportunity

To support investors seeking to minimise their exposure to climate risks, we offer the HSBC Climate Paris Aligned UCITS ETFs, cost-efficient investment solutions designed to reduce carbon emissions in line with the Paris Agreement requirements.

|

|

HSBC MSCI World Climate Paris Aligned UCITS ETF |

More information |

|

|

HSBC MSCI USA Climate Paris Aligned UCITS ETF |

More information |

|

|

HSBC MSCI Europe Climate Paris Aligned UCITS ETF |

More information |

|

|

HSBC MSCI Japan Climate Paris Aligned UCITS ETF |

More information |

|

|

HSBC MSCI Emerging Markets Climate Paris Aligned UCITS ETF |

More information |

|

|

HSBC MSCI AC Asia Pacific ex-Japan Climate Paris Aligned UCITS ETF |

More information |

|

|

HSBC FTSE EPRA Nareit Developed Climate Paris Aligned UCITS ETF

|

More information |

-

-

-

Fund centre

View our ETF funds

Key risks

- Counterparty Risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations

- Derivatives Risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset

- Exchange Rate Risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly

- Index Tracking Risk: To the extent that the Fund seeks to replicate index performance by holding individual securities, there is no guarantee that its composition or performance will exactly match that of the target index at any given time (“tracking error”)

- Interest Rate Risk: When interest rates rise, bond values generally fall. This risk is generally greater the longer the maturity of a bond investment and the higher its credit quality

- Investment Leverage Risk: Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source

- Liquidity Risk: Liquidity Risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors

- Operational Risk: Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things

Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Index-based Investing - The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Stock market investments should be viewed as a medium to long term investment and should be held for at least five years. Any performance information shown refers to the past and should not be seen as an indication of future returns.