Five insights in five minutes

Corporate taxes

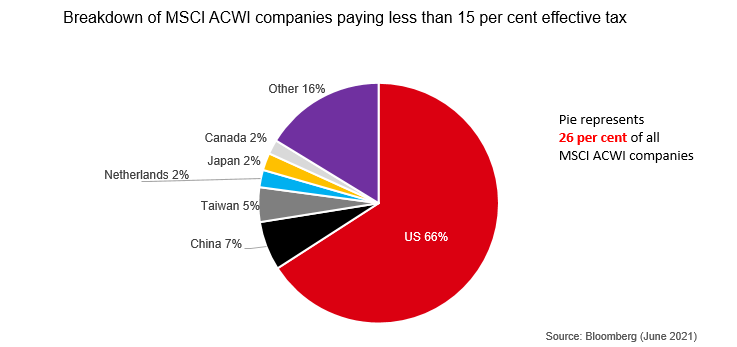

Last weekend the G7 announced a ‘historic’ deal on tax, whereby big and profitable multinationals will be required to pay in the countries where they operate, rather than where they are headquartered. The principle of a global minimum rate of 15 per cent was also agreed. What is the right way for investors to react? First, remember that potentially higher corporate taxes – like all taxes – must be paid by people in the end, either via lower shareholder returns, more expensive products and services, or reduced wages. That’s because companies don’t really exist the way politicians think they do, but are rather a series of trade-offs between owners, customers, suppliers and employees. That said, academics are utterly divided on how changes in tax are distributed among these stakeholders. Some studies reckon investors suffer most; others show that workers tend to bear the brunt. Even if the former is right, the G7 move is mostly an American issue – with US equities accounting for two thirds of companies globally that paid less than 15 per cent tax last year, as can be seen in the chart below.

Themes: global equities

Chinese inflation

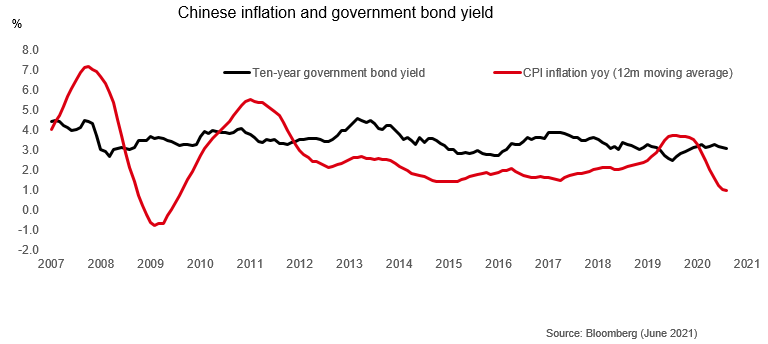

China’s producer price inflation number for May was nine per cent, beating the previous month’s then-jaw-dropping figure of seven per cent. But there was no spill over to consumer prices, which rose a meagre one per cent. Readers may think we are wearing out the record, but the hot tune of inflation has been topping the investor charts for multiple weeks, so please let us play you Another Reason Not To Worry one more time. The chart below shows, rather surprisingly, that China’s ten-year government bond yield remains remarkably stable at around three to four per cent, despite the ups and downs in CPI inflation. Moreover, if you are a foreign investor who finds negative ten-year real yields (minus 90 basis points for treasuries and double that for bunds) none too pleasing to the ear, maybe it’s time to consider adding Chinese bonds to your collection.

Themes: China, bonds

Sustainable healthcare

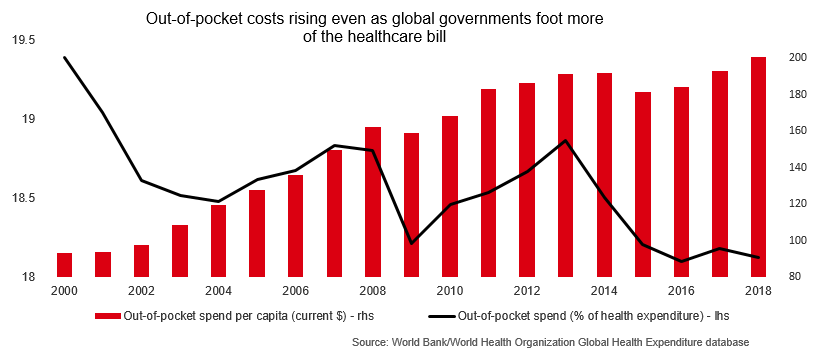

The FDA approved a new treatment this week that is hoped to slow the progression of Alzheimer’s, an illness that affects 50 million people globally. Unfortunately, it retails for USD56,000 per year on top of USD10,000 in diagnostic tests. While global healthcare costs for Alzheimer’s are estimated at over $1 trillion today, treating all patients with this new drug would cost an impossible USD3 trillion (for example, fully reimbursed access in the US means a 50 per cent increase to the country’s Medicare budget). High prices may seem attractive for companies in the short-run, but putting a drug out of reach of most patients will inevitably trigger access restrictions, which is in nobody’s interest. Per our previously published "Sustainable healthcare, healthy returns”, this underlines the need for pharma to stay incentivised to continue their R&D efforts. With luck, the next Alzheimer’s drug can be priced responsibly to maximise clinical and financial impact. Knowledgeable investors can participate in these solutions.

Themes: Sustainability, thematic equities

Eurozone policy

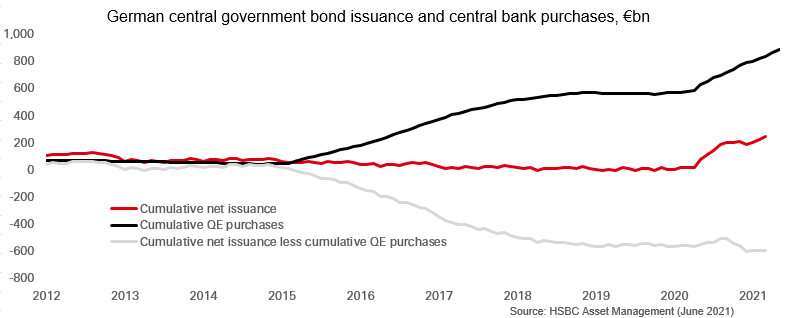

The long-awaited ECB meeting on Thursday revealed exactly what the markets were expecting (and hoping for) by maintaining a high pace of bond purchases under the pandemic emergency purchase programme scheme. Do note the key role that the central bank has played in anchoring long term core yields and sovereign spreads at low levels since it began its asset purchases in 2015. Take German bunds. As can be seen below, the ECB has been reducing the stock of benchmark government debt held by the public, which is 45 times lower than before. For peripheral countries such as Italy, it has absorbed new debt issuances for the past six years. Despite the reluctance to officially utter the ‘tapering’ word just yet, the mixed dovish and hawkish stances of the Governing Council do nothing to clarify the longer-term guidance. But with eurozone deficits still high and inflation expected to remain below target, our economists reckon this suggests that the central bank’s monetary policy stance should remain accommodative for the foreseeable future. Good news for risk assets.

Themes: Euro assets

Growth and equities

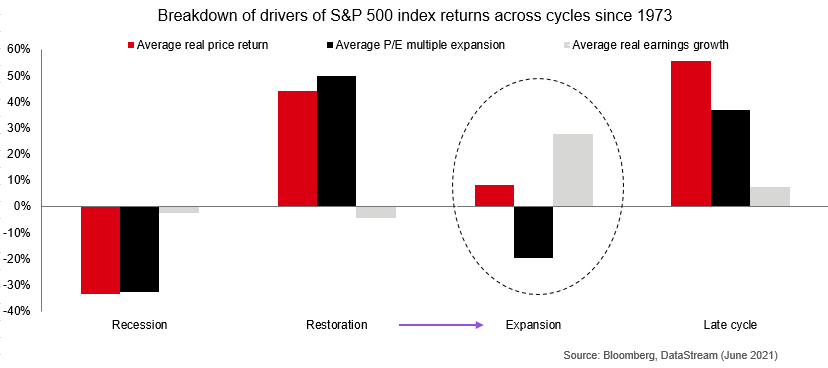

The global prevalence of V-shaped recoveries is all very welcome, but the fact is that if something drops ten per cent and then rebounds ten per cent, it ain’t back to where it started. And while second quarter GDP is forecast to be higher than pre-pandemic levels for China, Australia, South Korea and the US – that’s about half of global output – no economy is likely to surpass where the OECD expected it to be at this point. In other words, the world remains below pre-Covid potential trend growth. This is a common transition for investors to navigate: moving from euphoric bounces to the hard work of economic recovery. Our strategy team shows this nicely in the chart below, by breaking down the components of returns for the S&P 500 over numerous market cycles back to 1973. In the restoration phase, more than all of the 45 per cent average return comes from multiple expansion, with earnings growth mired in the red. But as reality catches up, multiples contract and earnings struggle to compensate – resulting in still-attractive, but lower returns.

Themes: all asset classes, global equities

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in Canada and the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. Past performance contained in this document is not a reliable indicator of future performance whilst any forecasts, projections and simulations contained herein should not be relied upon as an indication of future results. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade. Mutual fund investments are subject to market risks, read all scheme related documents carefully.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Global Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Global Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination.

We accept no responsibility for the accuracy and/or completeness of any third party information obtained from sources we believe to be reliable but which have not been independently verified.

HSBC Global Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). HSBC Global Asset Management is the brand name for the asset management business of HSBC Group. The above communication is distributed by the following entities:

- In Argentina by HSBC Global Asset Management Argentina S.A., Sociedad Gerente de Fondos Comunes de Inversión, Agente de administración de productos de inversión colectiva de FCI N°1;

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws.

- in Austria by HSBC Global Asset Management (Österreich) GmbH which is regulated by the Financial Market Supervision in Austria (FMA);

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Canada by HSBC Global Asset Management (Canada) Limited which provides its services as a dealer in all provinces of Canada except Prince Edward Island and also provides services in Northwest Territories. HSBC Global Asset Management (Canada) Limited provides its services as an advisor in all provinces of Canada except Prince Edward Island;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin;

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Bank Middle East Limited which are regulated by relevant local Central Banks for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority.

- in Oman by HSBC Bank Oman S.A.O.G regulated by Central Bank of Oman and Capital Market Authority of Oman;

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore;

- in Switzerland by HSBC Global Asset Management (Switzerland) AG whose activities are regulated in Switzerland and which activities are, where applicable, duly authorised by the Swiss Financial Market Supervisory Authority. Intended exclusively towards qualified investors in the meaning of Art. 10 para 3, 3bis and 3ter of the Federal Collective Investment Schemes Act (CISA);

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

INVESTMENT PRODUCTS:

- Are not a deposit or other obligation of the bank or any of its affiliates;

- Not FDIC insured or insured by any federal government agency of the United States;

- Not guaranteed by the bank or any of its affiliates; and

- Are subject to investment risk, including possible loss of principal invested.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided as an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively 'the MSCI Parties') expressly disclaims all warranties (including, without limitation, all warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Copyright © HSBC Global Asset Management Limited 2021. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.