HSBC Nasdaq Global Semiconductor UCITS ETF

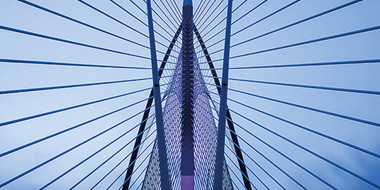

At the heart of the fourth industrial revolution

The HSBC Nasdaq Global Semiconductor UCITS ETF is designed to physically replicate the innovative Nasdaq Global Semiconductor Index, whilst minimising the tracking error between the fund and the index.

![]()

![]()

![]()

Resources

|

|

|

-

Exchange Traded Funds (ETFs)

Learn more about our ETFs -

Fund centre

View our ETF funds

Key risks

The value of an investment in the portfolios and any income from them can go down as well as up and as with any investment you may not receive back the amount originally invested. Concentration Risk: The Fund may be concentrated in a limited number of securities, economic sectors and/or countries. As a result, it may be more volatile and have a greater risk of loss than more broadly diversified funds

- Counterparty Risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations

- Derivatives Risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset

- Emerging Markets Risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

- Exchange Rate Risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly

- Index Tracking Risk: To the extent that the Fund seeks to replicate index performance by holding individual securities, there is no guarantee that its composition or performance will exactly match that of the target index at any given time (“tracking error”)

- Investment Leverage Risk: Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source

- Liquidity Risk: Liquidity Risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors

- Operational Risk: Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things

Any views expressed were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target.

The Product(s) is not sponsored, endorsed, sold or promoted by Nasdaq, Inc. or its affiliates (Nasdaq, with its affiliates, are referred to as the “Corporations”). The Corporations have not passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, the Product(s). The Corporations make no representation or warranty, express or implied to the owners of the Product(s) or any member of the public regarding the advisability of investing in securities generally or in the Product(s) particularly, or the ability of the Nasdaq Global Semiconductor Index to track general stock market performance. The Corporations' only relationship to HSBC Asset Management (“Licensee”) is in the licensing of the Nasdaq®, and certain trade names of the Corporations and the use of the Nasdaq Global Semiconductor Index which is determined, composed and calculated by Nasdaq without regard to Licensee or the Product(s). Nasdaq has no obligation to take the needs of the Licensee or the owners of the Product(s) into consideration in determining, composing or calculating the Nasdaq Global Semiconductor Index The Corporations are not responsible for and have not participated in the determination of the timing of, prices at, or quantities of the Product(s) to be issued or in the determination or calculation of the equation by which the Product(s) is to be converted into cash. The Corporations have no liability in connection with the administration, marketing or trading of the Product(s).

The Corporations do not guarantee the accuracy and/or uninterrupted calculation of Nasdaq Global Semiconductor Index or any data included therein. The Corporations make no warranty, express or implied, as to results to be obtained by Licensee, owners of the product(s), or any other person or entity from the use of the Nasdaq Global Semiconductor Index or any data included therein. The Corporations make no express or implied warranties, and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the Nasdaq Global Semiconductor Index or any data included therein. Without limiting any of the foregoing, in no event shall the Corporations have any liability for any lost profits or special, incidental, punitive, indirect, or consequential damages, even if notified of the possibility of such damages.

Index-based Investing - The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Stock market investments should be viewed as a medium to long term investment and should be held for at least five years. Any performance information shown refers to the past and should not be seen as an indication of future returns.