Energy Transition Infrastructure

What’s new

As the world transitions towards a low-carbon economy, the HSBC AM Energy Transition Infrastructure (ETI) strategy taps into the opportunities arising from the global demand for energy transition investments. The ETI strategy has an illustrated gross IRR of 15-20 per cent1, and assists in the transition to a more sustainable economy.

1. Any forecast, projection or target when provided is indicative only and is not guaranteed in any way. Illustrated using model and assumption and may not reflect actual fund’s performance

The Asian Energy Transition - The Future of Infrastructure Investing

The Asian Opportunity

Estimated Energy Supply Investment to reach Net Zero, select regions (2020-50)

The opportunity - at a glance

|

Asia-Pacific will require an estimated USD15tn energy supply investment to reach Net Zero, 2020-20502 |

A substantial portion of that will be in infrastructure assets, our core investment focus. |

We believe that the growing demand for clean energy will create room for scalability within our strategy. |

A Regional Growth Opportunity

- The largest market opportunity in the space

- Asia’s fast-growing population and economic growth driving demand for energy

- Robust governmental support via regulatory regimes and policies

- Need to diversify energy sources away from fossil fuels

Developed Asia Markets

Australia, Hong Kong, Japan, Korea, New Zealand, Singapore, Taiwan

- Investment grade markets with net-zero ambitions

- Deep and liquid capital markets with increasing focus on sustainable energy investments

- Nascent sector with markets lag mature European counterparts in renewables capacity as % of total energy mix, greater scope for growth

- USD275bn investment in next 5 years in North Asia markets alone

Secondary Markets

South and Southeast Asia

- Fast growing regional markets including India, Indonesia, Malaysia, Philippines, Thailand and Vietnam

- Government targets for renewable energy generation

- Opportunistically looking at other OECD markets with nexus or expansion plans to Asia

Source: BloombergNEF NEO 2022; 2. APAC Data set excludes Mainland China, Tsinghua estimates for China 2021, IGCC estimates for Australia 2021, AIGCC estimates for other countries 2021

The Mid Market Opportunity

We believe that the mid-market can provide a greater breadth of deals at more compelling valuations

The Pillars of the Strategy

Opportunities in renewable regeneration, grids, energy storage, charging and meter infrastructure in developed Asia

|

ETI Pure Play |

Asia based team, for asian investment |

Mid-Market |

Value-Added |

A Regional Answer to a Global Issue

Leadership

Paul Rhodes Head of ETI APAC (Hong Kong) 25+ years in investment banking |

Rowan te Kloot Head of Investments ETI APAC (Singapore) 19+ years investing in renewables and infrastructure |

Ana Carolina Romero Investment Specialist (Singapore) 14+ years in PE, cap-intro, energy & infrastructure |

Andrew Wang 王浩晖 Investment Principal (Singapore) 13+ years in renewables, infra & TMT |

Clare Morton Senior Responsible Investment Specialist (Singapore) 12+ years in Responsible Investing |

Chris Yamane 山根 クリス Investment Associate Principal (Japan) 10+ years in renewables & industrial design |

Takayasu Hori 堀 隆泰 Industry Associate Principal (Japan) 16+ years in renewables & logistics |

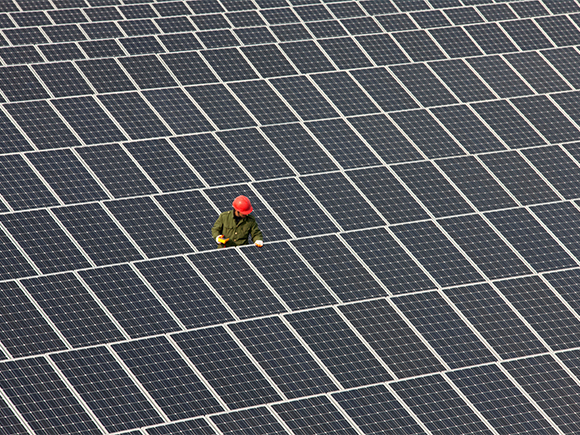

Our First Investment

The HSBC Asset Management ETI team has acquired a solar PV business focused on developing and operating energy transition projects across north Asia.

We expect the experienced management team to capture the sector opportunity in mature markets that are transitioning, with a robust pipeline of corporate Purchasing Power Agreement off-takers.

Key Risks

Risk Considerations: There is no assurance that a portfolio will achieve its investment objective or will work under all market conditions. The value of investments may go down as well as up and you may not get back the amount originally invested. Portfolios may be subject to certain additional risks, which should be considered carefully along with their investment objectives and fees.

Illiquidity: An investment in alternatives is a long-term illiquid investment. By their nature, alternatives' investments will not generally be exchange traded. These investments will be illiquid.

Long term horizon: Investors should expect to be locked-in for the full term of the investment.

Economic conditions: The economic cycle and prevailing interest rates will impact the attractiveness of the underlying investments. Economic activity and sentiment also impacts the performance of underlying companies and will have a direct bearing on the ability of companies to keep up with interest and principal repayments.

Valuation: These investments may have no or a limited liquid market, and other investments including those in respect of loans and securities of private companies, may be based on estimates which cannot be marked to market until sale. The valuation of the underlying investments is therefore inherently opaque.

Market risk: There is no guarantee in respect of the repayment of principal or the value of investments, and the income derived therefrom may fall as well as rise. Investors therefore may not recoup the original amount invested in the Partnership. In particular, the value of investments may be affected by political and economic news, government policy, changes in technology and business practices, changes in demographics, cultures and populations, natural or human-caused disasters, pandemics, weather and climate patterns, scientific or investigative discoveries, costs and availability of energy, commodities and natural resources. The effects of market risk can be immediate or gradual, short-term or long-term, narrow or broad.

Political and economic risks: General economic conditions may affect the activities. Changes in economic conditions, including, for example, inflation, unemployment, competition, technological developments, political events and other factors, none of which will be within the control of the General Partner or the service providers, can substantially and adversely affect the business and prospect investors. Due to the geographic scope of its activities, the strategy may be vulnerable to country or regional-specific political, macroeconomic and financial environments or circumstances.

Further information on the potential risks can be found in the LPA.

Important Information

Insights from HSBC Asset Management Singapore

For Accredited and Institutional Investors only and should not be distributed to or relied upon by Retail Clients.

HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. HSBC Asset Management is the brand name for the asset management business of the HSBC Group. The contents of this presentation have been compiled by HSBC Global Asset Management (Singapore) Limited, which forms part of HSBC Asset Management.

Singapore

Important Information

This document provides and may include a high level overview of the recent economic environment, and is for information purposes only. This document is not meant for retail audience and does not constitute an offering document and should not be construed as a recommendation, an offer to sell or the solicitation of an offer to purchase or subscribe to any investment nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document has not been reviewed by The Monetary Authority of Singapore (the "MAS").

HSBC Global Asset Management (Singapore) Limited ("AMSG") has based this document on information obtained from sources it reasonably believes to be reliable. However, AMSG does not warrant, guarantee or represent, expressly or by implication, the accuracy, validity or completeness of such information. Any views and opinions expressed in this document are subject to change without notice. It does not have regard to the specific investment objectives, financial situation, or needs of any specific person. Investors and potential investors should not make any investment solely based on the information provided in this document.

Investors should seek advice from an independent financial adviser. Investment involves risk. Past performance and any forecasts on the economy, stock or bond market, or economic trends are not indicative of future performance. The value of investments and income accruing to them, if any, may fall or rise and investor may not get back the original sum invested. Changes in rates of currency exchange may affect significantly the value of the investment.

This document is provided for information only.

In Singapore, this document is issued by AMSG who is licensed by MAS to conduct Fund Management Regulated Activity in Singapore. AMSG is not licensed to carry out asset or fund management activities outside of Singapore. Recipients of this document in Singapore are to contact AMSG in respect of any matter arising from, or in connection with, this document or analysis.

Today we and many of our customers contribute to greenhouse gas emissions. We have a strategy to reduce our own emissions and to develop solutions to help our clients invest sustainably. For more information visit https://www.hsbc.com/sustainability or https://www.assetmanagement.hsbc.co.uk/en/institutional-investor/about-us/road-to-net-zero

HSBC Global Asset Management (Singapore) Limited

10 Marina Boulevard, Marina Bay Financial Centre, Tower 2, #48-01, Singapore 018983

Telephone: (65) 6658 2900 Facsimile: (65) 6225 4324

Website: https://www.assetmanagement.hsbc.com.sg

Company Registration No. 198602036R

Contact us

If you are considering investing in alternatives, or want to learn more about our investment strategies, please get in touch.