Real Estate APAC

Dedicated Asia Pacific direct Real Estate investment manager

What’s new

Who we are

Our Real Estate APAC team provides investors access to value-add and core-plus investment approaches, leveraging our long track record and presence in the region.

|

|

|

|

Source: HSBC AM, as of 30th June 2025

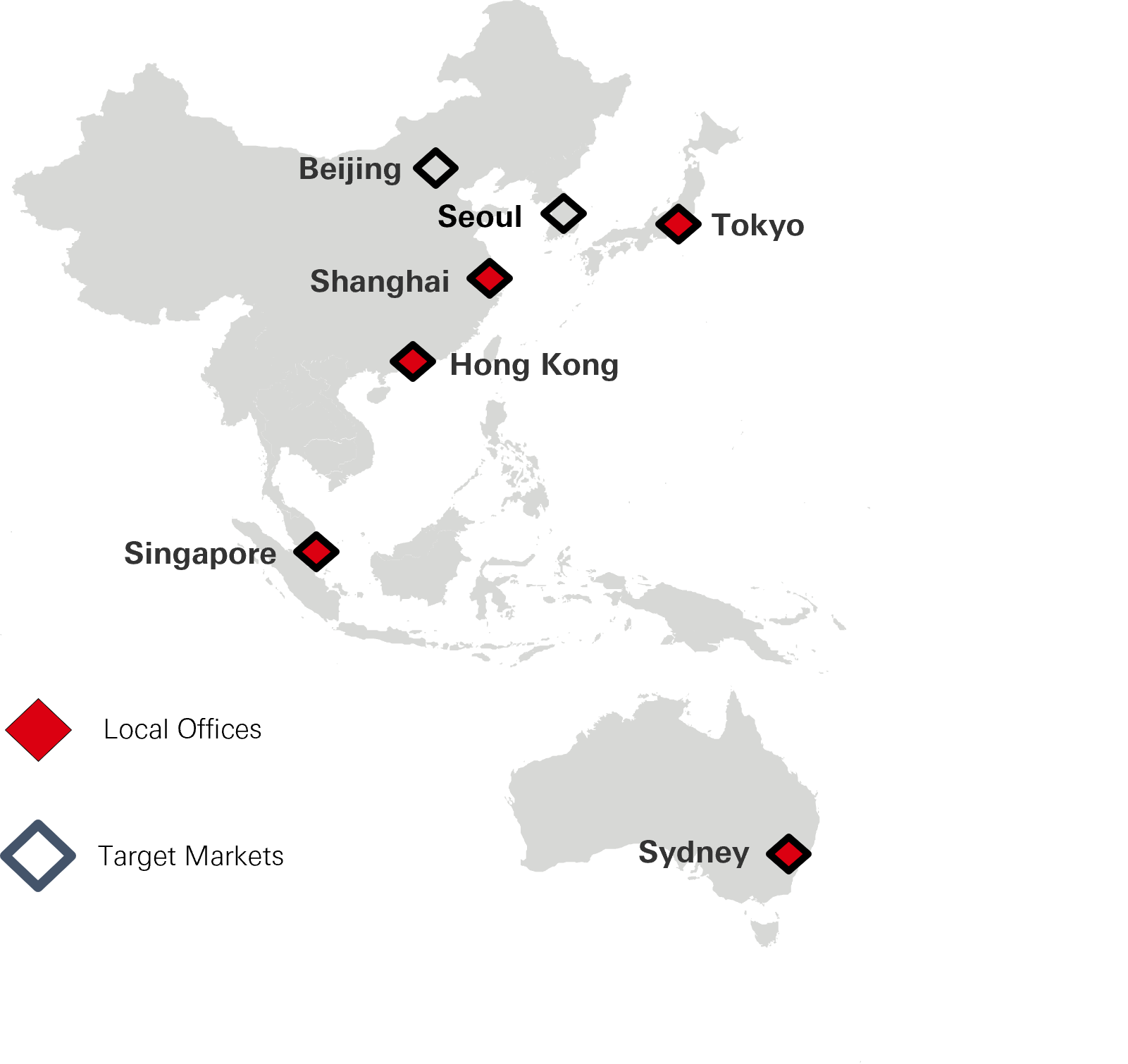

We target the most mature, institutionalised, liquid and transparent markets in the Asia Pacific Region

Our Investment Approach

|

Invest

|

Optimise

|

Realise

|

What we do

Our Portfolio

Our team currently manages over 20 properties in the region – representative properties include:

Experienced Investment Team

|

|

|

Leadership

25 investment professionals locally based across APAC

Peter Wittendorp, CEFA Head of Real Estate, APAC 30 years of real estate experience |

Berend Poppe, CFA Head of China 20 years real estate experience |

George Kang Head of Singapore 20 years real estate experience |

Nick Kearns, CFA Head of Hong Kong 20 years real estate experience |

Takashi Hamajima Head of Japan 20 years real estate experience |

Key Risks

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested.

The risk factors listed below are not exhaustive.

General Real Estate Risk: The investments will be subject to risks incidental to owning and operating real estate projects, including risks associated with the general economic climate, geographic or market concentration. There is no guarantee in respect of the repayment of principal or the value of investments, and the income derived therefrom may fall as well as rise. Investors therefore may not recoup the original amount invested. In particular, the value of investments may be affected by political and economic news, government policy, changes in technology and business practices, changes in demographics, cultures and populations, natural or human-caused disasters, pandemics, weather and climate patterns, scientific or investigative discoveries, costs and availability of energy, commodities and natural resources. The effects of market risk can be immediate or gradual, short-term or long-term, narrow or broad.

Liquidity Risk: Private real estate, including investments made directly or through corporate or fund structures, is an illiquid asset class. Investors should be warned that there may not be a secondary market for their shares or interest in the fund or partnership. Liquidity risk may arise due to challenges in selling assets quickly, and it may require a substantial length of time to liquidate.

Tenure Risk: Institutional direct real estate investments are typically underwritten with a long holding period and are only suitable for investors who have a long-term investment horizon.

Economic Conditions: The economic cycle and prevailing interest rates will impact the fundamentals of the underlying investments. Economic activity and sentiment also impacts the performance of underlying companies and could have a direct bearing on the ability of companies to keep up with interest and principal repayments.

Risks Associated with Certain Types of Real Estate: In addition to the general real estate risks described above, other factors that may adversely affect the value and successful operation of, and income generated from, certain types of real estate investments includes the following: the physical attributes of a building used to generate income, location of the property , ability of management to provide adequate maintenance and insurance, the types of services or amenities that the property provides, the property's reputation, competition from other real estate investors, the level of mortgage interest rates, presence or construction of competing properties, the quality of tenants and tenant mix and adverse local, regional or national economic conditions. This list is not exhaustive and there could be other factors could have a material adverse effect on the performance of an investment.

Important Information

Contact us

If you are considering investing in alternatives, or want to learn more about our investment strategies, please get in touch.

Formulate Strategic Asset Plan (SAP), ensuring a real estate asset is developed and / or managed to optimise long-term performance

Formulate Strategic Asset Plan (SAP), ensuring a real estate asset is developed and / or managed to optimise long-term performance