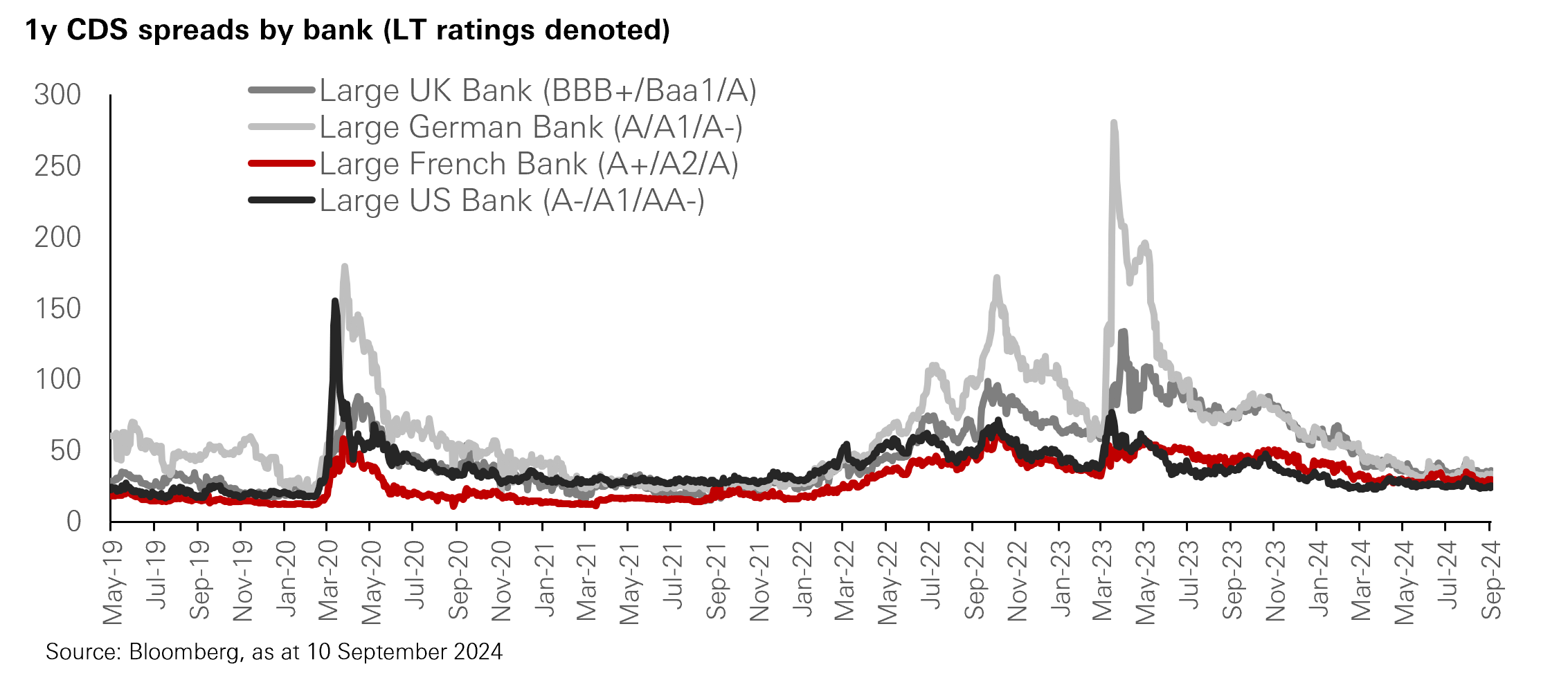

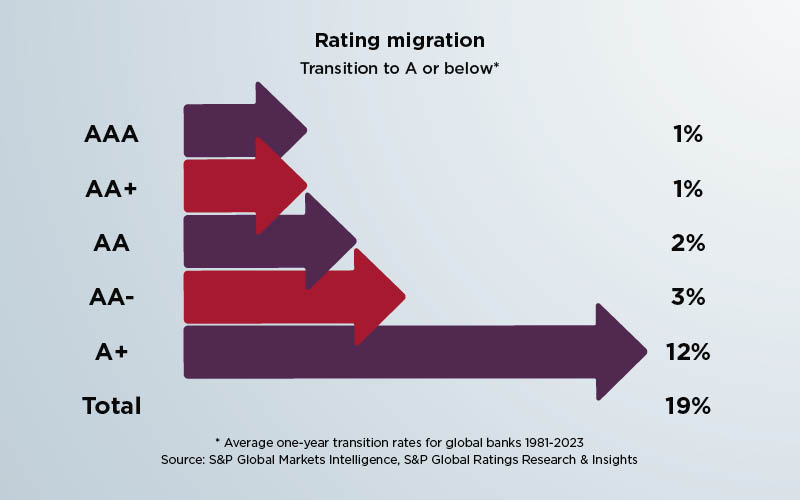

Despite nearly 18 months passing since the collapse of Silicon Valley Bank (SVB) and Credit Suisse’s acquisition by UBS, counterparty risk remains top of mind. Bank deposits expose investors directly to the financial health of a single bank in which funds are deposited. Should a bank face financial instability, the liquidity and safety of funds deposited at that institution can be in serious jeopardy. Additionally, efforts to enhance yield by terming out deposits further increase implicit counterparty risk – the longer you are exposed to a given counterparty, the more time there is for something to go wrong and for you not to get your money back. High profile, and undoubtedly high consequence, bankruptcies and restructurings dominate headlines and institutional memory. In reality, a treasury team’s counterparty risk challenges are ever present. Credit rating migration (where a bank’s rating is downgraded below thresholds specified in treasury investment policy) can lead to intensive additional due diligence, increased resource requirements across the organisation and, ultimately, financial opportunity loss should a decision be made to attempt to break a deposit at an institution a treasury department no longer sees as safe.

MMFs mitigate counterparty risk thorough portfolio diversification. Prime MMFs invest in commercial paper, permitting for a broader diversification across issuers and potentially enhancing yield while adhering to stringent credit quality standards. Prime MMFs employ dedicated in-house credit research teams to continuously monitor and assess the creditworthiness of their holdings, which, in turn, adds an additional layer of oversight.