Heightened Volatility? Hedge Funds could help weather the storm

History would say that volatility is set to increase

2024 has been a year which, for many, has confounded market expectations. Heading into the year, the market had priced in a number of interest rate cuts, with the idea from a macroeconomic perspective of a ‘soft-landing’ looking more tangible than alternative scenarios. Indeed, markets seemed to be following this script for the first half of the year. Equities reached new highs, powered by continuous enthusiasm for artificial intelligence, semiconductors, and healthcare and expectations for interest rate cuts during the second half of the year. Meanwhile, bond markets struggled, with central banks keeping rates steady in the US, resulting in further monetary policy uncertainty.

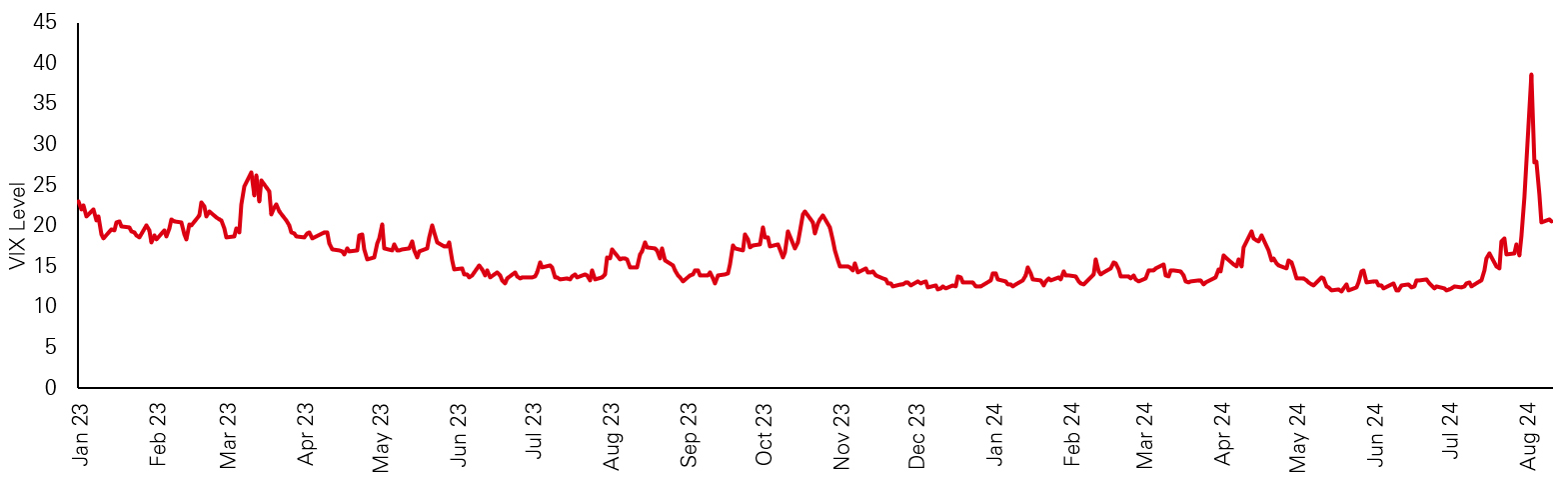

Moving into the second half of the year , we have experienced a different environment. From the mid-July peaks, equities pulled back as allocators crystallised profits and rotated into other asset classes. The tension underpinning monetary policy and geopolitics came to a head in early August, as markets experienced a sharp, albeit temporal, sell off. This concurrently witnessed the VIX spiking in one of its highest ever one day rises, thrusting asset class volatility into the forefront of investors’ minds.

VIX Index (since January 2023)1

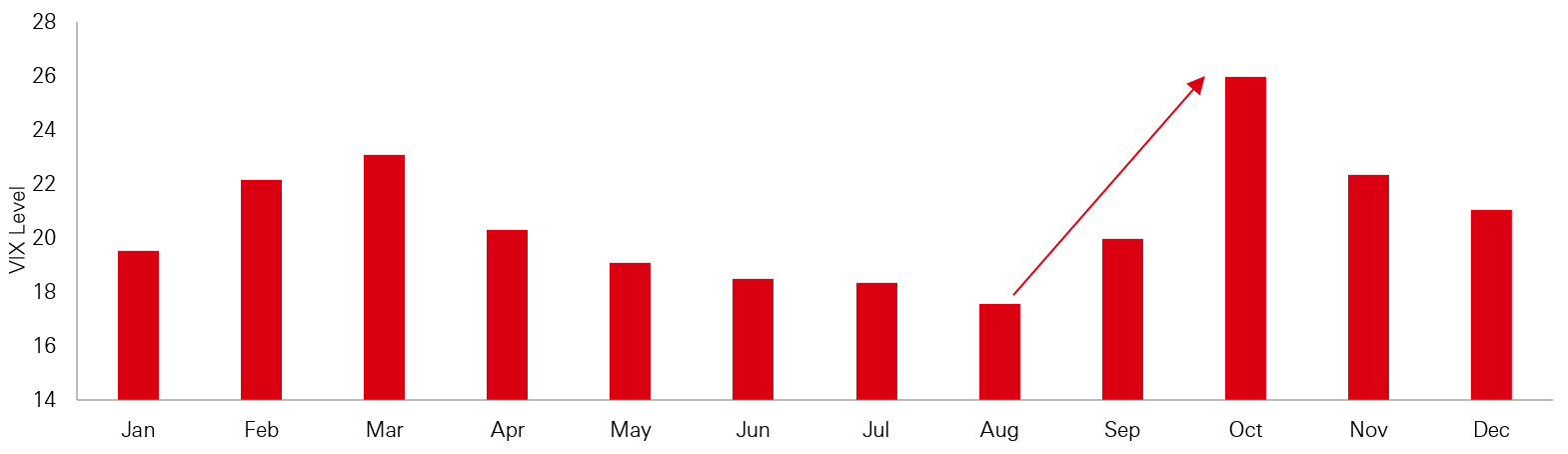

Uncertainty in monetary policy has been an ever-present consideration so far this year, but changes in the geopolitical environment have also been a driver of market movements. Electoral uncertainty has already affected asset prices across the globe, with the repercussions of surprise election victories and election candidate drop-outs heightening their unpredictable direction. With the US election set to take place in November, history would tell us to expect a more persistent uptick in asset class volatility. Investors ought to be wary of how to navigate these potentially choppy markets, and which asset classes are likely to benefit from the wider opportunity set, which volatility gives rise to.

Average VIX Index level in US election years (since 1982)2

Hedge Funds – uniquely positioned to benefit?

With the uncertain theme of markets likely to continue in the coming months, investors are naturally open to expanding their avenues for return accrual. As uncertainty breeds volatility, it is to be expected that allocators will seek greater exposure to asset classes which traditionally elicit opportunity in choppier markets. In our view, hedge funds provide a solution to meet the need of diversifying portfolios without compromising on return.

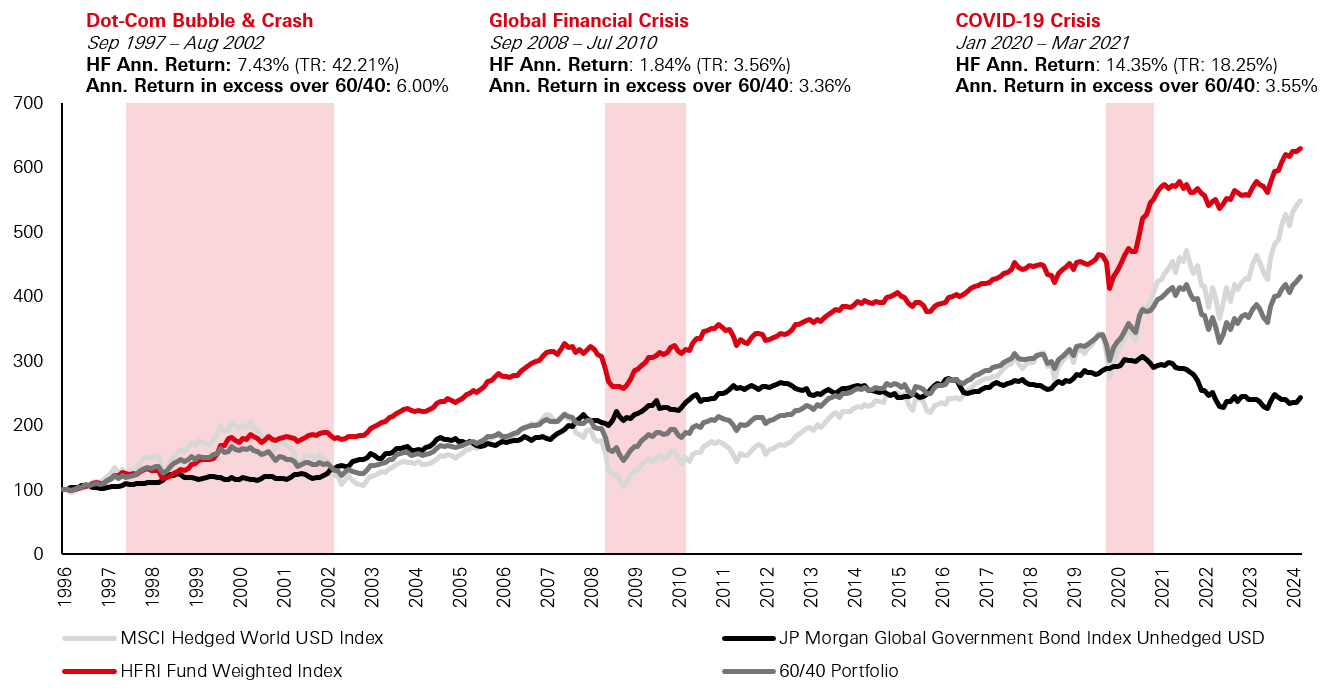

Performance of hedge funds in periods of high volatility3

Looking back at previous periods of particularly high volatility, we see hedge funds outperforming global balanced portfolios. The volatility profile of a well-managed diversified hedge fund portfolio also stacks up favourably over the longer term against traditional asset classes. The unique ability of hedge funds to position themselves long and short a given asset represents a particular advantage during volatile markets. Combining this with what is often best-in-class risk management (amongst other advantages), the superior alpha generative capabilities of hedge funds is highlighted in these periods.

A concurrent relevant point is the negative correlation which exists between hedge funds and global balanced portfolios in periods of stress. This is depicted below and indicates a relationship whereby hedge funds are capable of capturing the upside, whilst also delivering returns in market downturns.

Correlation in returns between hedge funds and 60/40 portfolio4

Trends bolster the case for hedge fund allocations

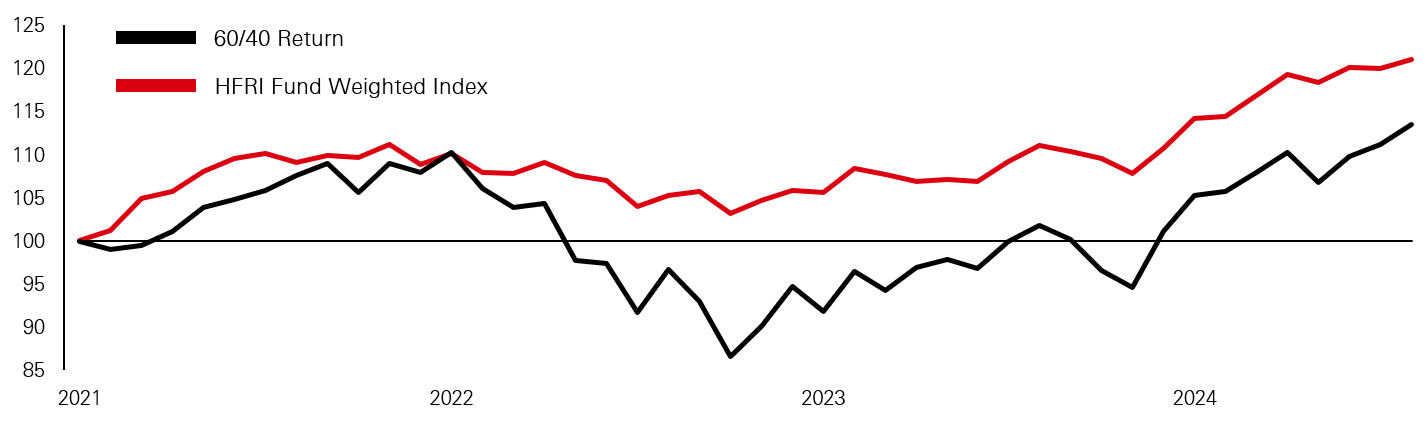

With heightened uncertainty in mind, looking at recent performance hedge funds have offered favourable returns relative to global balanced portfolios. In the light of this 60/40 investors are likely to start questioning the efficacy of simple 60/40 portfolio construct, with allocations to bonds failing to cushion the downside over the last 3 years due to new monetary policy regime since Q4 2021. At the same time, hedge funds have generally performed within expectations, namely delivering returns in a non-correlated fashion through the cycle.

Outperformance of hedge funds vs global balanced portfolios5

At the time of writing, we believe the opportunity set for hedge funds is especially wide as a number of market dynamics appear to be offering managers the potential to generate alpha.

Wide Opportunity set for hedge fund managers

Geopolitical Risk

Geopolitical landscapes are as pivotal as ever in shaping market dynamics. With almost half of the world’s population headed to the polls during 2024, markets have experienced volatility, excluding the additional market effervescence expected from the US presidential election. Compounding this effect with the ongoing conflicts in Europe and the Middle East, there are many possible outcomes for asset class performance. We foresee Macro and Multi-Strategy managers benefitting the most from this backdrop.

Corporate Activity

The first half of 2024 has seen an uptick in M&A activity, as well as in the number of activist campaigns deployed globally. Despite recent volatility, we see Event-Driven managers continuing to deploy capital in the form of activism, as well as in speculation of further M&A. These managers have the inherent ability to cancel out the noise of the market and focus on their view of a true value of a prospective investment.

Elevated Cost of Borrowing

Rates remaining ‘higher for longer’ has arguably been the theme of the year thus far in 2024. Whilst consensus is for rates to gradually start to fall, we expect to see market breadth grow as the repercussions of higher rates are experienced, much to the benefit of Equity Long/Short managers. The uncertain path of interest rates evokes volatility in credit markets too, where we would envisage Credit long/short managers are able to profit.

Market Dispersion

Equity markets have seen growth in dispersion in 2024, meaning the performance difference in returns between underlying assets has grown. Hedge funds, particularly Equity long/short, are likely to benefit from the wider stock picking environment and more diverse earnings picture.

Hedge funds in volatile environments

Conclusion

Looking forward into both the short and medium term, One can make the case that asset class volatility is set to increase and stay elevated for the foreseeable future. The backdrop of uncertainty surrounding inflation, the geopolitical landscape, election uncertainty as well as the prevalence of market trends, leads us to this conclusion.

Whatever one’s views on which macro scenario will prevail, history tells us that in periods of volatility hedge funds can produce returns in excess of other asset classes. We would argue that a well-diversified, fund of hedge funds product is a key allocation investors should have as part of their wider portfolios, especially in the current and forecast market environment.

Past performance does not predict future returns. Diversification does not ensure a profit or protect against a loss. Any forecast, projection or target when provided is indicative only and is not guaranteed in anyway. The costs/ returns may increase or decrease as a result of currency and exchange rate fluctuations.

For illustrative purposes only. Past performance does not predict future returns. The return may increase or decrease as a result of currency fluctuations.

1. & 2. HSBC Alternative Investments Limited, Bloomberg.

Past performance does not predict future returns. There is no guarantee that the fund objectives or target returns will be achieved. The return may increase or decrease as a result of currency fluctuations. Diversification does not ensure a profit or protect against loss.

3. Source: HSBC Alternative Investments Limited, Bloomberg. As of 30 July 2024. 60/40 portfolio is represented by: 60 per cent allocation to MSCI Hedged World USD Index; 40 per cent allocation to JP Morgan Global Government Bond Index Unhedged USD.

4. Source: HSBC Asset Management, Bloomberg, HFRI. Time period presented is from January 1990 to December 2023. Traditional 60/40 portfolio is made up 60 per cent Global Equities (MSCI World Index) and 40 per cent Global Bonds (JP Morgan Global Government Bond Index unhedged in USD). Hedge Funds are represented by the HFRI Macro Index. Correlation is calculated on a 12-month rolling basis.

5. Source: HSBC Alternative Investments Limited, Bloomberg, HFRI. As of 30 July 2024. 60/40 portfolio is represented by: 60 per cent allocation to MSCI Hedged World USD Index; 40 per cent allocation to JP Morgan Global Government Bond Index Unhedged USD.

Key Investment Risks

Investors in hedge funds should bear in mind that these products can be highly speculative and may not be suitable for all clients.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Past performance does not predict future returns. The return may increase or decrease as a result of currency fluctuations.

There are several key issues that one should consider before making an investment into hedge funds. The risks specific to this type of investment may include, but are not limited to:

Regulation

The hedge fund industry is lightly regulated, with the majority of funds domiciled in offshore jurisdictions. Hedge funds are generally classified as “unregulated” and are not typically subject to the same levels of scrutiny and protection as a traditional investment fund. A thorough due diligence process can mitigate these concerns.

Gating

In event that redemptions requests on a particular dealing date are much higher than the normal level and full satisfaction would jeopardise the longer term portfolio balance, a gate or partial execution of redemption requests may be implemented generally on a pro-rata basis.

Side pocket

There may be instances when certain assets in a fund portfolio could become less liquid and the fund manager may segregate these illiquid positions from the main portfolio into a side pocket (or a separate vehicle).

Suspension of redemption

Suspension of redemption is a temporary halt in exiting the fund during a given redemption window. This is a stronger measure than gating because there is no dealing for the fund. This is generally used under special circumstances such as when liquidity conditions have markedly deteriorated in a short period of time or when there are heavy asset outflow such as the loss of a core investor.

Access

Hedge funds operate larger investment minima than traditional investment funds. Investors are often unable to access a hedge fund unless they were willing to invest USD500,000 to USD2mn.

Liquidity

Hedge funds typically have much longer dealing cycles than traditional investment funds. Depending on the strategy being utilised, a hedge fund may only allow subscriptions and redemptions on a monthly or quarterly basis. Furthermore, some hedge funds have long lock-up periods, where an investor is not permitted to redeem from the hedge fund unless a period of 6 months, a year or even 2 years has passed. Some may allow a redemption before the lock-up period is over, but the investor would have to pay a hefty penalty to be able to do this.

Transparency

Many hedge fund managers are wary of regularly publishing their positions in the belief that this will remove any advantage that they have over their peers. This can pose a problem to the investor, as he or she cannot be certain to which stocks, geographies, markets or even strategies he or she will be exposed to when investing in the hedge fund. However, trusted investors who have built strong relationships with the hedge funds can access this information for the majority of funds, enabling thorough monitoring of the investment.

Manager failure

Over time, a number of hedge funds will close or fail, due to weak performance or operational difficulties. An investor must take this into consideration before making an investment, seeking professional advice to help minimise the risk of investing in a fund that is likely to fail.

The risk factors listed above are not exhaustive. Please refer to the official product documentation for the detailed risk disclosures specific to the HSBC GH Fund.

Disclaimer

For Professional Clients and intermediaries within countries and territories set out below, and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third-party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Argentina by HSBC Global Asset Management Argentina S.A., Sociedad Gerente de Fondos Comunes de Inversión, Agente de administración de productos de inversión colectiva de FCI N°1;

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- in Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.

NOT FDIC INSURED ◆ NO BANK GUARANTEE ◆ MAY LOSE VALUE

Copyright © HSBC Global Asset Management Limited 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.