Market spotlight: GST Reforms 2025

India’s indirect tax system – Goods and Services Tax – is undergoing its most significant overhaul since GST was introduced in 2017. Effective 22 September, the GST Council approved sweeping rationalisation replacing the 12 per cent and 28 per cent slabs with a simplified structure of 5 per cent and 18 per cent, plus a new 40 per cent rate for sin and ultra-luxury goods. This simplification is designed not just to spur demand but also to improve compliance, reduce litigation, and accelerate formalisation. The timing of these reforms is of particular importance. With US tariffs casting a shadow on external demand, policymakers are using GST rationalisation to strengthen domestic consumption.

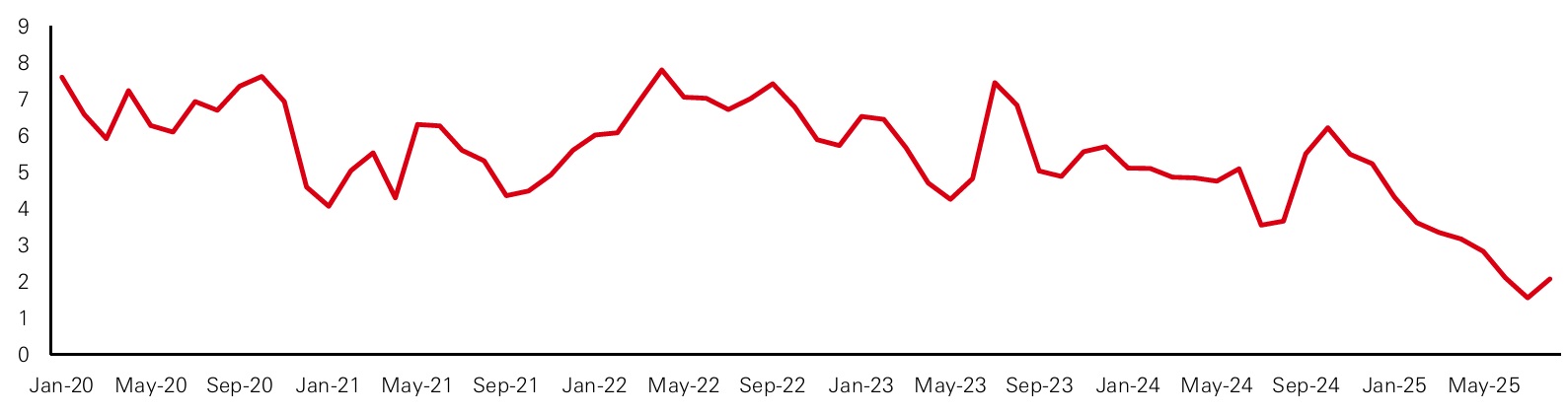

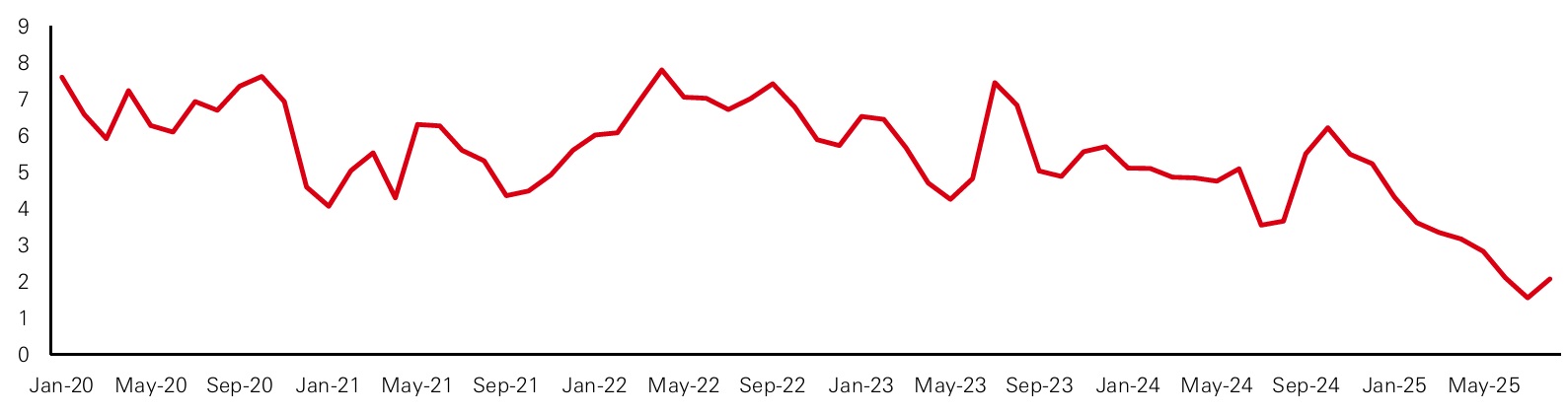

The measures cut across categories. Everyday essentials now fall into lower tax brackets, while services like salons, wellness, and yoga have been cut from 18 per cent to 5 per cent. Tractors and cement also benefit, easing input costs, while health and life insurance are exempt entirely – a move that nudges demand for financial protection. Collectively, these measures are expected to free household savings worth INR 1.8tn (0.6 per cent of GDP), lifting volumes in mass consumption categories. The ongoing fall in inflation gives policymakers much more flexibility, with GST reforms likely to exacerbate disinflationary forces, reinforcing macro stability at a critical juncture.

India CPI inflation year-on-year (per cent)

Click the image to enlarge

Source: HSBC Asset Management, September 2025.

While the short-term boost is clear, GST reform also addresses structural frictions. It eliminates inverted duty structures, narrows the price gap between branded and unbranded goods, and creates a more equitable tax burden for lower- and middle-income groups. This is in sharp contrast to tariffs, which risk raising uncertainty and costs, but comes with its own risks. Fiscal costs arising from these reforms are real, estimated at INR 480bn this year and rising to INR 576bn by FY26. Also, inflation may not fully reflect the expected 1.1pp decline if companies pocket part of the gains. Separately, ultra-luxury segments may face a heavier burden under the new 40 per cent rate. Still, GST reforms are expected to keep fiscal slippage contained to just 0.13 per cent of GDP.

In a wider emerging market context, India’s path stands out. Many EM peers remain exposed to global trade volatility or commodity swings, but India plans to reduce it by tilting policy toward its vast internal market. This approach underscores the importance of considering idiosyncratic stories while investing in the EM countries.

For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

India equities

GST cuts cushion tariff risks

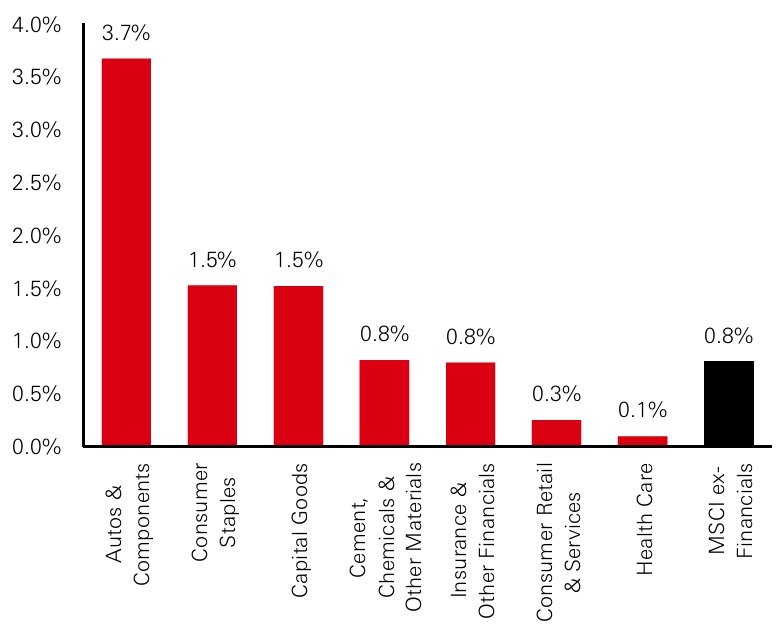

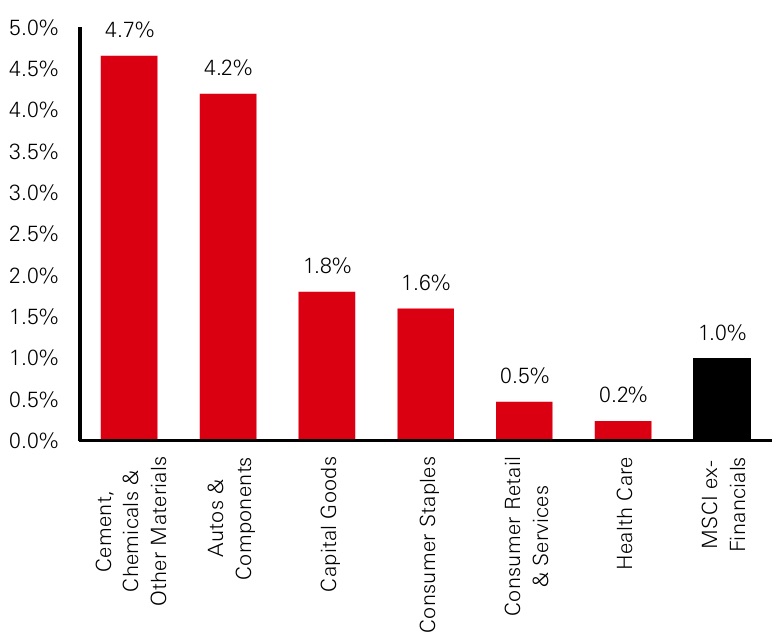

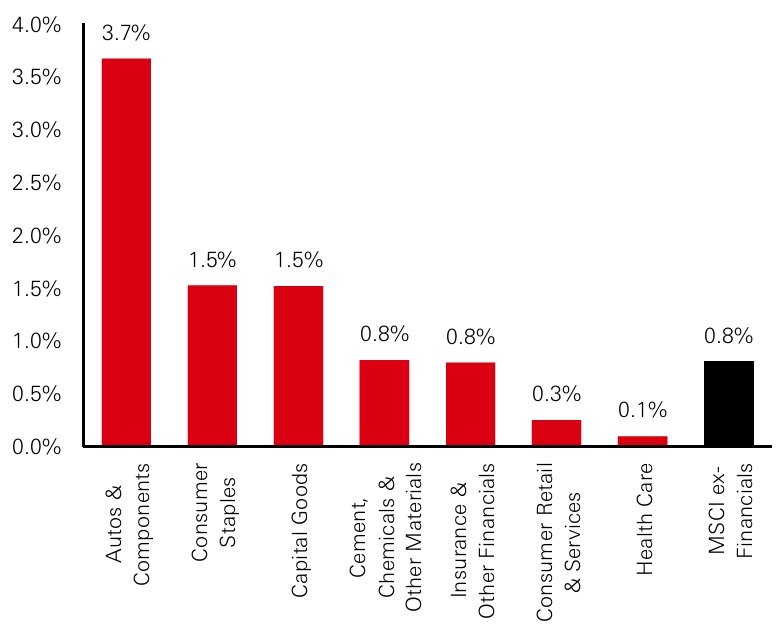

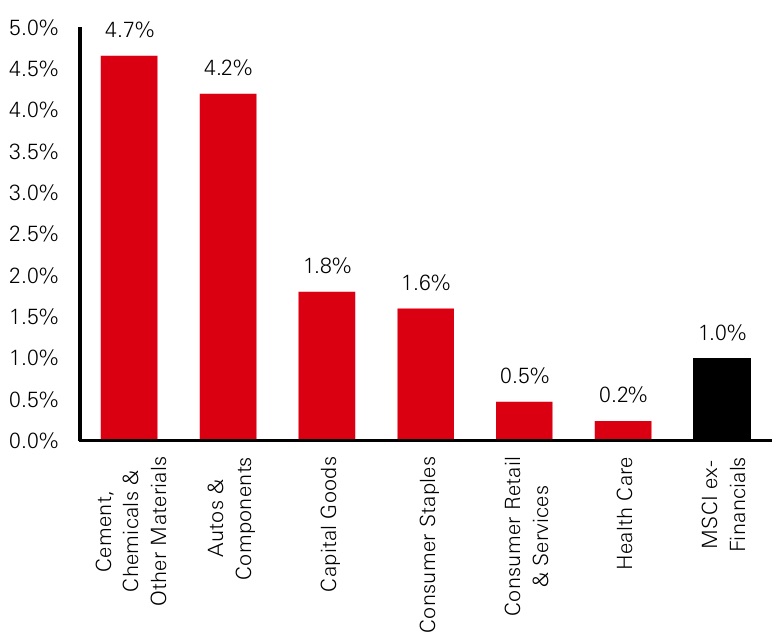

For equities, GST reform could be the single most powerful domestic policy driver in FY26. The reduction in indirect taxes disproportionately benefits consumer-sensitive sectors, which account for meaningful weight within MSCI India ex Financials. With roughly 14 per cent of the index’s revenue exposed to these cuts, the index could record a 0.8 per cent revenue increase, translating into ~1 per cent earnings growth. This comes at a time when valuations already look stretched with 12-month forward P/E multiples above median, and both short-and long-term momentum relatively muted.

GST cuts could add ~1 per cent earnings lift, supporting equities despite tariff headwinds.

Potential direct impact of GST rate changes to MSCI India revenue

Click the image to enlarge

Potential direct impact of GST rate changes to MSCI India earnings

Click the image to enlarge

Note: Based on our assumptions of pass-through of GST benefit and demand elasticity.

Past performance may or may not be sustained in future and is not a guarantee of any future returns.

Source: Goldman Sachs Global Investment Research, Data as of September 2025.

The broader equity market picture within India is nuanced. India still screens as expensive, but its quality score remains more balanced having strong return on equity, manageable leverage, and resilient margins. Manufacturing momentum is among the strongest in Asia, suggesting the economy’s underlying engine is intact. Against this backdrop, GST-driven demand growth adds a cushion that could keep earnings resilience intact, even if export-oriented sectors suffer from tariff-related pressures.

The reform also plays well into longer-term shifts. By lowering costs on tractors, cement, and consumer goods, it boosts both rural and urban demand. By exempting insurance, it channels household savings into financial products. And by simplifying compliance, it reduces frictions that have weighed on corporate India. These dynamics make GST less of a short-term stimulus and more of a structural tilt toward affordable mass-market goods and services that should sustain demand resilience. However, it will be clearer later if companies hold on to some of the tax benefits which could mute the demand pass-through.

Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

India fixed income

GST keeps bonds anchored

For fixed income investors, the GST reform helps anchor India’s macro narrative around stability and disinflation, while reducing concerns over fiscal slippage. Before the GST announcement, bond investors worried about a potential revenue hole between INR 800bn–1.5tn. The final estimated figure, at INR 480bn or 0.13 per cent of GDP, will be largely offset by higher duties on sin and luxury goods. This narrower shortfall reduces the risk of additional borrowing in FY26 and keeps the fiscal deficit broadly aligned with the 4.4 per cent glide path. Even in a scenario where the Centre absorbs the full loss, no material increase in gross issuance is expected. This combined with clearer second-half borrowing plans, strengthens demand-supply balances.

The disinflation impulse adds another supportive layer. Around 295 goods which is roughly 65 per cent of the GST basket have been moved from 12 per cent to 5 per cent or NIL. If passed through, CPI could fall by 50–60bps in FY26–27. Economists already expect growth of 6.3–6.5 per cent through FY26-27, with GST helping offset tariff-related drag. Together with earlier income tax cuts (0.3 per cent of GDP) and lower debt servicing costs from repo rate reductions (0.17 per cent of GDP), the total consumption boost could reach 0.6 per cent of GDP, enough to add around 0.2 per cent to growth even after accounting for savings.

Progress on inflation gives the RBI-MPC room for a final 25bps rate cut in December, taking the repo to 5.25 per cent, especially if the Fed continues easing. With inflation trending lower into FY27, accommodative policy would reinforce the bullish case for bond market demand especially for sovereign bonds.

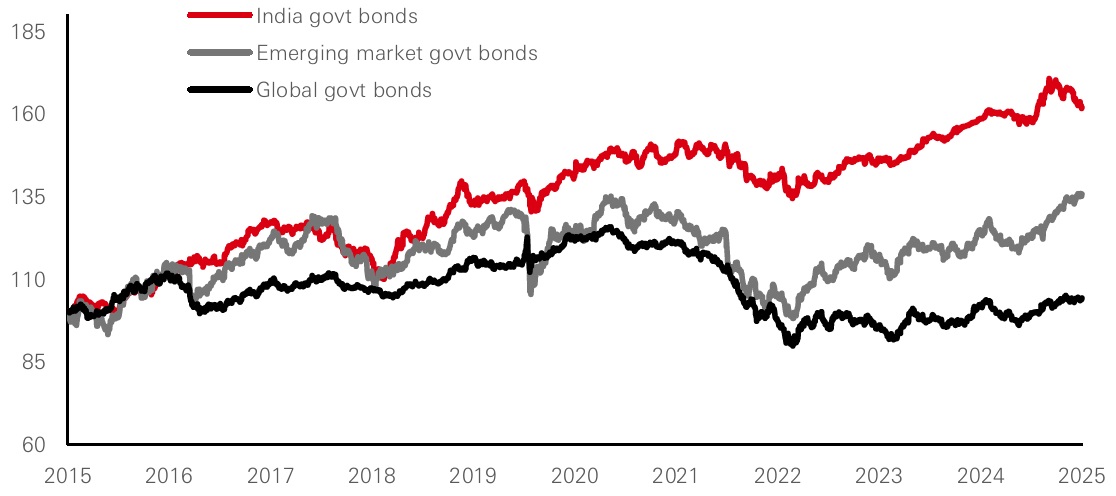

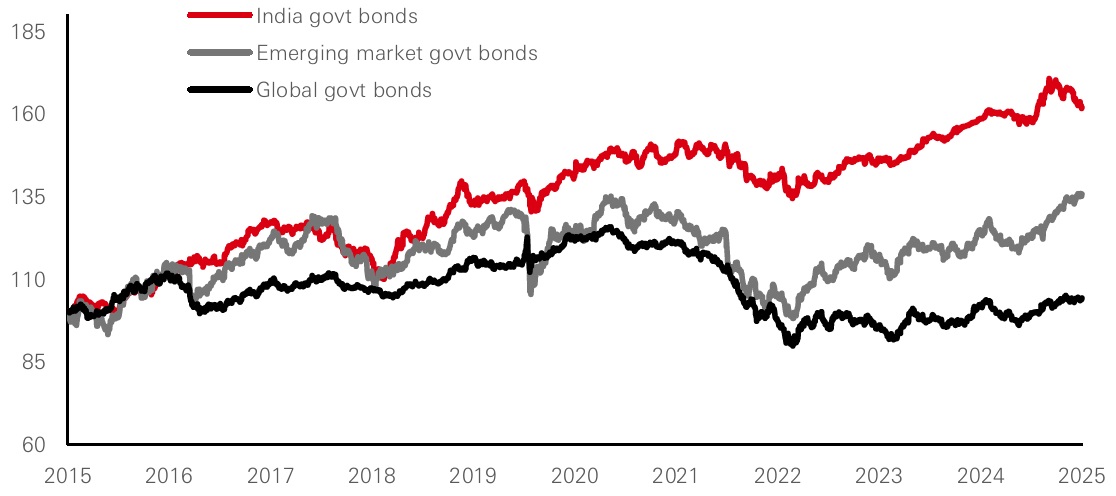

Against this backdrop, the risk-reward looks strongest at the long end of the sovereign curve, where term premiums remain elevated. India government bonds have not only outperformed global and EM peers but also shown low correlation of 0.15 with global bonds over the last 10 years, offering both return potential and diversification at a time of global uncertainty. A stable fiscal trajectory, manageable supply, a disinflationary impulse, and a dovish central bank further underpins a constructive stance. With GST reforms bolstering domestic fundamentals against tariff-induced global uncertainties, an overweight duration strategy appears well supported by both policy and market dynamics.

GST reform is estimated to lower fiscal risk to 0.13 per cent of GDP, reinforcing bond market stability.

10-year index performance in USD terms (rebased at 100)

Click the image to enlarge

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. Source: HSBC Asset Management, Bloomberg, August 2025.

Past performance does not predict future returns. For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Obtain information about the state guarantee to deposits at your bank or on www.cmfchile.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece, Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- In Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in Turkiye by HSBC Asset Management A.S. Turkiye (AMTU) which is regulated by Capital Markets Board of Turkiye. Any information here is not intended to distribute in any jurisdiction where AMTU does not have a right to. Any views here should not be perceived as investment advice, product/service offer and/or promise of income. Information given here might not be suitable for all investors and investors should be giving their own independent decisions. The investment information, comments and advice given herein are not part of investment advice activity. Investment advice services are provided by authorized institutions to persons and entities privately by considering their risk and return preferences, whereas the comments and advice included herein are of a general nature. Therefore, they may not fit your financial situation and risk and return preferences. For this reason, making an investment decision only by relying on the information given herein may not give rise to results that fit your expectations.

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.

Copyright © HSBC Global Asset Management Limited 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.

Content ID: D056313_V3.0; Expiry date: 30.09.2026.