Private equity with purpose

Executive summary

Capital markets are continually being buffeted by far-reaching forces that are shaping societies, economies, and the environment. Technological innovation, climate change, demographic shifts, rising inequalities, and evolving regulatory requirements all pose challenges but also create opportunities for forward-thinking investors as economies adapt to disruption.

A growing number of companies are providing innovative and competitive products and services aligned to these ‘megatrends’. Impact investing offers a clear pathway to invest in these companies, achieving both competitive financial returns and tangible positive social and environmental outcomes. Indeed, impact strategies can have a return premium because sustainability has proven to be a core lever for value creation at both fund and portfolio company level.

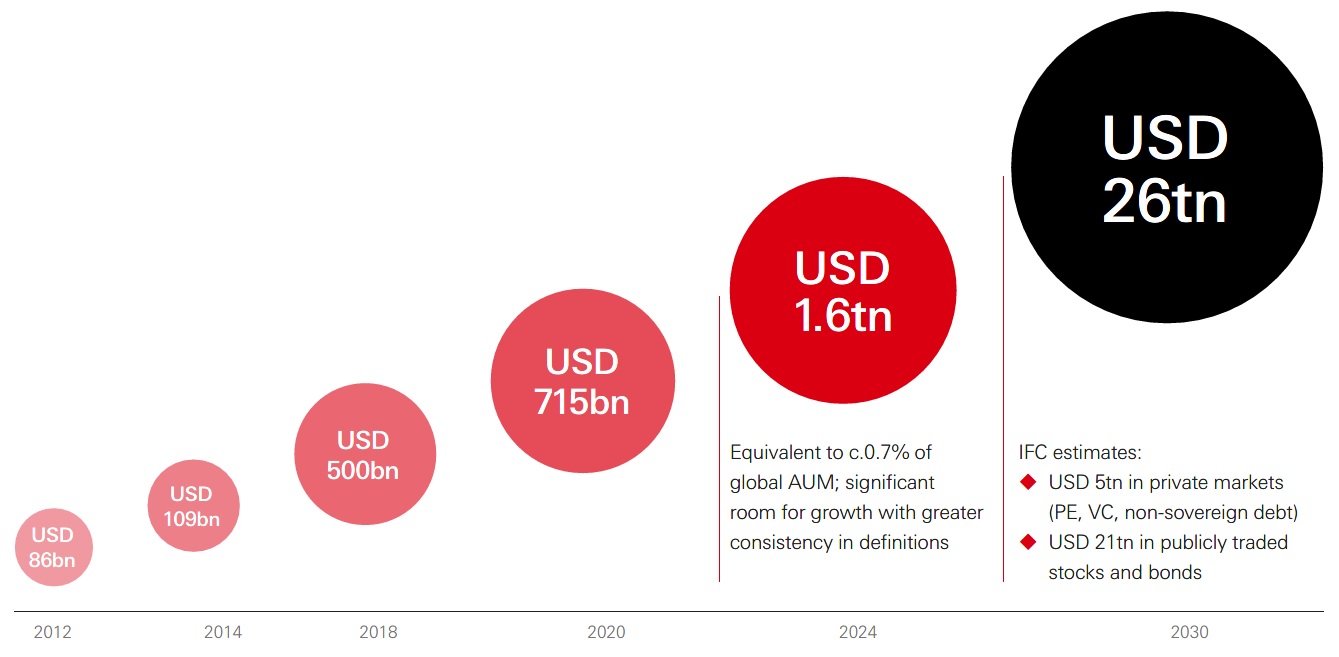

Over the last 20 years, impact investing has evolved from niche concept to the mainstream, with approximately USD 1.6tn of impact investing assets under management globally. Yet, there remains great potential for investors to help scale investment flows to address systemic issues. This paper analyses trends, data and real-word case studies to explore why impact investing is increasingly attractive among investors.

Private equity’s active ownership model and long-term horizon should enable investors to have impact, while potentially enhancing returns and lowering portfolio risk. Private equity impact funds can also allow mission-aligned investors to achieve targeted and measurable social and environmental goals without sacrificing financial returns.

Demystifying impact: Extracting the substance

Defining impact

Impact investing is a strategy that explicitly seeks to generate positive and measurable social and environmental outcomes alongside a financial return. Impact is aligned to various megatrends that are revolutionising the world and that provide differentiated sources of financial return.

The Global Impact Investing Network (GIIN) has been the global champion of impact investing, dedicated to increasing the scale and effectiveness of impact investing around the world. GIIN estimates that there are over 3,900 organisations managing USD 1.6tn in impact investing assets under management (AUM) worldwide. There has been 21 per cent compound annual growth (CAGR) of the total impact investing market since 20191.

The International Finance Corporation (IFC) estimates that impact investing AUM will grow from USD 1.6tn to USD 26tn by 2030, of which USD 5tn will be in private markets impact investments2.

Impact investing: Rapid market growth

For illustrative purposes only. Forecasts, forward-looking statements, views and opinions are subject to change without notice, are by their nature, subject to significant risks and uncertainties, and are not a reliable indicator of future performance. There is no guarantee that an investment approach with ESG factors will produce returns similar to those which don’t consider these factors. Investments which consider ESG factors may diverge from traditional market benchmarks. In addition, there is no standard definition of, or measurement criteria for environmental, social and governance impact (“ESG Impact”). ESG Impact measurement criteria are (a) highly subjective and (b) may vary significantly across and within sectors. There is no guarantee that: (a) the nature of the ESG Impact of an investment will be aligned with any particular investor’s ESG Impact goals; and (b) the stated level or target level of ESG Impact will be achieved.

Source: GSIA, as of 2014, IFC, as of 2019 & 2021, and GIIN, as of 2024.

Impact investing has evolved from niche to mainstream, with USD 1.6tn of AUM globally.

1. Sizing the Impact Investing Market 2024 - The GIIN

2. www.ifc.org

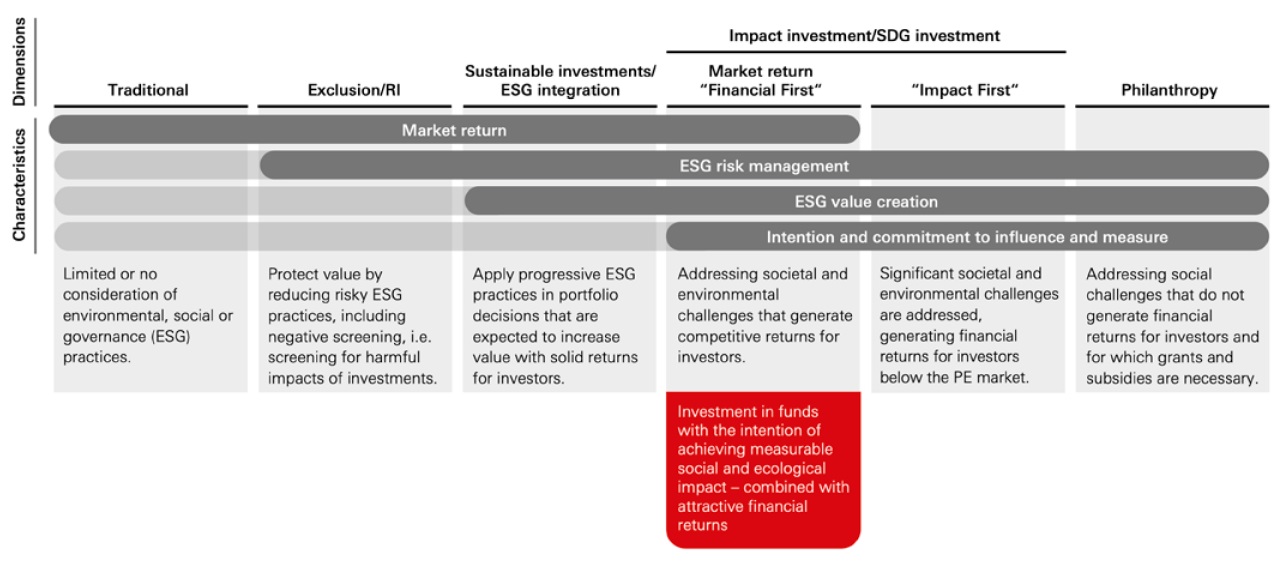

Impact investing on the sustainability spectrum

As the visual below shows, investment strategies can be placed along a ‘sustainability spectrum’ from traditional investing to philanthropy. Impact investing is a step beyond responsible investment/ ESG integration and incorporates financial first and impact first approaches.

Impact investing on the sustainability spectrum

Source: HSBC Asset Management (2025)

An impact financial first approach in private equity aims to take an active and long-term approach to generate competitive returns while addressing social and environmental challenges. Financial performance can be benchmarked against the broader private equity market, rather than a specific impact investing subset. This approach ensures alignment between the impact case and the investment case.

Having real-world impact: What is measured gets done

Three principles define impact investing:

- Intentionality: A clearly defined social or environmental impact thesis

- Contribution or Additionality: Quantifying the impact achieved towards a sustainable objective, which would not have occurred without the investment

- Measurement: Transparent impact measurement and reporting aligned with global standards

Examples of global standards and frameworks include the UN Sustainable Development Goals (SDGs), 17 global sustainability priorities (and 169 specific targets) to be met by 20303, IRIS+, GIIN’s standardised system for measuring and managing impact performance4, and Five Dimensions of Impact, as defined by the Impact Management Project (IMP)5.

3. THE 17 GOALS | Sustainable Development

4. Welcome to IRIS+ System | the generally accepted system for impact investors to measure, manage, and optimize their impact

5. https://impactfrontiers.org/

The Five Dimensions of Impact

|

Impact dimension |

Impact questions each dimension seeks to answer |

|

What |

|

|

Who |

|

|

How much |

|

|

Contribution |

|

|

Risk |

|

Impact can be measured in different ways depending on the objectives of a specific investment strategy. To ensure an investment can demonstrate an impact outcome, it is crucial to define suitable key performance indicators (KPIs) for each strategy or business model.

Some example metrics for measurement of impact across different investable themes are shown below. These are metrics that should be provided to investors on at least an annual basis.

Examples for Impact KPIs

|

Theme |

Sample KPIs |

|

Climate |

|

|

Healthcare |

|

|

Education |

|

|

Inclusion |

|

Impact thematics and regions

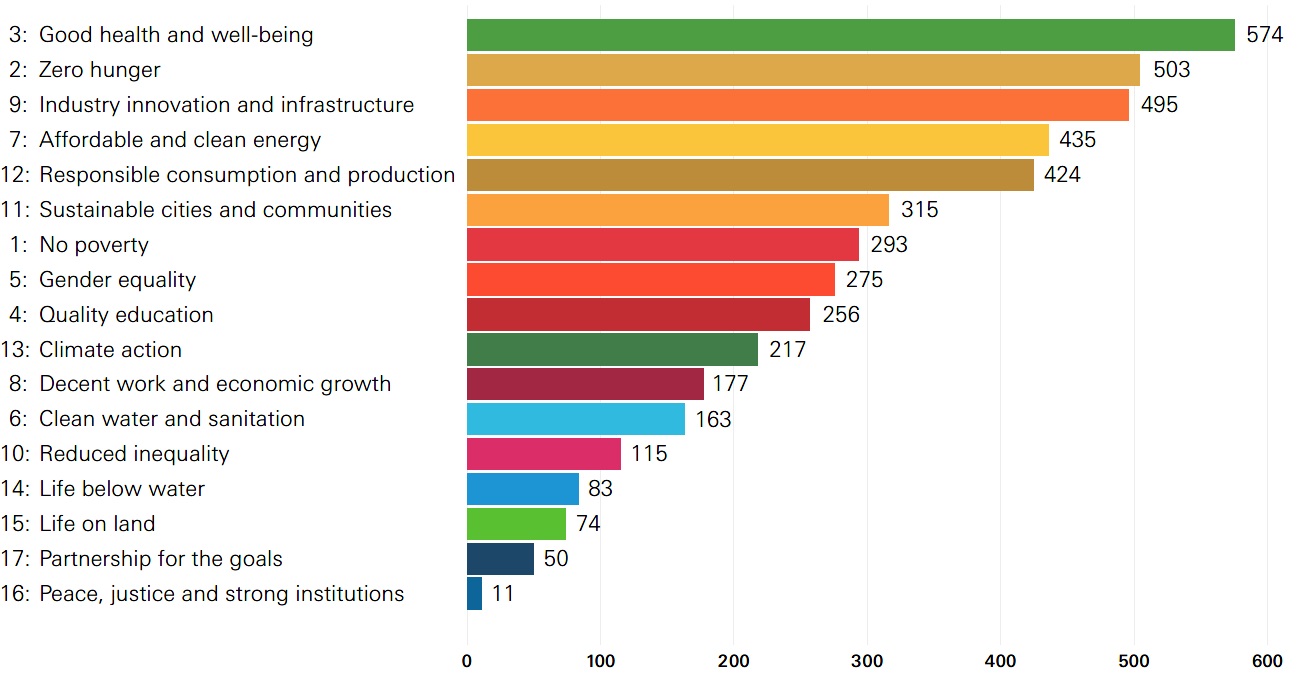

Phenix Capital, an investment consultant group, manages an impact investment database tracking almost 1,000 managers and 2,000+ impact funds. Phenix published a report showing data on UN SDGs targeted by private equity impact investment managers. The top opportunities focused on by private equity are SDG 3 – Good health and wellbeing, SDG 2 – Zero hunger, and SDG 9 – Industry, innovation, and infrastructure, with SDG 7– Clean energy also a prominent area. Increasingly traditional private equity managers are also recognising the opportunities for investment in these areas.

UN SDGs most targeted by Private Equity Funds*

Source: Phenix Capital (2025)

*Data may overlap as funds can target several SDGs.

Impact investing has a global opportunity set across both developed and developing countries. Impact investments address the same thematics but are tailored to the specific challenges and opportunities of each region or geography. Common investable opportunities target areas including sustainable infrastructure, renewables energy projects, and affordable housing.

GIIN’s ‘Sizing the Impact Investing Market’ 2024 report shows that developed market investors manage 95 per cent of global impact AUM, while emerging markets manage the remaining 5 per cent6. When it comes to where capital is invested to generate impact, developed markets receive 75 per cent of impact AUM and emerging markets receive 25 per cent. Emerging regions like Sub-Saharan Africa and South Asia are attracting growing capital targeted at high-impact opportunities, including climate resilience and poverty alleviation.

Overall, the manager’s impact thesis, goals, and risk tolerance will determine the choice of target region. Therefore, an investor can tailor their impact exposure to match their regional and risk preferences.

Is there a return trade-off?

Evidence suggests there is no return trade-off to private equity impact investing. Indeed, there is a potential return enhancement to be gained through careful impact manager selection.

In recent years, a growing proportion of private equity impact managers have invested with a financial first objective. These range from established traditional private equity platforms which added impact strategies to their suite of strategies to dedicated impact private equity firms. As such, the private equity impact market has matured into a performance-aligned, market-rate discipline. Research shows that well-constructed impact portfolios can meet or exceed traditional private equity benchmarks. Macroeconomic tailwinds, access to growth sectors, and market demand for sustainability can all enhance exit visibility and value7.

Well-constructed impact portfolios can meet or exceed traditional private equity benchmarks.

6. Implementing Sustainable and Impact Investing in Investment Portfolios - Cambridge Associates

7. Sizing the Impact Investing Market 2024 - The GIIN

A 2020 Preqin study based on returns from approximately 1,700 private equity funds with vintages between 2010–2017, showed impact funds marginally outperformed mainstream, or broader market private equity funds, with a materially lower level of volatility8. This represents potentially attractive risk/return dynamics for investors and can make impact portfolios a useful portfolio construction tool.

A study by Pensions for Purpose, a UK organisation that promotes impact investment among UK pension funds, gathered performance data from 17 asset managers with close to £19bn (USD 25bn) in impact assets under management, of which around 10 per cent was invested in private equity. Impact-focused private equity funds were found to outperform public equity markets (FTSE All-World Index). Top-quartile private equity impact funds have delivered performance equal to or above traditional peers9.

It is important to highlight the need to select the ‘right’ managers, as the dispersion of returns between top-performing funds and others can be considerable. Clearly, manager selection is incredibly important in maximising the benefits of an allocation towards impact.

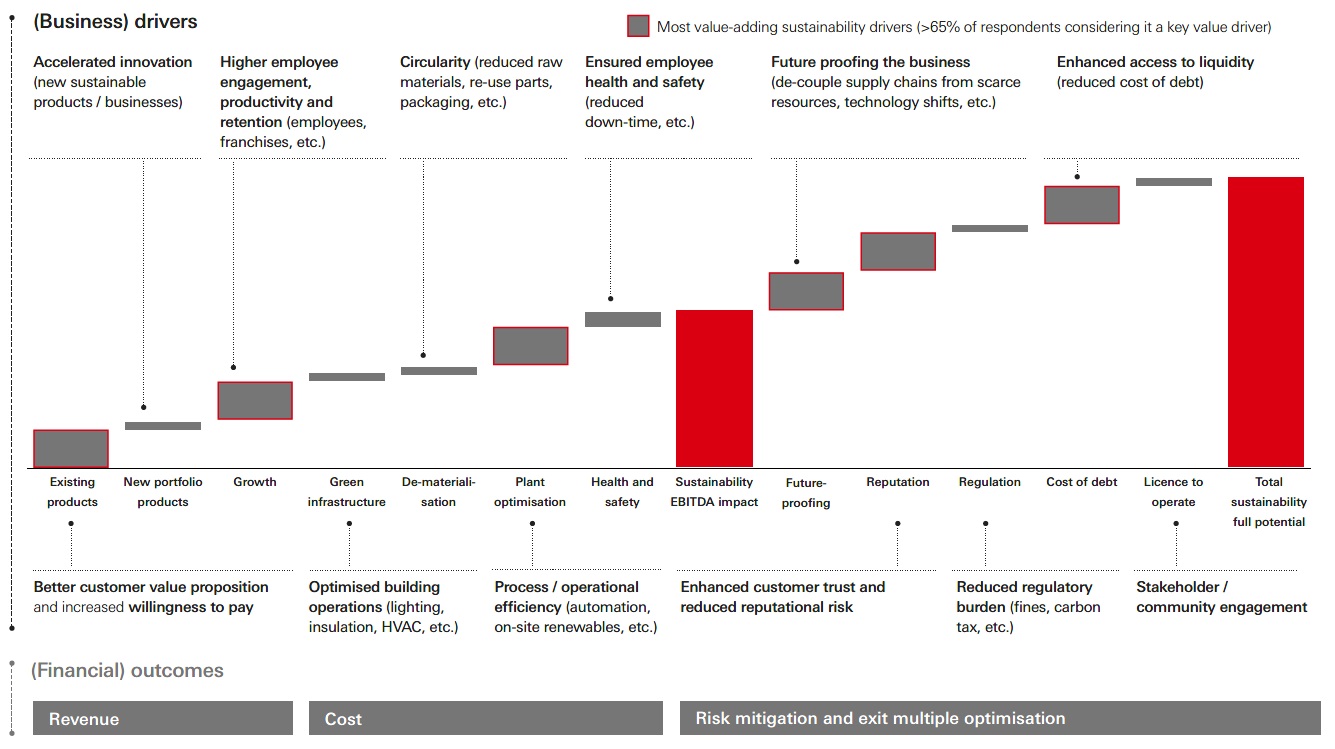

How does the return premium for impact strategies arise? A recent report surveying over 400 global investors illustrates that sustainability is now a core lever for value creation at both fund and portfolio company level. Integrating sustainability was found to drive c. 6 per cent of revenue growth and a 6–7 per cent uplift in exit multiples. Top value drivers were found to be a better customer value proposition and enhanced customer trust10.

Sustainability unlocks value across multiple drivers

Source: PRI, NYU Stern CSB, Bain & Co. (2024). Survey on sustainability-linked value creation in private markets (N=85)

8. 2019-Preqin-Global-Alternatives-Reports-Sample-Pages.pdf

9. Impact investment performance – a UK asset owner & investment consultant perspective | Pensions For Purpose

10. Value creation through sustainability in private markets | PRI

Is impact investing just ‘ESG Integration 2.0’?

No. ESG Integration considers how a company operates in relation to its stakeholders and the external environment. ESG Integration aims to incorporate material environmental, social, and governance considerations alongside financial considerations when managing a company. ESG Integration defines how a company is run. Here, sustainable practices can unlock relevant commercial value creation potential.

In contrast, impact investing focuses on whether and how a company’s product or service addresses underserved social and environmental challenges – it is therefore forward looking and focused on the business model. Impact investors identify and allocate funds to companies that improve social and/or environmental outcomes through their products and services. As discussed, impact strategies vary in their focus on achieving financial returns alongside impact outcomes. In a financial first approach, the investment case is clearly and positively correlated with the impact case.

|

|

An analogy is the image of handprint and footprint. ESG Integration analysis represents how a company reacts to environmental, social, and governance challenges, and how it performs on E, S, and G metrics. It can be seen as a company’s footprint, analogous to a company’s ‘carbon footprint.’ ESG Integration is often employed as risk mitigation but is also increasingly recognised as a powerful tool for value creation. Here, impact fund managers tend to be more advanced than the overall market. |

|

|

Impact investing is inherently about taking a hands-on approach to unlocking opportunity and is therefore linked to growth and the commercial investment case. It represents the innovative and proactive actions that a company and its private equity impact sponsors take to actively address and help solve social and environmental challenges, which can be seen as the company’s handprint. |

Private equity: A natural home for impact

Why private equity for impact?

Based on the GIIN annual impact investor survey, private equity represents 43 per cent of the close to USD 1.6tn impact AUM, the largest single asset class for impact investing. A large majority (73 per cent) of survey respondents have some of their impact AUM in private equity.

Impact investing themes in private equity are varied and include energy transition, circular economy, sustainable food and agriculture, health, and wellbeing, education, and natural capital. These are sectors benefiting from a range of regulatory and secular consumer trends.

We believe private equity is an excellent investment strategy to deliver impact outcomes for three key reasons:

- Active control and governance: General Partners (GPs) can take a hands-on approach to influence company strategy and outcomes having majority or significant minority stakes in the companies

- Long-duration capital: Supports sustained transformation beyond short-term public-market scrutiny. The scale of the environmental and social challenges being addressed require investment over timeframes better suited to private capital

- Operational engagement: Ensures accountability and scale, as well as aligned incentive structures

The value creation tools utilised by private equity managers – creating efficiency, stimulating innovation, and nurturing leadership – can all help to deliver profit and progress when applied with intention.

Accessing impact investing through private equity also benefits from the trend of companies increasingly choosing to stay private, rather than going public. This means there is a wider pool of fast-growing and innovative companies that investors can access through private equity managers.

All of this makes private equity a natural home for impact.

The value creation tools utilised by private equity managers can help deliver profit and progress when applied with intention.

The timing advantage: Why now for private equity impact?

The UN has stated that the world is at a crossroads, with geopolitical and economic fragmentation coinciding with environmental degradation, climate threats, and rising inequality. Transforming and diversifying economies and enhancing their resilience to shocks requires trillions of US dollars in investments aligned with the UN SDGs11.

There is increasing recognition from policymakers and regulators of the contribution of long-term financing aligned to sustainable and transformative development, including fostering innovation, creating jobs, and building a resilient and sustainable economy. This is expected to lead to the scaling up and integration of impact investing as part of wider EU and global policy goals.

11. UN Financing for Sustainable Development Report, 2023

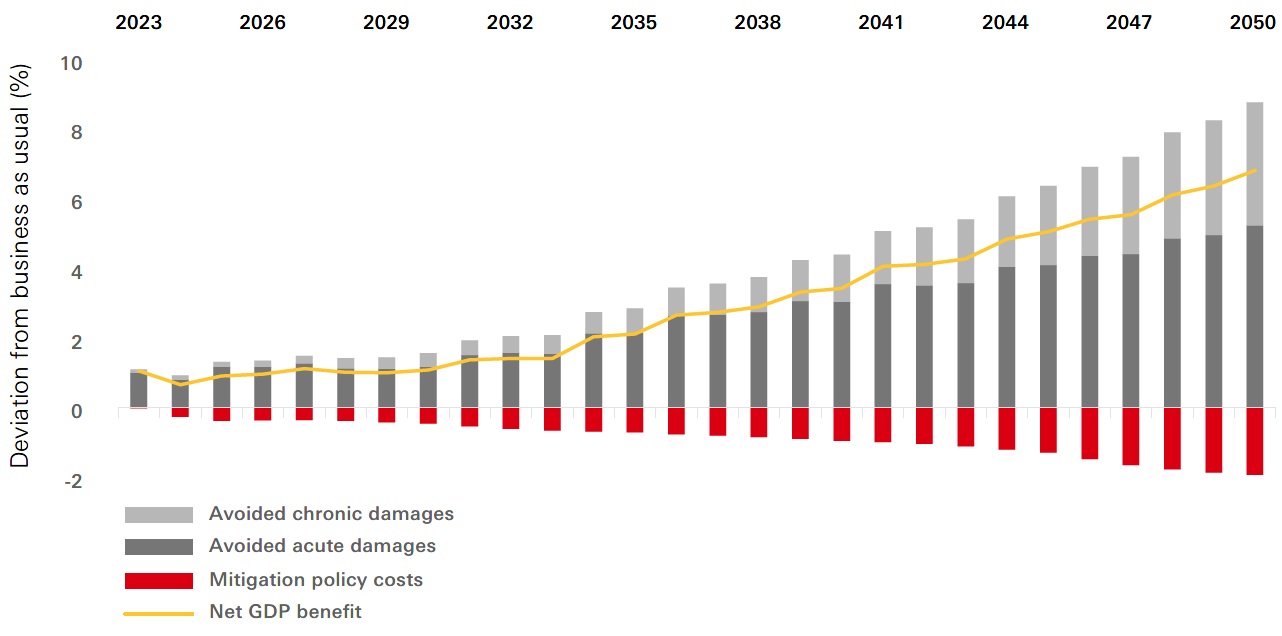

Only considering potential economic gains from the transition to net zero by 2050, the net expected GDP benefits will grow over time, as the chart below illustrates. These benefits are likely to accrue to innovative companies that are addressing the climate mitigation and adaptation.

Potential economic benefits from the net zero transition by 2050

Source: OECD (2025) (pg. 32)

Private impact investors can benefit from a powerful combination of tailwinds:

|

|

|

|

|

|

|

|

|

|

|

|

Investors are increasingly being drawn to the unique features and benefits of impact investing. In a recent survey of over 300 institutional investors globally, 27 per cent of investors are already doing impact investment and 26 per cent more are ‘planning to do so’12

12. Global Asset Owner Survey: Risk and Resilience

Drivers of this increased investor demand for impact investment are:

- Established market for private market impact: Increased allocation to private market impact strategies over recent years illustrates that investors are attracted to the demonstrable track record, scale, and validation of over time of such strategies. This should enable future investor inflows in coming years

- Generational wealth transfer: Cerulli finds that USD 105tn of wealth will be transferred to next-generation heirs (Gen X, Gen Y, and Gen Z) in the US by 2048, while the rest will be donated to charities13. These younger investors increasingly want to align their portfolios with social and environmental goals and increasingly demand values-aligned portfolios14

Spotlight on the renewable energy opportunity

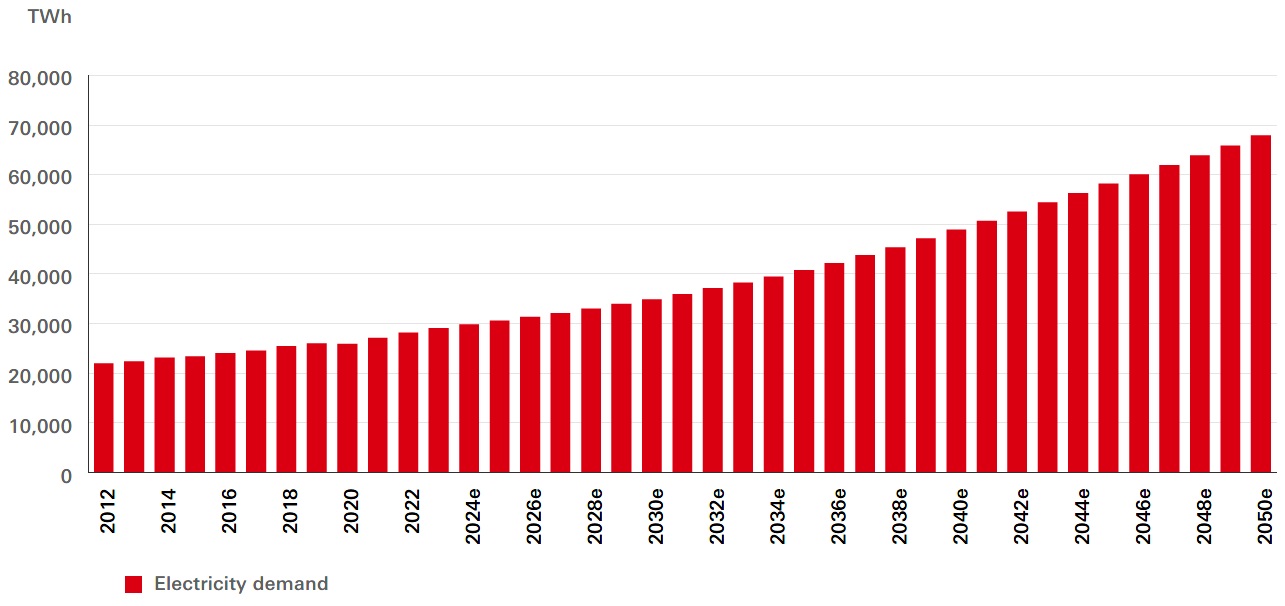

Electricity demand growth is projected to grow significantly in the coming years as the chart below shows. Demand is being driven by rapid the growth of AI and data centre demands and the electrification of everything (including for transport, manufacturing, and heating and cooling).

Expected change in global electricity demand

Source: HSBC (2024)

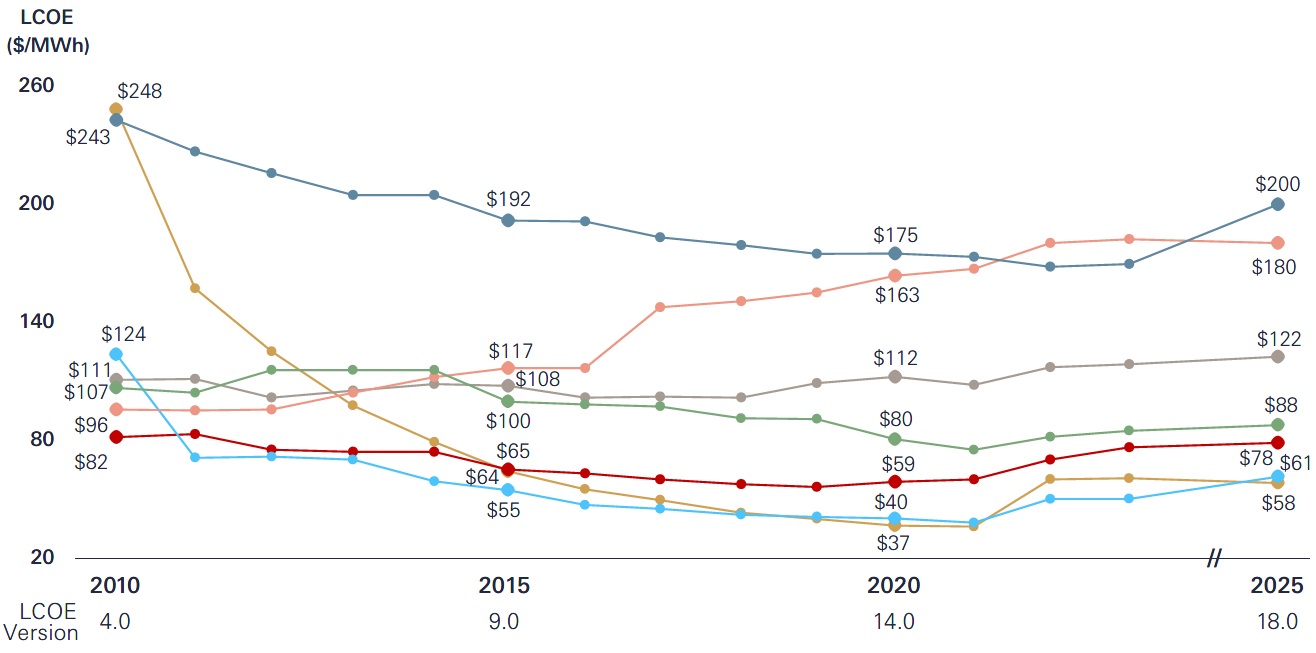

Renewable energy is well placed to meet growing energy demands in a way that is cost-efficient and helps to avoid greenhouse gases and environmental pollutants harmful to human health. The cost of solar and wind energy has fallen steadily over the last 15 years and is now cheaper than fossil fuel and geothermal energy15.

A vast majority (91 per cent) of new renewable projects are now cheaper than fossil fuels, with cost declines driven by technological innovation, competitive supply chains, and economies of scale16.

13. Cerulli Anticipates USD 124tn in Wealth Will… | Cerulli Associates

14. Navigating The New Era Of Sustainable Investing: How Family Offices Can Adapt to Evolving Regulations And Values

15. lazards-lcoeplus-june-2025.pdf.

16. 91 per cent of New Renewable Projects Now Cheaper Than Fossil Fuels Alternatives

Levelised Cost of Energy (LCOE) Comparison: Significant historical cost declines for utility-scale renewable energy generation technologies

Cost change for each technology

Source: Lazard (June 2025)

Levelised Cost of Energy (LCOE) represents the average cost of producing one unit of electricity over the lifetime of a generating asset. LCOE is expressed in cost per unit of energy, often as £/MWh (or USD /MWh).

Critically, most renewable projects, like solar and wind farms can typically be deployed within two years17. In contrast, fossil fuel plants can take up to five years to build and become operational18 and require further time to build pipelines. The construction timeline for nuclear reactors can take 10 years or longer19.

The growth of the renewable energy sector also promises to create many skilled and high-paid jobs. In the UK, for example, green jobs have grown at four times the rate of the overall UK employment market20.

17. Setting the Record Straight About Renewable Energy | World Resources Institute

18. Renewables evolve – fossil fuels ‘run out of road’ – Nuclear Consulting Group

19. | Construction lead times and opportunity costs for nuclear and... | Download Scientific Diagram

20. Green Jobs growing at four times the pace of the overall employment market

Bringing private equity impact to life

Impact investment in private equity spans a broad range of sectors and thematics, which makes it a useful diversifier in the context of portfolio construction.

To make the concept more tangible, below are two illustrative case studies of companies demonstrating social and environmental impact.

Case Study 1: TeachTown

TeachTown is a leading provider of special education solutions for students with moderate to severe learning challenges. Since its founding in 2003, TeachTown has been dedicated to improving the academic, behavioural, and adaptive functioning of students with disabilities from Pre-K through twelfth grade, empowering them to reach their educational goals with evidence-based instructional practices.

TeachTown has grown tremendously since its inception and today supports more than 100,000 students with differentiated products and purpose-built curriculum, earning the Company distinction on the 2023 Fortune Impact 20 list. To track the asset’s impact performance, Bain (the GP) reported on three impact KPIs: students served, treatment hours and student improvement. Bain Double Impact realised its position in TeachTown with a highly successful exit to L Squared Capital Partners in 202421.

Case Study 2: Nactarome

Nactarome is the leading provider of natural-based flavours and colours for the food industry. The substitution of synthetic (oil-derived or inorganic chemicals) flavours and colours with raw materials from natural origins, which are renewable in nature and do not pose any health issues, is becoming a preferred choice of industrial players and consumers in the food value chain.

Through the GP Ambienta’s buy and build approach, Nactarome Group is proactively supporting the shift toward natural-based products via a significant development plan that already translated in year-on-year growth rate for natural-based products of over 10 per cent.

The asset has a positive impact on UN SDG 12 (Responsible consumption and production). Through its Environmental Impact Analysis Framework, Ambienta also tracks Pollutants Avoided. Ambienta realised its Nactarome position with a successful sale to TA Associates22.

Impact themes are invested in by traditional private equity managers, but impact managers are especially suited to:

- Identify the right opportunities

- Manage for best impact outcome and therefore financial outcome

- Integrate the impact case firmly into the business model. This then becomes an attractive exit case as it is a valuable proposition for a range of buyers, including traditional PE funds, who may lack the in-depth expertise for the initial transformation

There is a wide diversity of impact investment opportunities available to private equity investors. An approach that incorporates different social and environmental impact opportunities allows investors to naturally diversify their portfolios by strategy, region, and company type.

21. TeachTown Secures Growth Investment from Bain Capital Double Impact | Bain Capital

22. Nactarome Group (fka AromataGroup) - Ambienta Sgr S.p.A.

Now is the time for impact

Private impact strategies can play a role as a satellite investment as part of a portfolio consisting of core private equity assets, providing access to a vast and growing opportunity set and a valuable source of portfolio diversification. For investors with sustainability preferences and goals, impact investing can also be part of a core private markets allocation as it is diversified across sectors, addresses real-world issues, and contributes to the creation of dynamic, prosperous economies and communities.

A financial first impact approach allows investors to achieve attractive returns while also addressing pressing social and environmental challenges. A considerable proportion of impact assets globally are allocated to private equity, and research suggests that impact strategies can have a return premium associated with them. Private equity impact returns perform in line with unconstrained private equity funds and outperform traditional equity markets.

While impact investing is an established investment strategy which has seen considerable growth in recent years, it is still early in scaling to address systemic challenges. These include climate change and the need for a circular economy, future-proofing food and agriculture, and addressing societal inequalities. These are significant and long-term challenges that will require innovative solutions, thus creating opportunities for forward-thinking investors.

Impact investing is a strategic opportunity to benefit from these opportunities and align capital with conviction, uniting value and purpose. Now is the time to invest in impact.