HSBC Asset Management launches active ETF range

HSBC Asset Management (HSBC AM) has entered the active ETF market with the launch of five new funds.

The HSBC PLUS Active ETF range will provide investors with country and regional exposures through ‘core’ and ‘income’ versions, aiming to blend the benefits of the ETF wrapper with the potential to outperform.

The funds utilise a quantitative driven investment approach with proprietary factors forming the basis of a stock selection process which leverages HSBC AM’s Quantitative Equity capabilities.

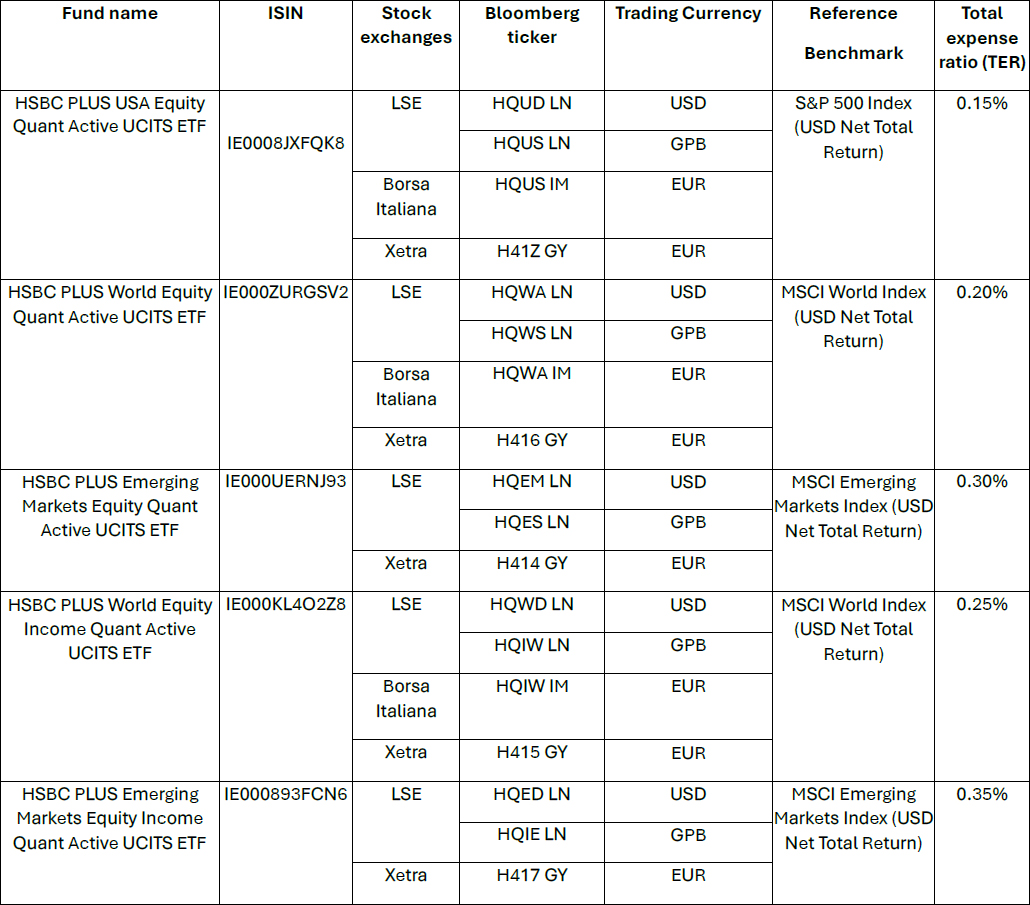

The funds that comprise the HSBC PLUS Active ETF range are:

- HSBC PLUS USA Equity Quant Active UCITS ETF

- HSBC PLUS World Equity Quant Active UCITS ETF

- HSBC PLUS Emerging Markets Equity Quant Active UCITS ETF

- HSBC PLUS World Equity Income Quant Active UCITS ETF

- HSBC PLUS Emerging Markets Equity Income Quant Active UCITS ETF

The overall investment approach aims to target specific drivers of equity returns and select stocks based on their ‘style’ characteristics, including stocks which show the greatest association with value, quality, industry momentum, low risk and size. The stock selection process relies on HSBC AM’s well-defined criteria which has been developed by the business for 20 years.

The core range, which includes the HSBC PLUS USA Equity Quant Active UCITS ETF, HSBC PLUS World Equity Quant Active UCITS ETF and HSBC PLUS Emerging Markets Equity Quant Active UCITS ETF funds, aims to maximise exposure to the highest ranked stocks based on their factor characteristics whilst minimising the portfolio’s overall risk.

The income range consists of the HSBC PLUS World Equity Income Quant Active UCITS ETF and HSBC PLUS Emerging Markets Equity Income Quant Active UCITS ETF funds which aim to identify equity securities with attractive income and quality characteristics and that provide additional income compared to a market-cap index, while preserving the capital growth.

The funds will be registered and available to retail, wholesale and institutional investors in Austria, Germany, Spain, France, Italy, Luxembourg, Sweden and the UK. They will also be listed on London Stock Exchange, Borsa Italiana and Xetra.

Olga de Tapia, Global Head of ETF and Indexing Sales at HSBC AM, said:

“The active ETF market is enjoying strong growth, and we are pleased to introduce our suite of funds in this space as part of our efforts to bring innovative and relevant investment tools to investors.

“Our HSBC PLUS Active ETF range combines quantitative active management with the efficiency of an ETF structure and aims to provide investors with additional alpha beyond core passive exposures in a cost-efficient way and ensuring resilience across diverse market cycles and economic regimes.

“As investors seek more sophisticated strategies and more efficient ways to capture risk premia, as well as enhance equity returns in today’s complex investment environment, we believe factor strategies can be used to complement existing investments and help with diversification by sitting in a space between traditional active and passive investments.”

Click to enlarge

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested.

Funds are denominated in currencies other than GBP. Returns and costs may vary with fluctuations in exchange rates.

Media enquiries

Ellis Ford – ellis.ford@hsbc.com

Notes to editors

For journalists only and should not be distributed to or relied upon by any other persons.

Notes to investors

The information contained in this press release does not constitute an offer or solicitation for, or advice that you should enter into, the purchase or sale of any security or fund. Any views expressed are subject to change at any time.

This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Global Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. HSBC PLUS USA Equity Quant Active UCITS ETF, HSBC PLUS World Equity Quant Active UCITS ETF, HSBC PLUS Emerging Markets Equity Quant Active UCITS ETF, HSBC PLUS World Equity Income Quant Active UCITS ETF and HSBC PLUS Emerging Markets Equity Income Quant Active UCITS ETF are sub-funds of HSBC ETFs plc (“the Company”), an investment company with variable capital and segregated liability between sub-funds, incorporated in Ireland as a public limited company, and is authorised by the Central Bank of Ireland. The company is constituted as an umbrella fund, with segregated liability between sub-funds. Shares purchased on the secondary market cannot usually be sold directly back to the Company. Investors must buy and sell shares on the secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current Net Asset Value per share when buying shares and may receive less than the current Net Asset Value per Share when selling them. UK based investors in HSBC ETFs plc are advised that they may not be afforded some of the protections conveyed by the Financial Services and Markets Act (2000), (“the Act”). The Company is recognised in the United Kingdom by the Financial Conduct Authority under section 264 of the Act. The shares in HSBC ETFs plc have not been and will not be offered for sale or sold in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United States Persons. Affiliated companies of HSBC Global Asset Management (UK) Limited may make markets in HSBC ETFs plc. All applications are made on the basis of the current HSBC ETFs plc Prospectus, relevant Key Investor Information Document (“KIID”), Supplementary Information Document (SID) and Fund supplement, and most recent annual and semi-annual reports, which can be obtained upon request free of charge from HSBC Global Asset Management (UK) Limited, 8 Canada Square, Canary Wharf, London, E14 5HQ. UK, or from a stockbroker or financial adviser. The indicative intra-day net asset value of the sub-fund[s] is available on at least one major market data vendor terminal such as Bloomberg, as well as on a wide range of websites that display stock market data, including www.reuters.com.

Investors and potential investors should read and note the risk warnings in the prospectus, relevant KIID and Fund supplement (where available) and additionally, in the case of retail clients, the information contained in the supporting SID.

HSBC Asset Management

HSBC Asset Management should be referred to either in full or as HSBC AM to avoid confusion with any other financial services firms.

HSBC Asset Management, the investment management business of the HSBC Group, invests on behalf of HSBC’s worldwide customer base of retail and private clients, intermediaries, corporates and institutions through both segregated accounts and pooled funds. HSBC Asset Management connects HSBC’s clients with investment opportunities around the world through an international network of offices in 20 countries and territories, delivering global capabilities with local market insight. As at 31 March 2025, HSBC Asset Management managed assets totalling USD 748bn (excluding HSBC Jintrust Fund Management Company Limited) on behalf of its clients.

For more information see http://www.global.assetmanagement.hsbc.com/

HSBC Asset Management is the brand name for the asset management businesses of HSBC Holdings plc.

HSBC Holdings plc

HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 58 countries and territories. With assets of USD 3,054bn at 31 March 2025, HSBC is one of the world’s largest banking and financial services organisations.