Investment Monthly

Summary

House View

- We expect a “role reversal” this year in areas of the macro, policy, and market environment, with US exceptionalism fading, and growth converging in the west. Global market performance will be dependent on profits growth

- The new year rally concentrated in Asia and other emerging markets shows a “broadening out” of market leadership amid better EM corporate profits. EMs also look to be structurally safer and less volatile

- With government bonds potentially less reliable as a portfolio hedge, investors should manage volatility by seeking to “diversify the diversifiers” with bond substitutes like hedge funds and private markets

Macro Outlook

- US growth has been robust, but there are some imbalances. K-shaped dynamics are in play: with AI capex booming, but a cooling labour market and tariff-driven price rises proving to be headwinds to consumers

- We expect more balanced, trend-like US growth this year. Tariffs and AI capex still pose upside risks to inflation

- Geopolitical events have been in focus in early 2026, and are expected to remain an important influence on the economic environment and markets

- Supportive macro policies and tech/industrial competitiveness aid China’s growth resilience, but economic imbalances remain a key challenge

Policy Outlook

- The US Fed is in wait-and-see mode as it assesses the impact on the economy of trade tariffs, immigration policy, and the AI investment boom

- Kevin Warsh’s nomination as the next Fed Chair resolves a key question for investors but the impact on policy is not clear cut

- With EM Asia approaching the end of its rate cutting cycle, governments have space to use fiscal policy to respond to growth disappointments

- China will continue its targeted and calibrated policy support to aid domestic demand, alongside reform efforts focused on strategic objectives such as technology innovation and self-reliance, and economic rebalancing

Scenarios

Click the image to enlarge

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. The views expressed above were held at the time of preparation and are subject to change without notice. Diversification does not ensure a profit or protect against loss. This information shouldn’t be considered as a recommendation to invest in the country or sector shown. This information shouldn’t be considered as a recommendation to invest in the country or sector shown. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Source: HSBC Asset Management as at February 2026.

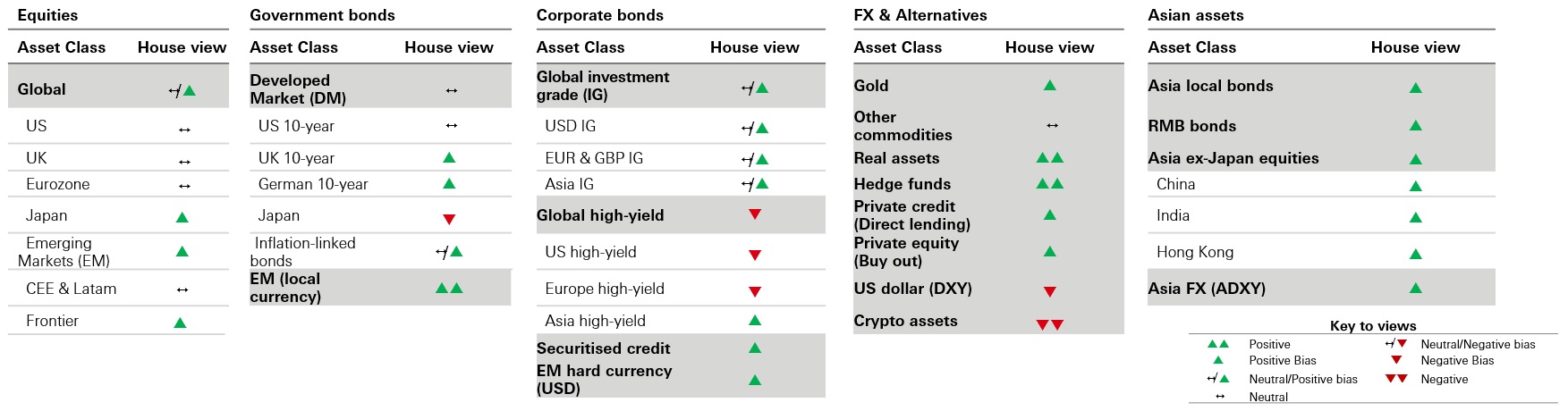

House View

As US exceptionalism continues to fade, market leadership can continue to broaden out, particularly to emerging and frontier markets, which are becoming structurally safer and less volatile. Asia is also well placed to benefit from the AI boom. And with conventional diversifiers less reliable, portfolios need alternative sources of resilience

- Equities – Re-ratings drove global returns last year, but profits growth will be increasingly important in 2026. Assuming these are delivered, there is scope for a further broadening out of performance beyond US large-cap tech to other sectors and regions, particularly emerging markets

- Government bonds – Bond yields are expected to remain range-bound amid inflation risks, fiscal concerns, and growth imbalances. EM local currency bonds benefit from lower inflation, stronger growth and improved debt sustainability

- Corporate bonds – Investment grade credit spreads remain tight, but strong technicals, healthy balance sheets, and a positive profits outlook are supportive. We maintain a defensive stance with a preference for higher quality credits

Click the image to enlarge

The level of yield is not guaranteed and may rise or fall in the future. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. The views expressed above were held at the time of preparation and are subject to change without notice. This information shouldn’t be considered as a recommendation to invest in the country or sector shown. Diversification does not ensure a profit or protect against loss. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target. House view represents a >12-month investment view across major asset classes in our portfolios.

Source: HSBC Asset Management as at February 2026.

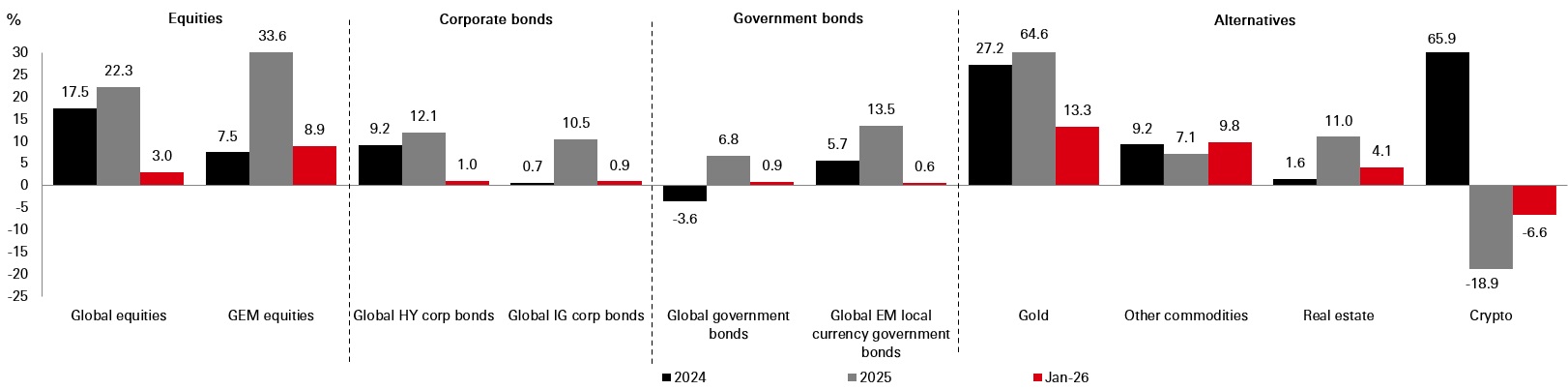

Asset class performance at a glance

January saw some exceptionally strong returns across global stock markets, especially in emerging economies, as the broadening out trade continued. Some volatility in longer-dated bond yields reflected uncertainty over future rate cuts and fiscal concerns. A major rally in precious metals saw sharp reversals at month-end

- Government bonds – Sovereign bond yields saw volatility and divergence, with 10-year yields rising in Japan and the US, but moderating across the eurozone. Investors continue to weigh an uncertain fiscal, inflation, and growth outlook

- Equities – Stocks saw blistering gains in parts of Asia and Latam amid a weaker US dollar and rally in commodity prices. There were also strong positive moves in Japan, the UK, and US small-caps. India continued to underperform

- Alternatives – Gold and silver prices led a remarkable rally in precious metals, before declining sharply late in the month. Industrial metals prices were also strong. Oil prices strengthened on geopolitical tensions. Crypto prices slumped

Click the image to enlarge

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. This information shouldn’t be considered as a recommendation to invest in the country or sector shown. The views expressed above were held at the time of preparation and are subject to change without notice.

Source: Bloomberg, all data above as at close of business 31 January 2026 in USD, total return, month-to-date terms. Note: Asset class performance is represented by different indices. Global Equities: MSCI ACWI Net Total Return USD Index. Global Emerging Market Equities: MSCI Emerging Market Net Total Return USD Index. Corporate Bonds: Bloomberg Barclays Global HY Total Return Index value unhedged. Bloomberg Barclays Global IG Total Return Index unhedged. Government bonds: Bloomberg Barclays Global Aggregate Treasuries Total Return Index. JP Morgan EMBI Global Total Return local currency. Commodities and real estate: Gold Spot $/OZ, Other commodities: S&P GSCI Total Return CME. Real Estate: FTSE EPRA/NAREIT Global Index TR USD. Crypto: Bloomberg Galaxy Crypto Index.

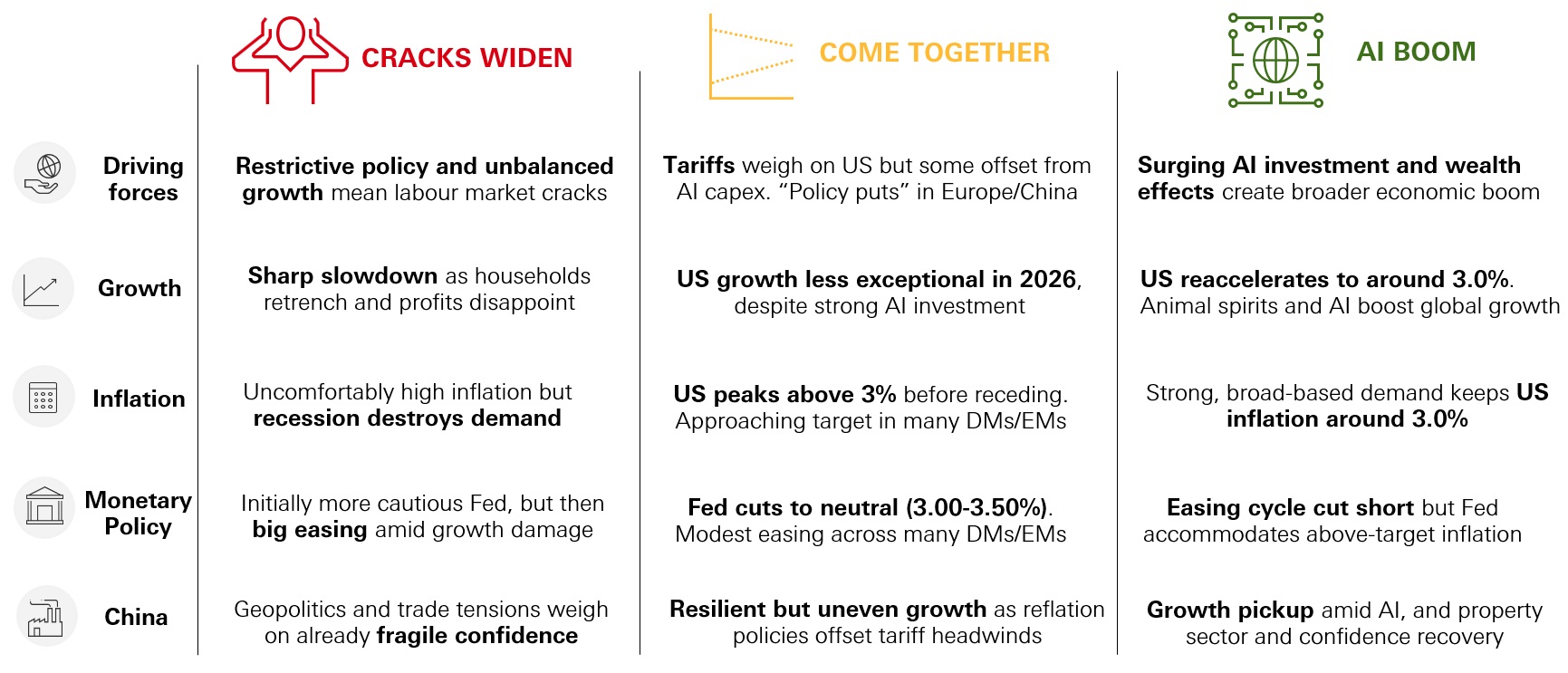

Macro scenarios

Click the image to enlarge

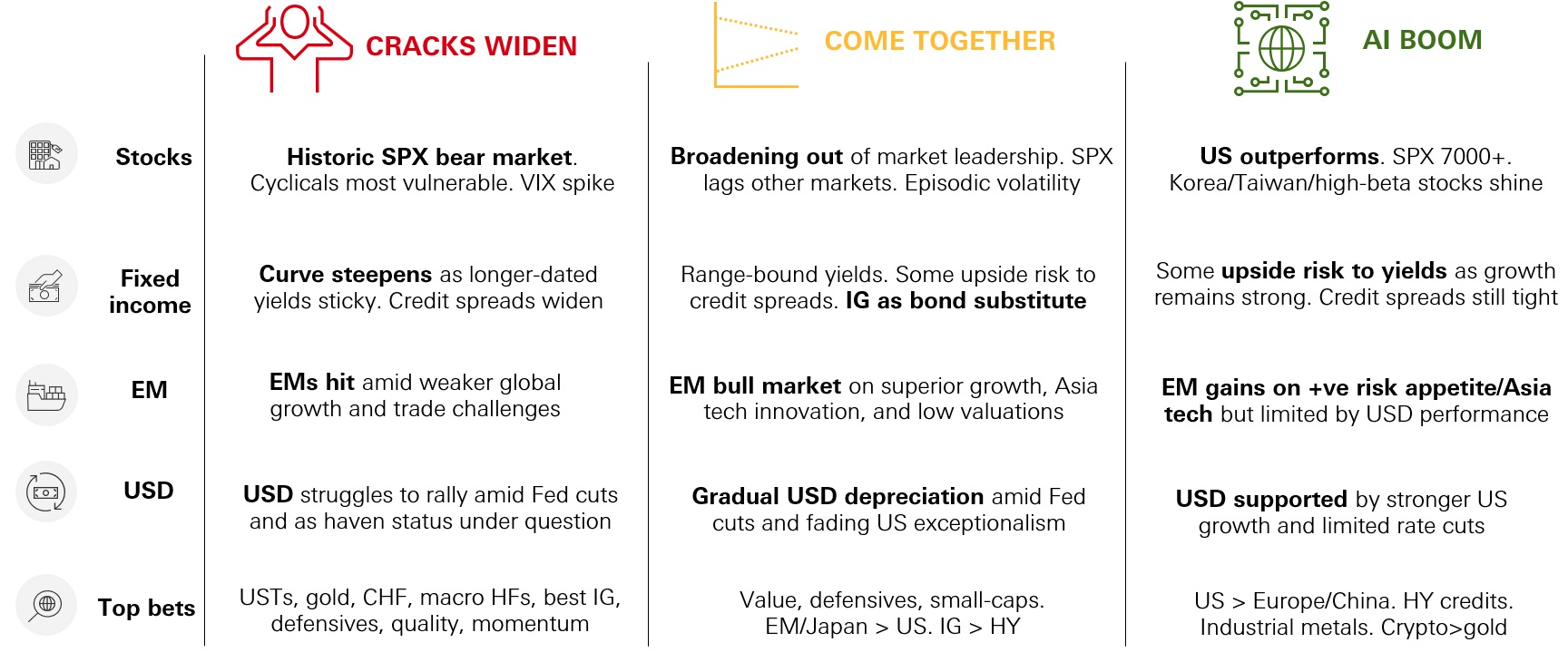

Market scenarios

Click the image to enlarge

The commentary and analysis presented in this document reflect the opinion of HSBC Asset Management on the markets, according to the information available to date. They do not constitute any kind of commitment from HSBC Asset Management. Consequently, HSBC Asset Management will not be held responsible for any investment or disinvestment decision taken on the basis of the commentary and/or analysis in this document. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Source: HSBC Asset Management, February 2026.

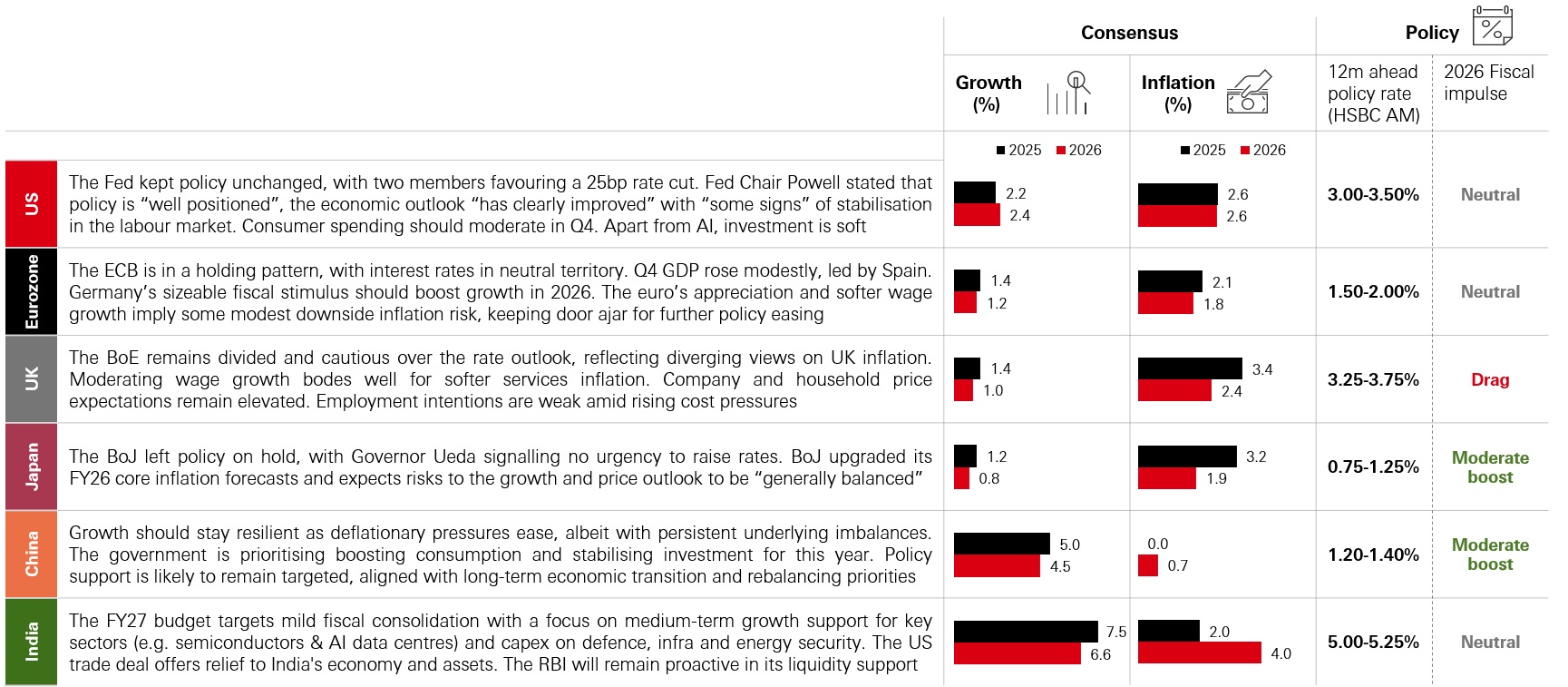

Economic outlook

Fed in wait-and-see mode

Click the image to enlarge

Past performance does not predict future returns. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management Limited accepts no liability for any failure to meet such forecast, projection or target. This information shouldn't be considered as a recommendation to invest in the specific country mentioned. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Source: HSBC Asset Management, consensus numbers from Bloomberg, February 2026.

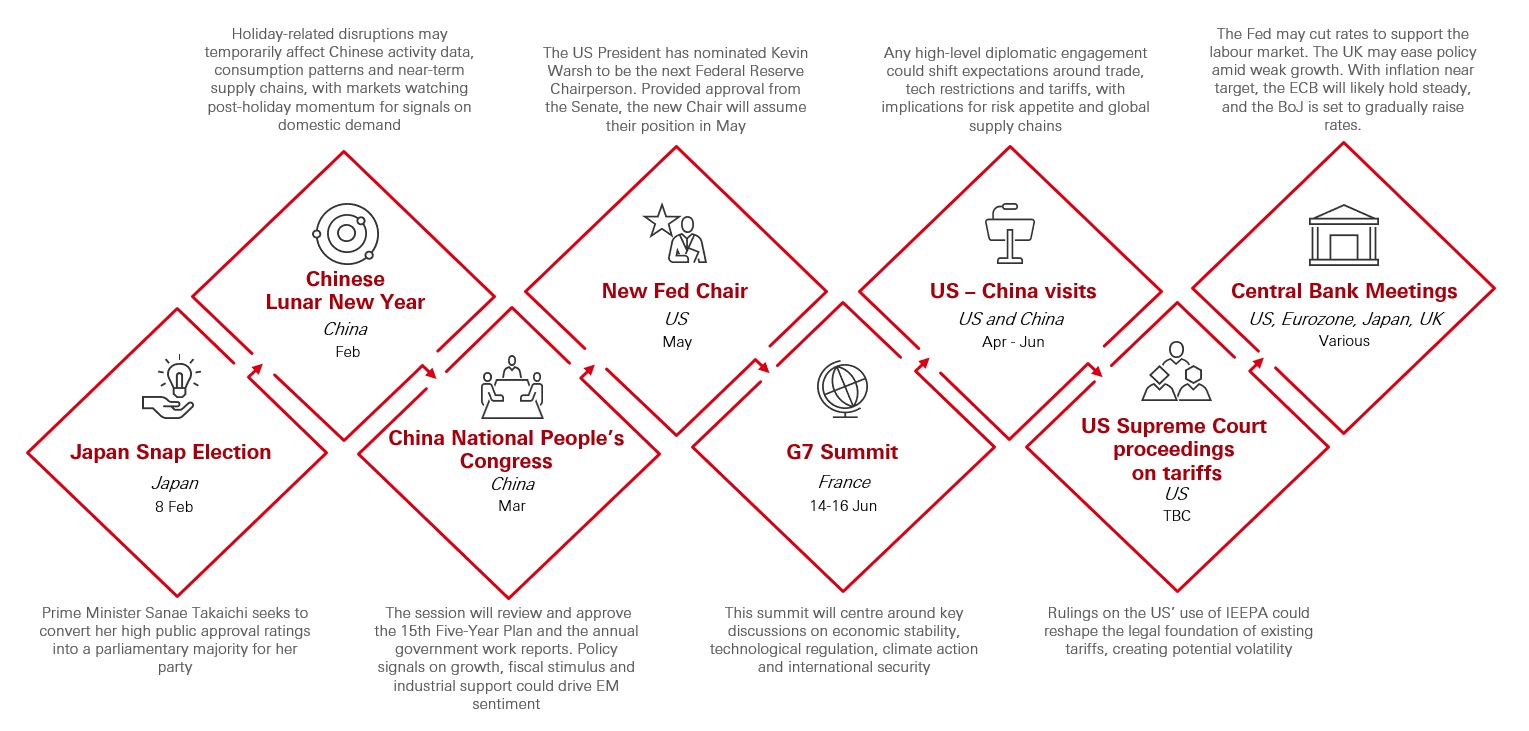

Events to look out for in H1 2026

Click the image to enlarge

The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target. Past performance does not predict future returns.

Source: HSBC Asset Management, January 2026.

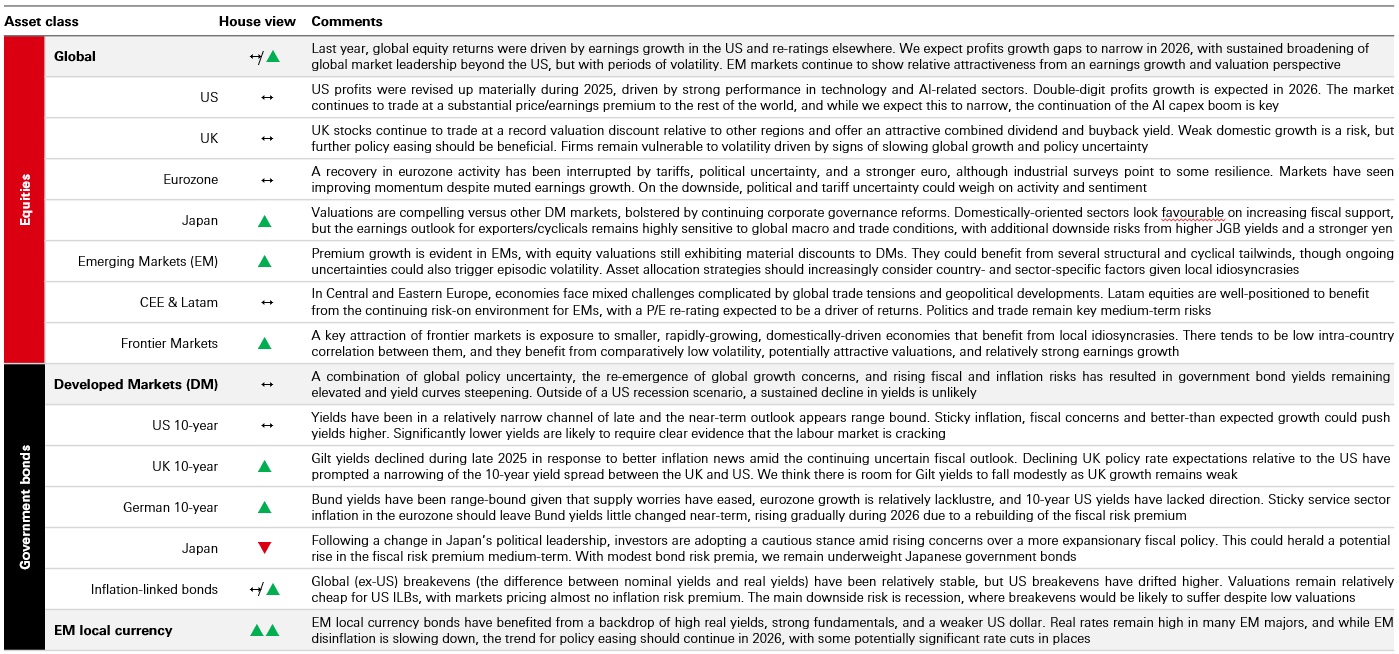

Investment Views

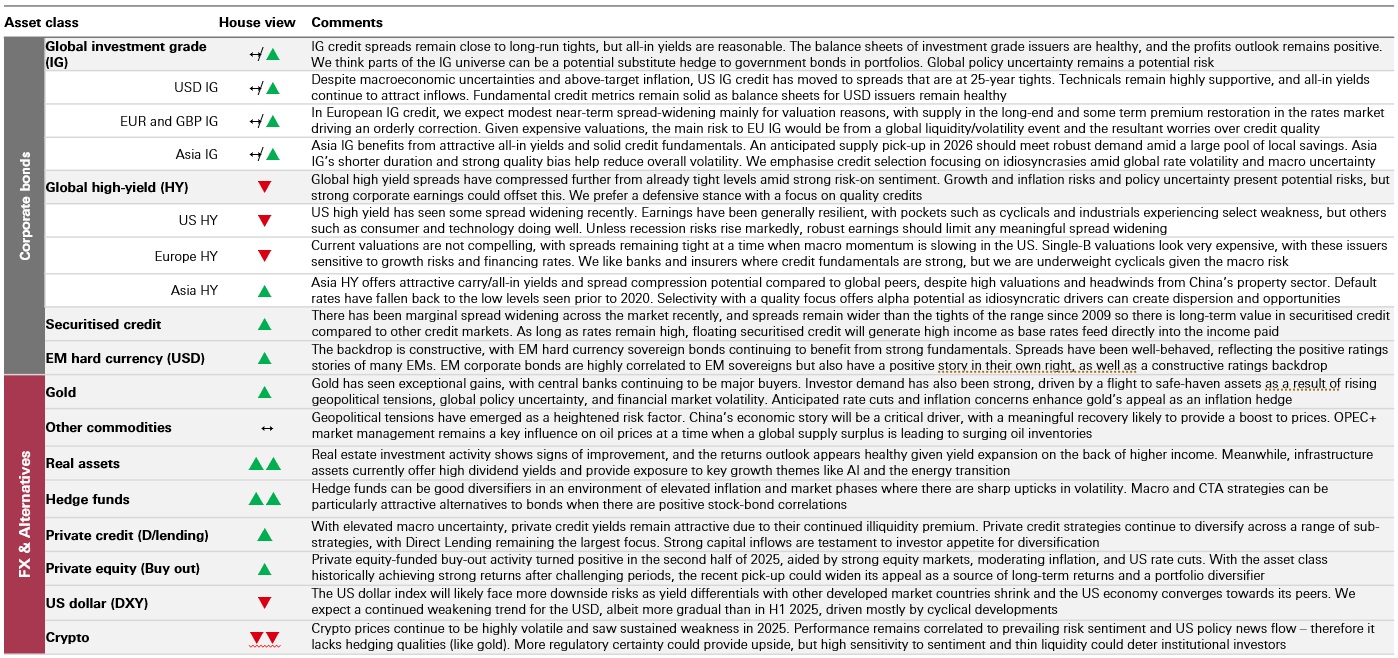

Asset class positioning

House view represents a >12-month investment view across major asset classes in our portfolios.

Click the image to enlarge

Click the image to enlarge

Click the image to enlarge

Click the image to enlarge

The level of yield is not guaranteed and may rise or fall in the future. Diversification does not ensure a profit or protect against loss. The views expressed above were held at the time of preparation and are subject to change without notice. This information shouldn’t be considered as a recommendation to invest in the country or sector shown. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Source: HSBC Asset Management as at February 2026.

On Top of Investors’ Minds

What have been the eye-catching themes in stock markets this year?

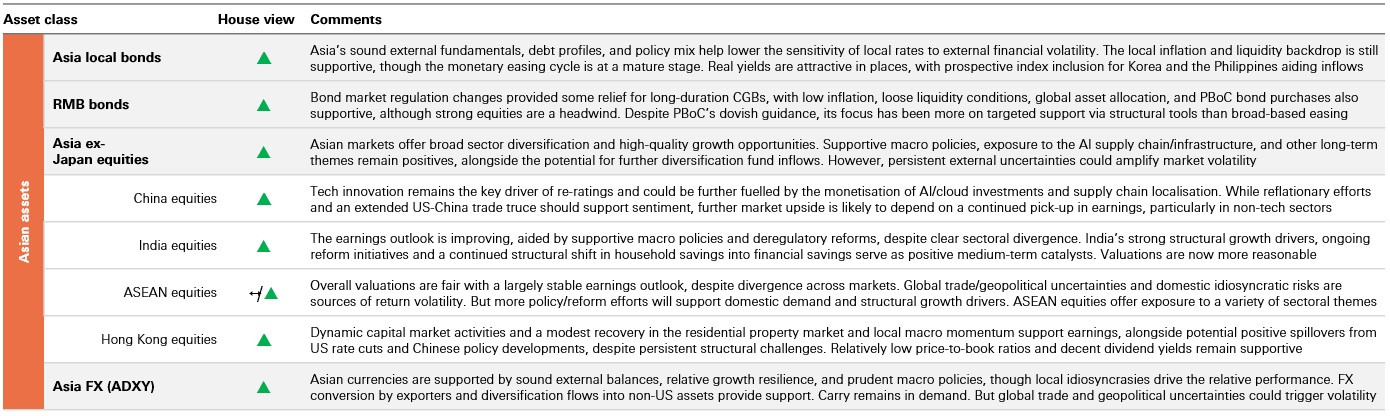

First, is that the S&P 500 is delivering bumper profits again in Q4 2025 earnings season. Year-on-year growth for Q4 was pencilled-in at 8 per cent, but that figure has already risen closer to 12 per cent and could rise further. Among the surprises has been a stellar pick-up in 2026 profits expectations for the Materials sector.

Second, is that mega-cap tech and AI stocks – which have driven US profits and price gains for three years – are diverging a bit. The sector still dominates the broad profits picture, but investors are being picky, and some stocks have slumped after disappointing the market. There are also signs that some software firms could suffer because of AI, as well as persistent concerns about stretched valuations, high concentration, and a potential bubble in AI stocks given uncertainty about when vast capex investments will pay-off. Overall, it has left the sector lagging the broader index this year.

Finally, last year’s broadening out of market leadership is continuing – both within the US (notably to small-caps and value) and to emerging markets and Europe. Outside the US, a pick-up in momentum has been helped by a weaker US dollar, but valuation discounts, better fundamentals, and policy support are also playing a role.

S&P 500 year-on-year expected earnings growth

Click the image to enlarge

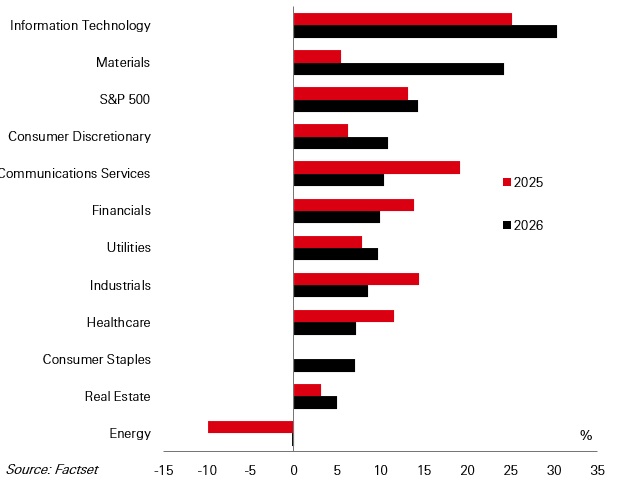

Why have emerging market stocks been so strong in early 2026?

Emerging market stocks have got off to an exceptionally strong start in 2026. In some ways, it’s a case of history repeating. This time last year, a sharp decline in the US dollar was under way, and EM stocks were strengthening just as US stocks were fading. After the volatility around April’s ‘Liberation Day’ tariff surprise, EM markets went on to outperform the US for the full year.

Amid further signs that global investors have cooled towards dollar assets, the EM momentum trend is accelerating. But unlike last year, there is more to this outperformance than EMs just being lucky. Improvements in both regional structural stories and company fundamentals are playing a role too.

Korea and Taiwan have extended last year’s world-beating gains as the global AI build-out boosts the outlook for tech and semiconductor names. Meanwhile in Brazil, structural reforms and the prospect of lower rates is providing relief to the fiscal outlook. The mining sector has benefit from the current commodities rally.

Overall, EMs are proving again in 2026 that they can be both lucky and good – with the tailwind of dollar weakness acting as a catalyst to attractive structural stories and improving fundamentals and profits.

MSCI Emerging Market index performance relative to MSCI US index

Click the image to enlarge

What does a Kevin Warsh-led Fed mean for markets?

President Trump’s decision to back Kevin Warsh as the next Chair of the Federal Reserve was a bit of a surprise. However, Fed rate expectations and US Treasury yields have been stable, suggesting investors have placed greater weight on other factors when determining the policy and rate outlook.

It is important to remember that US monetary policy is set by the Federal Open Market Committee (FOMC), not just the Chair. At the margin, the Fed Chair could push through policy changes if the data are ambiguous and FOMC is split, but it would be difficult for any Fed Chair to force through changes in policy that are not broadly supported by the economic data.

Warsh has been regarded as a policy hawk during his career. However, more recently, he has focussed on the disinflationary impact of AI, which could allow for lower rates despite a strong economy. Warsh has also advocated for a much smaller Fed balance sheet, But again, this would require committee approval, and needs to consider the impact on liquidity conditions.

The pick of a perceived “orthodox” candidate may temper concerns over the erosion of Fed independence and policy rates being cut too far, allowing runaway inflation. January’s US dollar and gold volatility reflect this. But with policy uncertainty still high, the US dollar's role as a reliable haven asset is still questionable.

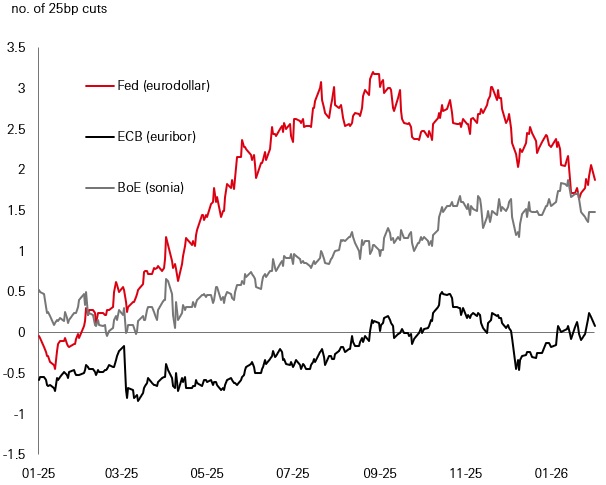

How many rate cuts from Fed, ECB, BoE in 2026?

Click the image to enlarge

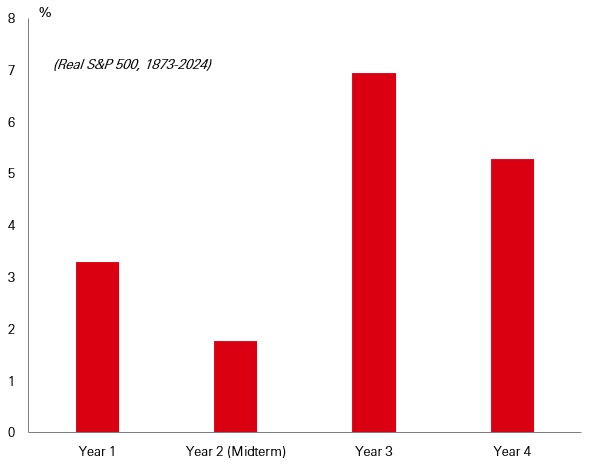

How could the US midterm elections impact markets?

Historically, the second year of a US presidential term tends to be a tricky one for markets. It’s often the weakest for real stock returns in the S&P 500, thanks to the uncertainty that midterm elections bring. Investors don’t like surprises; unexpected policy shifts and questions about the economic outlook often weigh on risk appetite during this time.

We also know that almost every midterm election has resulted in the incumbent president's party losing seats in the House of Representatives. If Republicans lose their slim House majority this year, it could result in a Republican president and a Democrat-controlled House: a political gridlock scenario. The good news is that markets often welcome this. A divided government means a lower chance of large policy changes, which tends to calm volatility and boost stocks post-election.

Nonetheless, in an environment where AI enthusiasm persists but there are risks of episodic volatility caused by high policy and economic uncertainty, high tech sector valuations, and elevated geopolitical concerns, the impact of the US midterms on market sentiment is also worth monitoring.

Average annual real equity price returns in a US presidential term

Click the image to enlarge

The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Diversification does not ensure a profit or protect against loss. This information shouldn’t be considered as a recommendation to invest in the country or sector shown.

Source: HSBC Asset Management as at February 2026.

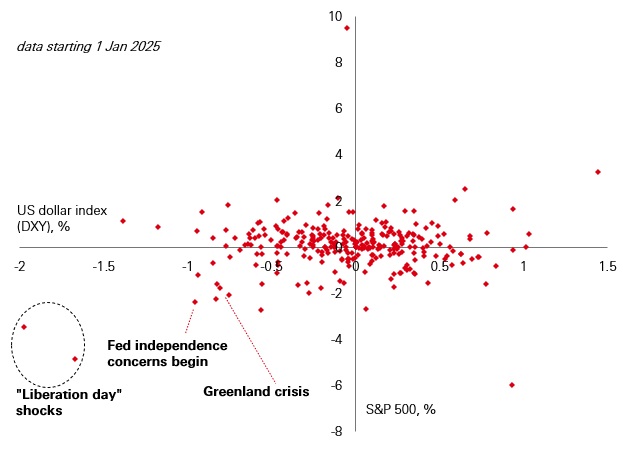

Where are the safe havens?

Amid January's geopolitical turmoil, we saw echoes of last April’s “Liberation Day” market action: US stocks declining in lockstep with US Treasuries and the US dollar. This is important. It provides further evidence that traditional portfolio diversifiers may struggle to perform as expected, particularly when US policy decisions – whether it be around trade, the Fed, and foreign relations – are driving investor caution.

For investors looking to hedge against further market turbulence in 2026 we think it makes sense to look elsewhere for protection. Gold and the Swiss franc, for example, performed very well in January. And with concerns about the health of US public finances overlaying the geopolitics, high-quality corporate bonds may be structurally less risky. Meanwhile, private markets continue to offer a route to dampen portfolio volatility and gain exposure to Fed cuts. And amid elevated dispersion and macroeconomic volatility, hedge funds are displaying uncorrelated returns.

However, recent sharp moves in gold serve as a reminder that no single safe haven is flawless. These fluctuations underscore the importance of “diversifying the diversifiers” – adopting an active, multi-asset approach that captures uncorrelated performance across a broader spectrum of assets.

S&P 500 daily versus US dollar index (DXY) daily return

Click the image to enlarge

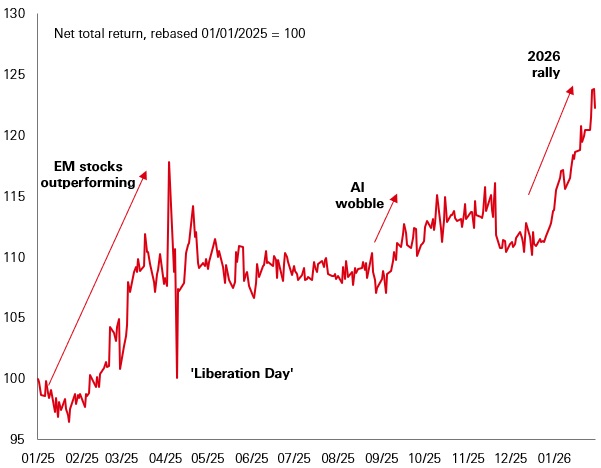

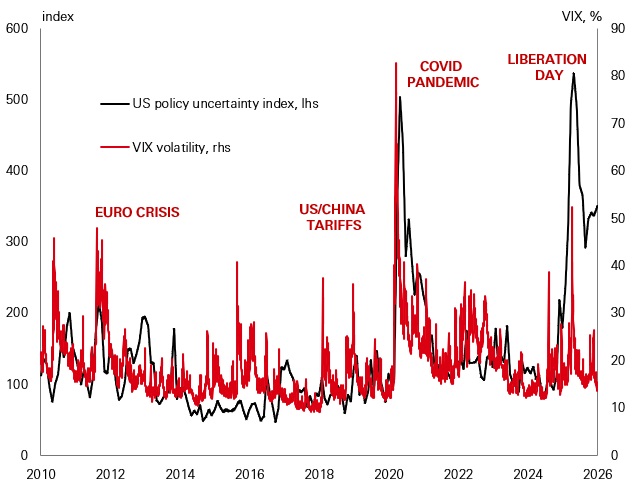

What impact is geopolitics expected to play in markets this year?

Geopolitical events have been in focus in early 2026, with investors digesting news on Venezuela, Greenland, Iran, and Ukraine. But commodity and investment markets have remained mostly unperturbed. Oil prices – which tend to be a key channel for geopolitical events to shock the macro system – have been stable. And global stocks have enjoyed a solid start to the year, with Asian indices reaching record highs.

This contrast between elevated uncertainty and calm markets seems puzzling, but makes sense in the context of a good global growth outlook, and an expected “coming together” of global profits growth in 2026. But as in 2025, we think geopolitical events will be a key influence on markets this year. That’s important because despite the bullish mood, a continuation of last year’s “bull market in almost everything” depends on good fundamental news being delivered. With some asset classes arguably “priced for perfection”, any burst of adverse news could stoke volatility.

Currently, we remain moderately pro-risk but wary that episodic volatility is possible. A complex economic and geopolitical environment means a changed playbook for investors too. That means re-assessing the old stereotypes about emerging markets and using new diversifiers to secure portfolio resilience.

Decomposing 2025 stock market returns

Click the image to enlarge

The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Diversification does not ensure a profit or protect against loss. This information shouldn’t be considered as a recommendation to invest in the country or sector shown.

Source: HSBC Asset Management as at February 2026.

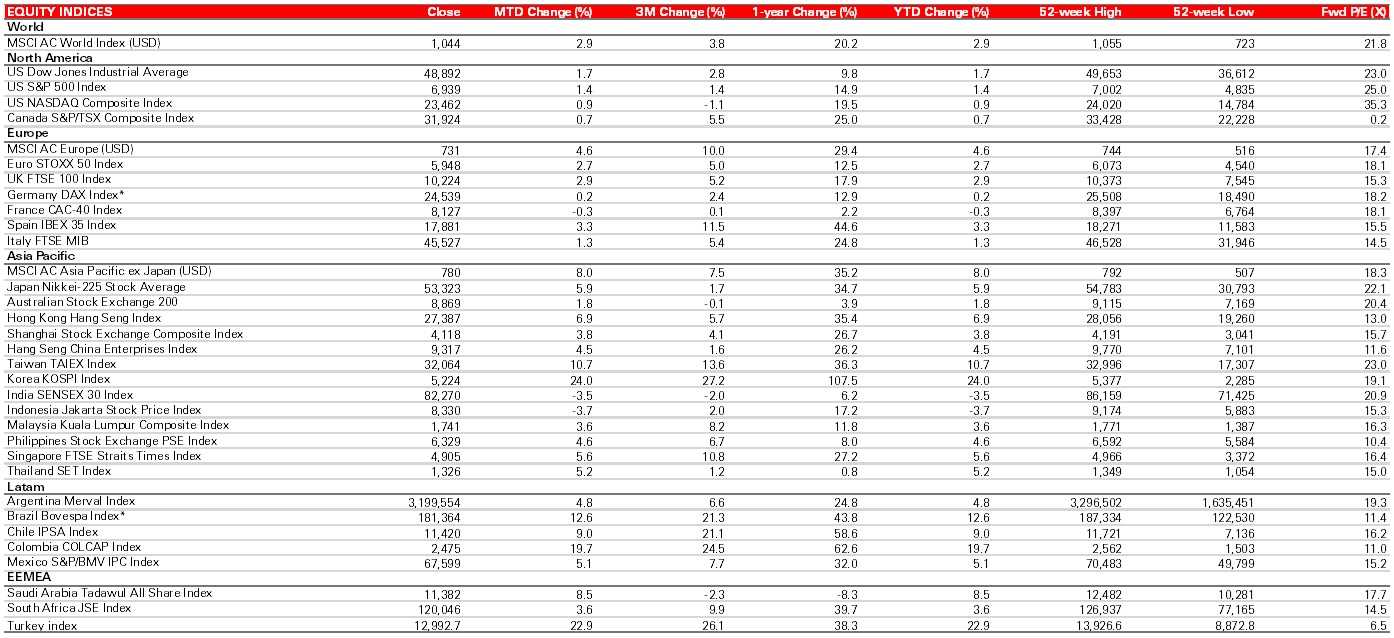

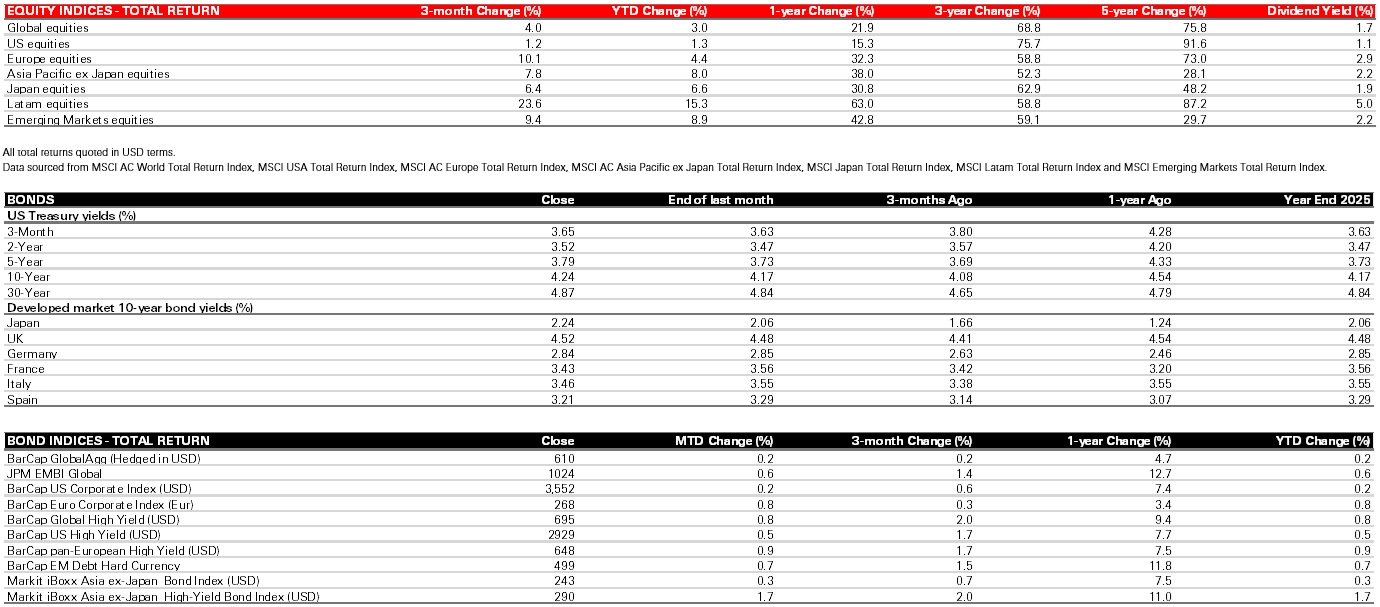

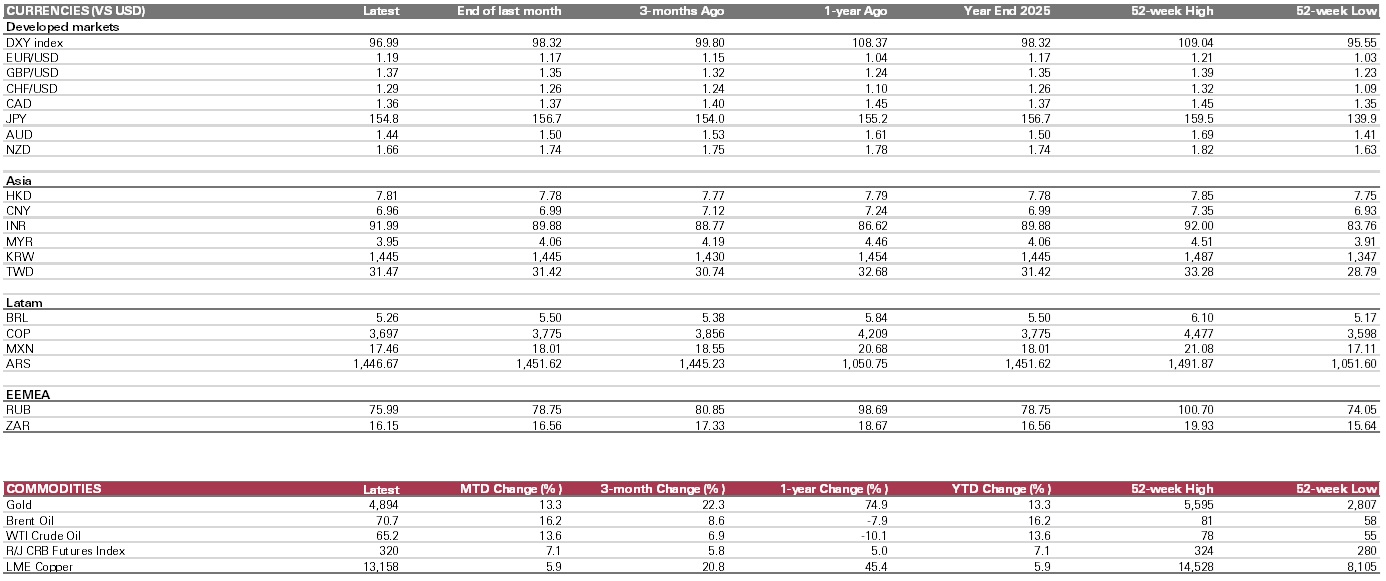

Market Data

January 2026

Click the image to enlarge

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. This information shouldn’t be considered as a recommendation to invest in the country or sector shown.

Sources: Bloomberg, HSBC Asset Management. Data as at close of business 31 January 2026. (*) Indices expressed as total returns. All others are price returns.

Click the image to enlarge

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. This information shouldn’t be considered as a recommendation to invest in the country or sector shown.

Sources: Bloomberg, HSBC Asset Management. Data as at close of business 31 January 2026. Total return includes income from dividends and interest as well as appreciation or depreciation in the price of an asset over the given period.

Click the image to enlarge

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. This information shouldn’t be considered as a recommendation to invest in the country or sector shown.

Sources: Bloomberg, HSBC Asset Management. Data as at close of business 31 January 2026.

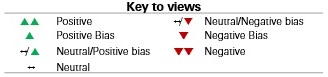

Important information

Basis of Views and Definitions of ‘Asset class positioning’ tables

- Views are based on regional HSBC Asset Management Asset Allocation meetings held throughout January 2026, HSBC Asset Management’s long-term expected return forecasts which were generated as at 31 December 2025, our portfolio optimisation process and actual portfolio positions

- Icons: ↑ View on this asset class has been upgraded – No change ↓ View on this asset class has been downgraded

- Underweight, overweight and neutral classifications are the high-level asset allocations tilts applied in diversified, typically multi-asset portfolios, which reflect a combination of our long-term valuation signals, our shorter-term cyclical views and actual positioning in portfolios. The views are expressed with reference to global portfolios. However, individual portfolio positions may vary according to mandate, benchmark, risk profile and the availability and riskiness of individual asset classes in different regions

- “Overweight” implies that, within the context of a well-diversified typically multi-asset portfolio, and relative to relevant internal or external benchmarks, HSBC Global Asset Management has (or would have) a positive tilt towards the asset class

- “Underweight” implies that, within the context of a well-diversified typically multi-asset portfolio, and relative to relevant internal or external benchmarks, HSBC Global Asset Management has (or would) have a negative tilt towards the asset class

- “Neutral” implies that, within the context of a well-diversified typically multi-asset portfolio, and relative to relevant internal or external benchmarks HSBC Global Asset Management has (or would have) neither a particularly negative or positive tilt towards the asset class

- For global investment-grade corporate bonds, the underweight, overweight and neutral categories for the asset class at the aggregate level are also based on high-level asset allocation considerations applied in diversified, typically multi-asset portfolios. However, USD investment-grade corporate bonds and EUR and GBP investment-grade corporate bonds are determined relative to the global investment-grade corporate bond universe

- For Asia ex Japan equities, the underweight, overweight and neutral categories for the region at the aggregate level are also based on high-level asset allocation considerations applied in diversified, typically multi-asset portfolios. However, individual country views are determined relative to the Asia ex Japan equities universe as of 31 December 2025

- Similarly, for EM government bonds, the underweight, overweight and neutral categories for the asset class at the aggregate level are also based on high-level asset allocation considerations applied in diversified, typically multi-asset portfolios. However, EM Asian Fixed income views are determined relative to the EM government bonds (hard currency) universe as of 31 Janauary 2025

This information shouldn’t be considered as a recommendation to invest in the country or sector shown. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Diversification does not ensure a profit or protect against loss.

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in emerging markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets: investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third-party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group).

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- In Bermuda, this document is issued by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- In France, Belgium, Netherlands, Luxembourg, Portugal, Greece, Finland, Norway, Denmark and Sweden this document is issued by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- In Germany, this document is issued by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- In Hong Kong, this document is issued by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This content has not been reviewed by the Securities and Futures Commission;

- In India, this document is issued by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- In Italy and Spain, this document is issued by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- In Malta, this document is issued by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- In Mexico, this document is issued by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- In the United Arab Emirates, this document is issued by HSBC Investment Funds (Luxembourg) S.A. – Dubai Branch (Level 20, HSBC Tower, PO Box 66, Downtown Dubai, United Arab Emirates) regulated by the Securities and Commodities Authority (SCA) in the UAE to conduct investment fund management, portfolios management, fund administration activities (SCA Category 2 license No.20200000336) and promotion activities (SCA Category 5 license No.20200000327).

- In the United Arab Emirates, this document is issued by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- In Singapore, this document is issued by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- In Switzerland, this document is issued by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- In Taiwan, this document is issued by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- In Turkiye, this document is issued by HSBC Asset Management A.S. Turkiye (AMTU) which is regulated by Capital Markets Board of Turkiye. Any information here is not intended to distribute in any jurisdiction where AMTU does not have a right to. Any views here should not be perceived as investment advice, product/service offer and/or promise of income. Information given here might not be suitable for all investors and investors should be giving their own independent decisions. The investment information, comments and advice given herein are not part of investment advice activity. Investment advice services are provided by authorized institutions to persons and entities privately by considering their risk and return preferences, whereas the comments and advice included herein are of a general nature. Therefore, they may not fit your financial situation and risk and return preferences. For this reason, making an investment decision only by relying on the information given herein may not give rise to results that fit your expectations.

- In the UK, this document is issued by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- In the US, this document is issued by HSBC Securities (USA) Inc., an HSBC broker dealer registered in the US with the Securities and Exchange Commission under the Securities Exchange Act of 1934. HSBC Securities (USA) Inc. is also a member of NYSE/FINRA/SIPC. HSBC Securities (USA) Inc. is not authorized by or registered with any other non-US regulatory authority. The contents of this document are confidential and may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose without prior written permission.

- In Chile, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Obtain information about the state guarantee to deposits at your bank or on www.cmfchile.cl;

- In Colombia, HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- In Costa Rica, the Fund and any other products or services referenced in this document are not registered with the Superintendencia General de Valores (“SUGEVAL”) and no regulator or government authority has reviewed this document, or the merits of the products and services referenced herein. This document is directed at and intended for institutional investors only.

- In Peru, HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.

Copyright © HSBC Global Asset Management Limited 2026. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Asset Management.

Content ID: D064271; Expiry Date: 01.02.2027