Q1 Real Estate APAC Quarterly Spotlight

A global economy in flux

Flagging growth despite a resilient first half

- Although global activity was remarkably resilient in H1 2025, risks to the global economy continue to lie to the downside. Prolonged uncertainty, simmering geopolitical and trade tensions amid more protectionism, as well as labor supply and inflationary shocks could reduce growth

- The International Monetary Fund (“IMF”) also cautioned in October 2025 of rising fiscal vulnerabilities, potential financial market corrections, and erosion of institutions that could threaten stability in the financial markets

- Global trade is expected to remain soft as higher US tariffs take effect and the lagged effects of heightened uncertainty are likely to suppress investment. The underlying demand story and outlook in major economies, including Asia Pacific (“APAC”), remains somewhat downbeat amid weak corporate sentiment and private consumption

- Based on IMF’s projections in October 2025, global growth is expected to decelerate from 3.3 per cent in 2024 to 3.2 per cent in 2025 – this is below the pre-pandemic average of 3.7 per cent

What piqued our interest?

More signs of a reversion to recovery for Asia Pacific commercial real estate markets, aided by easing interest rates and some progression in trade deals

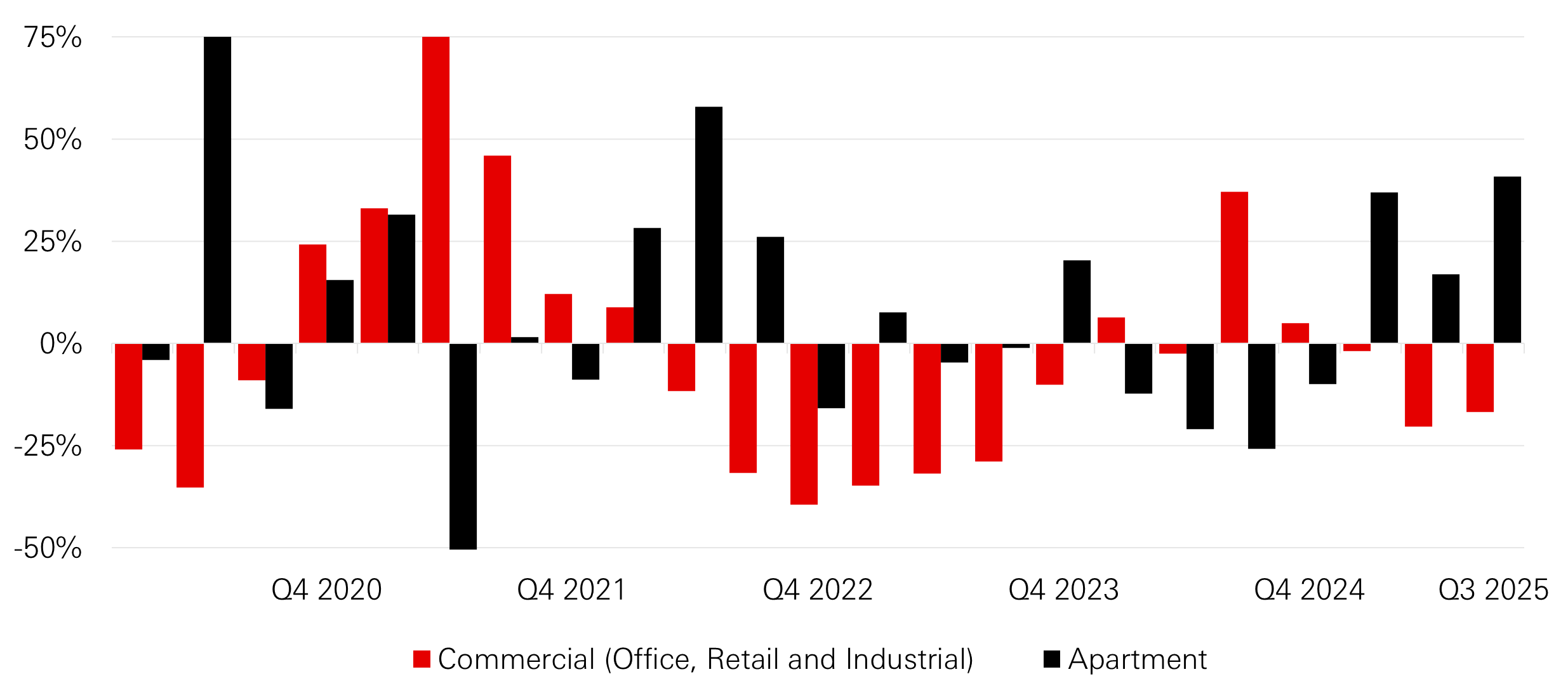

- Capital flows taking a positive turn. Following two consecutive quarterly dips in real estate investment volume, APAC saw regionwide volume rising by 25 per cent in Q3 2025 according to MSCI Real Capital Analytics (“RCA”). Inbound cross-border activity remained strong, as acquisitions by overseas investors grew for a fifth consecutive quarter – the share of investment activity by these investors grew to 36 per cent as of Q3 2025, the highest since 2019

- Institutional capital returning. Institutional capital has become more active in many regional markets, especially for larger portfolio and entity-level deals as investors sought to scale up their allocation to sectors in demand. According to MSCI RCA, such transactions formed 50 per cent (USD 25.4bn) of the assets traded in Q3 2025, and a number of large entity-level deals were notably led by global investors

- Leasing situation improving. According to CBRE’s latest Asia Pacific Leasing Market Sentiment Index in September 2025, overall leasing sentiment improved across most markets and sectors in Q3 2025. The exception was Mainland China, where overall occupier sentiment remained lacklustre due to persistently weak demand

Figure 1: APAC Investment Transaction Volume YoY per cent Change by Sector

Source: MSCI Real Capital Analytics, HSBC Asset Management, as of October 2025.

- Recovery more selective than broad-based. Despite the marked improvement in liquidity in Q3 2025, the uplift in investment activity has only been only apparent in specific markets (e.g., Japan and Australia) and sectors (e.g., living and data centres). According to MSCI RCA, many of the large deals year-to-date have mainly been in data centres, emerging living sectors i.e., student and senior housing, Japan multifamily, as well as Australian warehouses. Meanwhile, global investors have (on top of the forementioned sectors) been also targeting office investments in Japan, Australia and South Korea

- Encouraging developments in Hong Kong. There have been more positive developments in the embattled Hong Kong real estate market in recent months: interest rate pressures have moderated considerably, its equity market has been performing robustly- according to KPMG, the city is the top global IPO spot in 2025 with an all-time high of more than 300 active IPO applications as at 7 December 2025), leasing sentiment and activity have improved especially in the prime areas i.e., Greater Central, and large-ticket deal flow has sustained well – following the sale of the top nine floors of One Exchange Square in April 2025, there has been more multi-billion dollar (HKD) office deals transacting across H2 2025 e.g., Virtus Medical Tower, 13 floors at One Causeway Bay and more recently, a 50 per cent stake in CCB Tower

- Student housing investments gaining traction. Purpose-built Student Accommodation (“PBSA”) in APAC is becoming more popular with investors, buoyed by positive international student mobility trends, tightening visa regulations in the US and supply constraints across many markets in the region. While Australia has typically been the most active (and largest) PBSA market in APAC, as evidenced by the standout deal of Greystar’s AUD 1.6bn acquisition of a joint portfolio from GIC and Wee Hur comprising 5,662 PBSA beds (seven assets), Hong Kong is now emerging to be a hotspot for PBSA

- Strong public sector support for PBSA in Hong Kong. In July 2025, Hong Kong's Development Bureau and Education Bureau jointly launched the Hostels in the City Scheme (which included plot ratio relaxation and streamlined development control procedures) to encourage the market to convert commercial buildings into student hostels, as part of wider efforts to improve the city’s position as an international hub for post-secondary education

- Alongside a surge in local and international student enrolments, Colliers1 noted in a December 2025 report that “policy changes have already triggered concrete market activity, with nine hotel and living sector investment transactions reflecting a total deal volume of over HKD 2.9bn between June and September 2025.” Notably, four transactions (estimated at about HKD 1.1bn in value) were earmarked for conversion to PBSA

- Retail C-REITs seeing strong demand. There has been a notable surge in market activity pertaining to retail China’s Real Estate Investment Trust (“C-REIT”) scene – for instance, CapitaLand Commercial C-REIT achieved 254.5 times subscription coverage from offline institutional investors in the bookbuilding tranche and its IPO in September 2025 also saw strong retail interest, with the public tranche closing ahead of schedule and being 535.2 times subscribed. Following this, China Overseas Land & Investment C-REIT also achieved 374x oversubscription from offline institutional investors. According to Cushman & Wakefield, the retail sector in China, in particular, has seen 12 listings in 2025, raising an estimated total of RMB 30.3bn. Meanwhile, there has also been several high-profile retail deals happening the recent quarters e.g., 48 Wanda Plaza megamalls and 10 Livat shopping centres

- Singapore showing more surprises on the upside. While uncertainties in the global trade situation have been less ideal for Singapore, Q3 2025 witnessed a marked improvement in real estate investment activity which came on the back of continued easing of domestic short-term interest rates, better-than-expected economic performance in H1 2025 and sustained momentum in institutional-led big-ticket (above SGD 300mn) office and retail transactions e.g., a 55 per cent stake in CapitaSpring, Jem office tower and Kinex.

According to CBRE, Singapore’s total investment volume (excluding public investment transactions) in Q3 2025 were up by about 32 per cent QoQ. Correspondingly, 9M 2025 private investment volumes were up by 15.9 per cent on a YoY basis. This positive momentum is expected to maintain, as evidenced by the continuation of sizeable transactions in Q4 2025 e.g., PLQ Mall, The Clementi Mall and a one-third stake in Marina Bay Financial Centre Tower 3 - Some exuberance at the smaller end of Singapore’s investment market. In particular, the shophouse investment market was more active after a lull performance in late 2023 and 2024. Apart from a marked increase in shophouse sales that are SGD 10mn and above, there were several non-caveated prime shophouse portfolio sales which transacted in Q1 2025 that came to light in recent months – these were namely Macau property magnate Loi Keong Kuong’s sale of five shophouses at Pagoda Street and Spanish-turned-Singaporean tycoon Ricardo Portabella’s divestment of six shophouses at Stanley Street.

Factoring in the forementioned, total shophouse investment sales volume 9M 2025 have already surpassed that for the whole of 2024. Meanwhile, there were also more strata-titled offices transacting in Q3 2025, notably at Visioncrest, Suntec Towers and Vision Exchange - Japan staying strong but taking a breather. We believe Japan is set to take the pole position as the most active APAC investment market in 2025, as investment volume (excluding development sites) in the market over the first three quarters of the year came in at USD 36.8bn based on MSCI RCA data, well ahead the other top contenders i.e., China (USD 23.5bn) and Australia (USD 21.0bn). Leasing fundamentals, particularly for office and residential, also remained solid.

While Japan multifamily portfolio sales have returned to strength after slowing in 2024, overall commercial real estate deal activity appears to have somewhat plateaued in recent months after a strong run between 2021 and 2023 – the year-to-date growth in investment volume in the market was only 7 per cent YoY with offices and data centres accounting for most of this growth. In view of the compressed cap rates across many sectors (notably office, residential and hotel), as well as further interest rate hikes in the horizon, this tapering off in growth is not the least surprising

What was concerning?

Some challenges in Greater China persist, while risks continue to loom

- Still seems like a slowburn for China real estate. Despite some positive macro developments e.g., resilient economic growth in 9M 2025 (5.2 per cent), growth in high-tech sectors surpassing overall industrial production growth, the stock market reaching a new high since the pandemic2, sustained residential and land sales in select top-tier cities’ residential markets and remarkable growth in the C-REIT space3, the tougher external environment – marked by higher US tariffs and more restrictive industrial policies – has blunted policy impact.

The overall commercial real estate investment market in China remains thick in transition. Investment volume in 9M 2025 was down 16 per cent YoY according to MSCI RCA and the share of distressed sales surged to a new high of around 37 per cent in Q3 2025 in the face of the uncertainty around tariffs. The office market continued to grapple with oversupply concerns, rising vacancy and downward rent pressure. Cross-border investments have also plummeted with insurance companies and to some extent, end-users being the dominant sources of capital. Meanwhile, leasing fundamentals remained soft with the ongoing trade uncertainty and weak consumption weighing on expansionary appetite. Demand drivers for the retail sector stayed lacklustre in H2 2025, bogged down by labour market and property sector pressures. Golden Week spending was a strong tell-tale sign – per-capita trip spend was down 0.6 per cent YoY and 2.6 per cent down relative from 2019. Given these circumstances, more landlords have relented to offering longer rent-free periods and more significant rental discounts - Hong Kong facing its fair share of challenges. Ongoing US-China trade tensions and geopolitical risks continue to weigh on the market, and this uncertainty alongside fundamental challenges e.g., oversupply in some key sectors, continued to have a net negative impact on the commercial real estate market. The office sector, especially in emerging/ decentralised submarkets, remained the weakest link in Hong Kong. The supply overhang situation remains a major challenge – the new supply from 2025 to 2027 (estimated at 7 million sq ft) is estimated by JLL to be five times the historical average annual take-up. This implies a very uncertain recovery trajectory for the office sector in the near- to mid-term.

Other commercial real estate sectors in the city also faced headwinds, with industrial and logistics languishing under the duress of the global trade uncertainties. Despite no new supply entering the market, leasing momentum was sluggish while warehouse vacancy rose to close to 12 per cent in Q3 2025 and rents continued to falter (year-to-date decline was around 6.5 per cent) based on CBRE estimates. - Burgeoning policy risks for residential investments. While most Asian governments (notably in Greater China) appear to favour pro-growth policies at this current juncture so as to counter any negative impact from US trade tariffs and/ or stimulate recovery, some jurisdictions have conversely been experiencing some tightening in their residential market policies. Singapore announced higher Seller Stamp Duty rates of between 4 per cent and 16 per cent, as well as longer holding periods (from three to four years) for all residential properties purchased from 4 July 2025. Meanwhile, Tokyo’s Chiyoda Ward proposed4 in July 2025 to implement anti-speculation measures on the residential sector.

In September 2025, the South Korean authorities introduced measures including strengthening LTV ratio, restrict loans to private housing business entities and tighten rules on the maximum jeonse loan amount for one-house owners in the Seoul metropolitan and/or speculation regulated areas. The higher taxation rates and tighter LTVs may put up new impediments to investors entering the market’s living sector, and may also temper the inbound cross-border capital flows going forward

What do we expect?

Firmer footing as we enter 2026, but on a cautious gait

Figure 2: World Uncertainty Index* (Global, GDP Weighted Average)

Source: Ahir, H, N Bloom, and D Furceri (2022), “World Uncertainty Index”, NBER Working Paper, HSBC Asset Management, as of November 2025.

*The WUI is computed by counting the percent of word “uncertain” (or its variant) in the Economist Intelligence Unit country reports. The WUI is then rescaled by multiplying by 1,000,000. A higher number means higher uncertainty and vice versa.

- Looking ahead, we are cautiously hopeful for more positive developments in 2026, taking into account the lower interest rates amid easing monetary policies and improving liquidity across most regional markets. Global uncertainty, while remaining elevated, has moderated in recent months and this may have a positive spin on investor and occupier sentiment to some extent

- Some of the salient regional trends we expect to see in the year ahead:

- Continued “recentralisation” and renewed focus on a flight to quality for offices, as trade tensions ease, new economy sectors grow and physical office attendance improve

- Sustained focus on capital recycling, especially among institutional investors and this will help stimulate more private market investment activity and liquidity

- Shift up in gear for investments into the living sector given its potentially attractive demand-supply fundamentals, though capital is likely to start delving deeper into more alternative and operational-based subsectors, as well as “living” markets where there is higher market scalability and further runway for growth

- Further growth in the C-REIT market (which improves the exit environment), especially with the expanded asset scope to include Grade A office and urban renewal projects after the National Development and Reform Commission added two new categories and lifted the number of qualified sectors to 15 in Q4 2025. According to HSBC Global Investment Research, the penetration rate of commercial C-REITs in China is only 0.1 per cent vs 5.1 per cent in 36 countries on average as of 2024, and it is estimated that it could reach RMB1.6 to 2.1 trillion if the penetration rate was to rise to 4 per cent to 5 per cent

- Stronger private wealth capital flows into real estate – according to JLL, this class of investor is becoming one of the most active participants in real estate, and expect their participation to continue to increase via direct investment in property and operators, indirect investment in private real estate funds, as well as taking other positions in the capital stack. APAC is forecast to lead global financial wealth expansion, with projected growth of about 9 per cent annually from 2024 to 2029, ahead of North America (4 per cent) and Western Europe (5 per cent) according to the Boston Consulting Group (BCG). It also expects Switzerland, Hong Kong and Singapore to capture nearly two-thirds of all new cross-border wealth over the period

The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Source: HSBC Asset Management, December 2025

1 Colliers also reported there was about HKD 3.2bn (USD 412mn) in student dormitory-related deals transacted in the first nine months of 2025, nearly doubling 2024 levels and accounting for 15 per cent of property investments above HK$100 million.

2 The Shanghai Composite Index crossed 4,000 in November 2025, a post-COVID high.

3 According to Cushman & Wakefield, China’s REIT market expanding its market value by approximately 85 per cent last year, securing a position among the top three REIT markets in Asia for the first time in 2024.

4 According to Bloomberg, the proposal includes a request for real estate developers to implement restrictions that prohibit the resale of condominiums for five years after purchase. Additionally, the ward has asked that buyers be prohibited from acquiring multiple units within the same property. Chiyoda Ward is not the only entity seeking to address the issue. The ward has also requested that the national and Tokyo metropolitan governments implement measures to curb property reselling, such as increasing taxes on such transactions.

Important Information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Obtain information about the state guarantee to deposits at your bank or on www.cmfchile.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece, Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- In Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in Turkiye by HSBC Asset Management A.S. Turkiye (AMTU) which is regulated by Capital Markets Board of Turkiye. Any information here is not intended to distribute in any jurisdiction where AMTU does not have a right to. Any views here should not be perceived as investment advice, product/service offer and/or promise of income. Information given here might not be suitable for all investors and investors should be giving their own independent decisions. The investment information, comments and advice given herein are not part of investment advice activity. Investment advice services are provided by authorized institutions to persons and entities privately by considering their risk and return preferences, whereas the comments and advice included herein are of a general nature. Therefore, they may not fit your financial situation and risk and return preferences. For this reason, making an investment decision only by relying on the information given herein may not give rise to results that fit your expectations.

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.

Copyright © HSBC Global Asset Management Limited 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.

Content ID: D060503_v1.0 ; Expiry: 31.12.2026