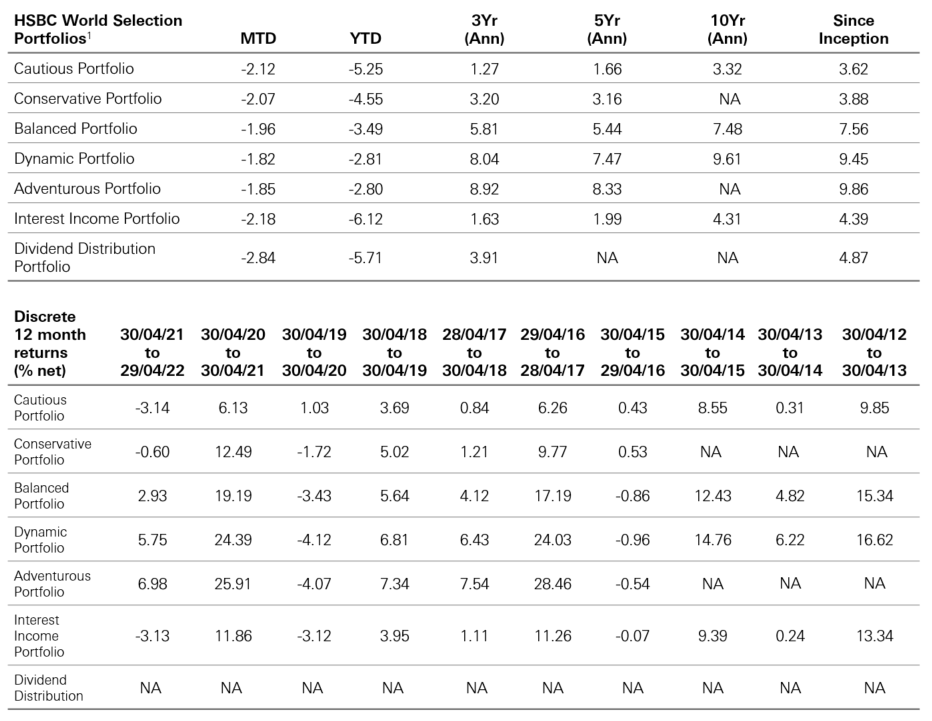

HSBC World Selection Portfolios (C Acc)

Impact on the portfolios

- The World Selection portfolios posted negative performance over the month.

- Active positioning added value over April, with the headline underweight to equities and overweight to short dated government bonds contributing. Our overweight positions in both Commodities and Gold also added value over the period, as did the defensive FX overlay.

- Granular trades were more mixed. Within the equity portfolio our overweight to Swiss versus European equity added value, while the overweight to Global financials and China A shares detracted moderately. Within the fixed income portfolio our preference for Asia over Global High Yield added value, while the overweight to Chinese versus Global Government bonds detracted.

Performance

Any performance information shown refers to the past and should not be seen as an indication of future returns.

Source for portfolio performance: HSBC Asset Management as of 30 April 2022. 1 Performance for C Accumulation share class is net of TER. Results are annualised when calculation period is over one year. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Global Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target.

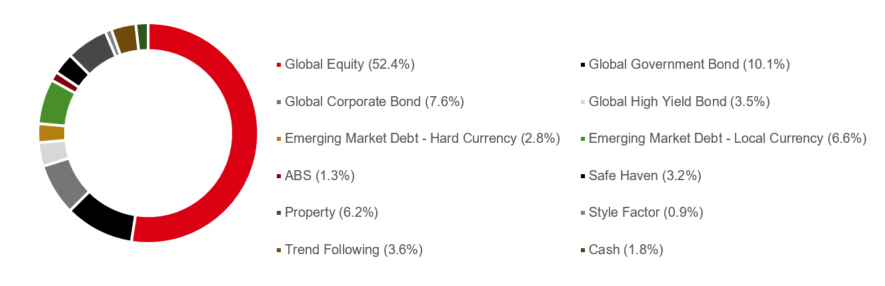

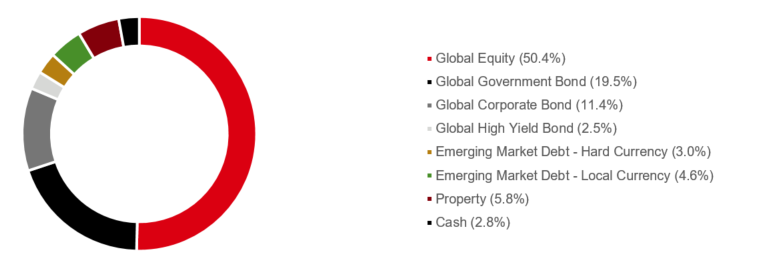

Asset class weightings per cent (World Selection Balanced)

Current Positioning and Trades

Equities

- Following the market rebound in March, we took some equity risk out of the portfolios at the start of April as we anticipated near term market volatility

- We maintain our overweights to USA Quality versus USA equity, World Financials versus World Equity, Swiss versus Europe ex UK equity, and Chinese onshore equity versus emerging market equity

Bonds

- At a headline level we are underweight the bond cluster within portfolios, although during the month we slightly increased our exposure to US 2 Year Treasuries

- We maintain our underweight to inflation linked bonds, while being neutral on Securitised credit and Corporate Bonds

- We continue to have a preference for US over Global bonds given the yield differential

Risky Fixed Income

Alternatives

- At a headline level we are overweight Alternatives

- We are neutral Style Factors and marginally underweight Trend, although we maintain a preference for defensive trend strategies

Source: HSBC Asset Management as of 30 April 2022. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Global Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target.

Key risks

The value of an investment in the portfolios and any income from them can go down as well as up and as with any investment you may not receive back the amount originally invested.

The key types of risk associated with the HSBC World Selection Portfolios asset allocations are as follows (please refer to the KIID for the full list):

- Equity risks

Market fluctuations can affect the performance of an investment fund both upwards and downwards. You may not get back the full amount invested - Emerging markets risk

Emerging economies typically exhibit higher levels of investment risk. Markets are not always well regulated or efficient and investments can be affected by reduced liquidity - Exchange rate risk

Investing in assets denominated in a currency other than that of your own currency perspective exposes the value of the investment to exchange rate fluctuations - Fixed income risk

As interest rates rise, debt securities will fall in value. Issuers of debt securities may fail to meet their regular interest and/or capital repayment obligations. All credit instruments therefore have potential for default. Higher yielding securities are more likely to default - Real estate risk

Cost of acquisition and disposal, taxation, planning, legal, compliance and other factors can materially impact real estate valuation

Important information

For Professional Clients only and should not be distributed to or relied upon by Retail Clients.

The material contained herein is for information only and does not constitute legal, tax or investment advice or a recommendation to any reader of this material to buy or sell investments. You must not, therefore, rely on the content of this document when making any investment decisions.

This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Global Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target.

The World Selection Portfolios are sub-funds of HSBC OpenFunds, an Open Ended Investment Company that is authorised in the UK by the Financial Conduct Authority. The Authorised Corporate Director and Investment Manager is HSBC Global Asset Management (UK) Limited. All applications are made on the basis of the prospectus, Key Investor Information Document (KIID), Supplementary Information Document (SID) and most recent annual and semiannual report, which can be obtained upon request free of charge from HSBC Global Asset Management (UK) Limited, 8, Canada Square, Canary Wharf, London, E14 5HQ, UK, or the local distributors. Investors and potential investors should read and note the risk warnings in the prospectus and relevant KIID and additionally, in the case of retail clients, the information contained in the supporting SID.

The HSBC Global Sustainable Multi-Asset Portfolios, are Sustainably Invested in line with one or more of the Global Sustainable Investment Alliance (GSIA) sustainable investment styles (positive/best-in-class screening, norms-based screening, sustainability themed investing, impact/community investing). It does not invest in companies involved in the manufacture of cluster munitions or anti-personnel mines. The fund is not guaranteed to outperform those which do not meet sustainability criteria.

Carbon Intensity Formula: Σ((current value of investment/current portfolio value)*(issuer's Scope 1 and Scope 2 GHG emissions/issuer's $M revenue)) Carbon Intensity Methodology: Scope 1 and Scope 2 GHG emissions are allocated based on portfolio weights (the current value of the investment relative to the current portfolio value), rather than the equity ownership approach. Gross values should be used. Company carbon data, can often be “partially disclosed”, i.e. partial geographic coverage, or incomplete operational data. Trucost undertakes analysis and research to assess company reported results. The proprietary Trucost model enables an estimate of total emissions which relies on more than just reported financial data. Where securities are not covered by Trucost , HSBC assigns a proxy value based on the average intensity score of comparable companies. Trucost are a division of S&P Global; they assess risks relating to climate change, natural resource constraints, and broader environmental, social, and governance factors.

These portfolios are sub-funds of HSBC OpenFunds an Open Ended Investment Company that is authorised in the UK by the Financial Conduct Authority. The Authorised Corporate Director and Investment Manager is HSBC Global Asset Management (UK) Limited. All applications are made on the basis of the prospectus, Key Investor Information Document (KIID), Supplementary Information Document (SID) and most recent annual and semiannual report, which can be obtained upon request free of charge from HSBC Global Asset Management (UK) Limited, 8, Canada Square, Canary Wharf, London, E14 5HQ, UK, or the local distributors. Investors and potential investors should read and note the risk warnings in the prospectus and relevant KIID and additionally, in the case of retail clients, the information contained in the supporting SID.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Stock market investments should be viewed as a medium to long term investment and should be held for at least five years. Any performance information shown refers to the past and should not be seen as an indication of future returns.

To help improve our service and in the interests of security we may record and/or monitor your communication with us. HSBC Global Asset Management (UK) Limited provides information to Institutions, Professional Advisers and their clients on the investment products and services of the HSBC Group.

Approved for issue in the UK by HSBC Global Asset Management (UK) Limited, who are authorised and regulated by the Financial Conduct Authority.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities provided through our local regulated entity, HSBC Global Asset Management (UK) Limited.

www.assetmanagement.hsbc.com/uk

Copyright © HSBC Global Asset Management (UK) Limited 2022. All rights reserved.

GD 0825 Exp. 30.06.2022

World Selection Sales Aids – Client facing

World Selection Sales Aids – Client facing

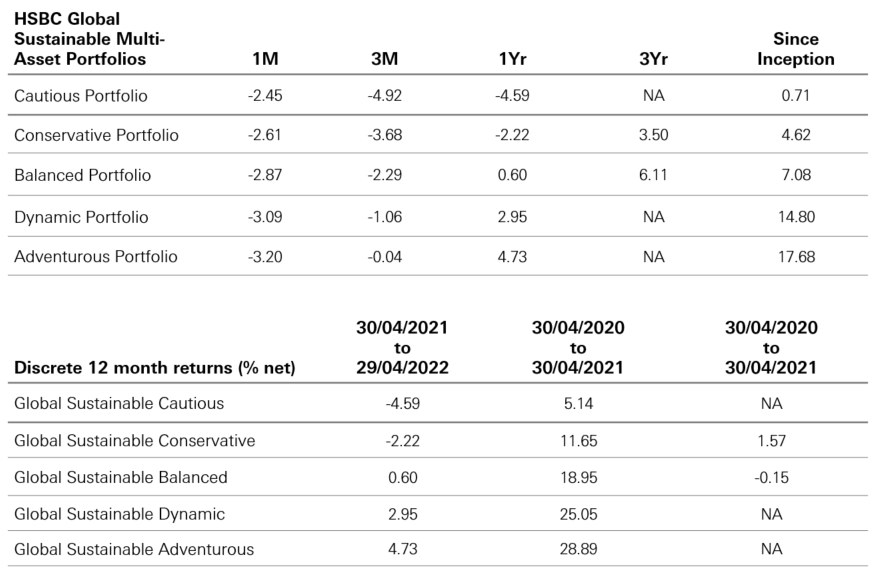

HSBC Global Sustainable Multi-Asset Portfolios

HSBC Global Sustainable Multi-Asset Portfolios HSBC Premier Investment Management Service

HSBC Premier Investment Management Service