HSBC PLUS Active ETFs

Activate your portfolio’s potential with ETFs designed with discipline

and built with precision

Access the power of PLUS

HSBC PLUS Active ETFs

Through a disciplined, quantitative investing approach, HSBC’s PLUS Active ETF range helps investors access the potential for excess returns.

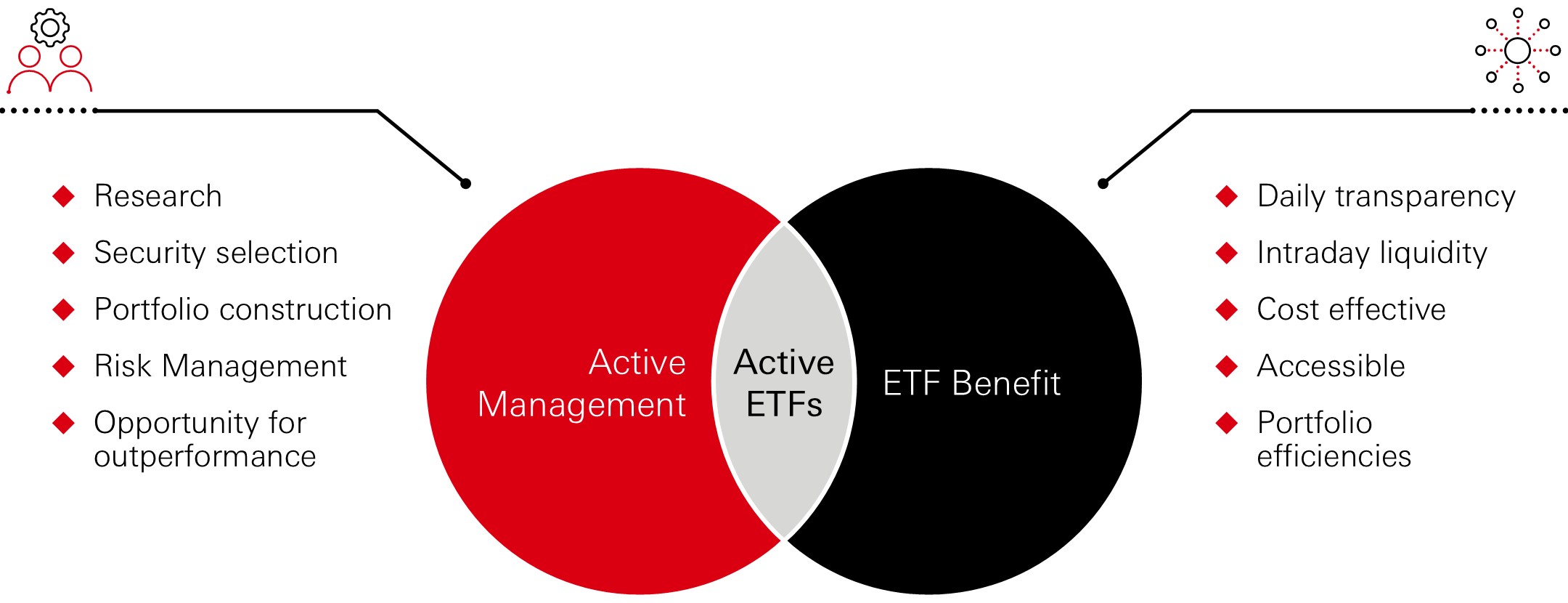

Active ETFs combine the benefits investors have come to value from ETFs — transparency, liquidity, broad diversification, and cost efficiency — with the potential for market outperformance in a risk-controlled manner.

Designed with discipline, our active ETFs offer investors enhanced core portfolio exposure and heightened diversification alongside existing ETF portfolios to aid in reducing investment process risk.

Three BIG reasons to choose HSBC PLUS Active ETFs

The benefits of Active ETFs

Explore our range

|

|

More information |

|

|

More information |

|

|

More information |

|

|

More information |

|

|

More information |

|

|

More information |

Speak with the team

Sales contacts

Bhavick Patel Head of UK ETF & Indexing Sales

Martin Pendlebery Director of Business Development

London, Northern England, Scotland and Ireland

Charlotte Satchell Director of Business Development

London, South and South West

Key Risks

Further information on the potential risks can be found in the Key Investor Information Document (KIID) and/or the Prospectus.

The value of an investment in the portfolios and any income from them can go down as well as up and as with any investment you may not receive back the amount originally invested.

◆ Counterparty Risk The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations.

◆ Derivatives Risk Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset.

◆ Emerging Markets Risk Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

◆ Exchange Rate Risk Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly.

◆ Investment Leverage Risk Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

◆ Liquidity Risk Liquidity Risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors.

◆ Operational Risk Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things.

◆ Real Estate Investments Risk Real estate and related investments can be negatively impacted by any factor that makes an area or individual property less valuable.

Important Information

For Professional Clients only and should not be distributed to or relied upon by Retail Clients.

The material contained herein is for marketing purposes and is for your information only. This document is not contractually binding nor are we required to provide this to you by any legislative provision. It does not constitute legal, tax or investment advice or a recommendation to any reader of this material to buy or sell investments. You must not, therefore, rely on the content of this document when making any investment decisions.

This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

The contents are confidential and may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This presentation is intended for discussion only and shall not be capable of creating any contractual or other legal obligations on the part of HSBC Global Asset Management (UK) Limited or any other HSBC Group company. The document is based on information obtained from sources believed to be reliable but which have not been independently verified. HSBC Global Asset Management (UK) Limited and HSBC Group accept no responsibility as to its accuracy or completeness. Care has been taken to ensure the accuracy of this presentation but HSBC Global Asset Management (UK) Limited accepts no responsibility for any errors or omissions contained therein.

This document and any issues or disputes arising out of or in connection with it (whether such disputes are contractual or non-contractual in nature, such as claims in tort, for breach of statute or regulation or otherwise) shall be governed by and construed in accordance with English law.

Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Global Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target. HSBC PLUS Active ETFs is a sub-fund of HSBC ETFs plc (“the Company”), an investment company with variable capital and segregated liability between sub-funds, incorporated in Ireland as a public limited company, and is authorised by the Central Bank of Ireland. The company is constituted as an umbrella fund, with segregated liability between sub-funds. Shares purchased on the secondary market cannot usually be sold directly back to the Company. Investors must buy and sell shares on the secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current Net Asset Value per share when buying shares and may receive less than the current Net Asset Value per Share when selling them. UK based investors in HSBC ETFs plc are advised that they may not be afforded some of the protections conveyed by the Financial Services and Markets Act (2000), (“the Act”). The Company is recognised in the United Kingdom by the Financial Conduct Authority under section 264 of the Act. The shares in HSBC ETFs plc have not been and will not be offered for sale or sold in the United States of America, its territories or possessions and all areas subject to its jurisdiction, or to United States Persons. Affiliated companies of HSBC Global Asset Management (UK) Limited may make markets in HSBC ETFs plc. All applications are made on the basis of the current HSBC ETFs plc Prospectus, relevant Key Investor Information Document (“KIID”), Supplementary Information Document (SID) and Fund supplement, and most recent annual and semi-annual reports, which can be obtained upon request free of charge from HSBC Global Asset Management (UK) Limited, 8 Canada Square, Canary Wharf, London, E14 5HQ. UK, or from a stockbroker or financial adviser. The indicative intra-day net asset value of the sub-fund[s] is available on at least one major market data vendor terminal such as Bloomberg, as well as on a wide range of websites that display stock market data, including www.reuters.com.

Investors and potential investors should read and note the risk warnings in the prospectus, relevant KIID and Fund supplement (where available) and additionally, in the case of retail clients, the information contained in the supporting SID. The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Stock market investments should be viewed as a medium to long term investment and should be held for at least five years. Any performance information shown refers to the past and should not be seen as an indication of future returns.

To help improve our service and in the interests of security we may record and/or monitor your communication with us. HSBC Global Asset Management (UK) Limited provides information to Institutions, Professional Advisers and their clients on the investment products and services of the HSBC Group.

Approved for issue in the UK by HSBC Global Asset Management (UK) Limited, who are authorised and regulated by the Financial Conduct Authority.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities provided through our local regulated entity, HSBC Global Asset Management (UK) Limited.

www.assetmanagement.hsbc.co.uk

Copyright © HSBC Global Asset Management (UK) Limited 2025. All rights reserved.

Index-based Investing - The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Stock market investments should be viewed as a medium to long term investment and should be held for at least five years. Any performance information shown refers to the past and should not be seen as an indication of future returns.