Framework for a resilient future

With HSBC Infrastructure Equity Strategy

Read moreHSBC Infrastructure Equity Strategy – Capitalising on long-term themes and capturing emerging opportunities

The HSBC Infrastructure Equity strategy has a more balanced exposure to the four macro infrastructure sectors. Outside of large cap stocks, the dedicated infrastructure investment team also scours attractive opportunities in the urbanisation, energy transition and digitalisation areas. Whether you are looking to deepen your existing allocation or re-allocate to infrastructure, HSBC Infrastructure Equity strategy can offer potential opportunities.

Long-term themes

Urbanisation

|

Energy transition

|

Digitalisation

|

Short-term themes

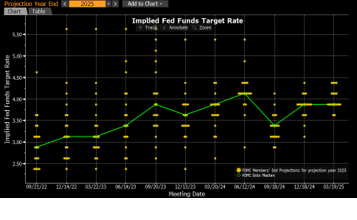

Evolution of interest rate expectations

|

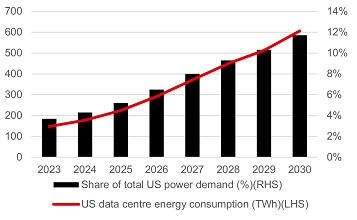

Higher power demand driven by AI and onshoring of manufacturingDemand for power for data centers is expected to rise significantly

Why it matters?

|

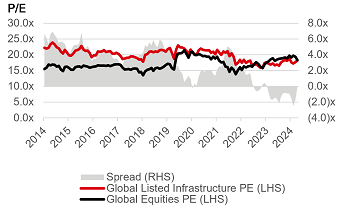

Global markets relative valuation

|

|

Source: HSBC AM, Bloomberg as of March 2025 |

||

Why Infrastructure Equity?

|

Inflation hedge Real assets potentially providing a natural hedge in inflationary environment |

Income Long duration assets generating potentially high distribution levels |

Liquid Liquidity providing immediate exposure to core infrastructure assets |

Defensive Defensive building block to a diversified equity portfolio |

Growth Secular growth pathway driven by a multi-decade investment cycle |

|

|

||||

Sectors we invest in

|

Communications

|

Energy infrastructure

|

Transportation

|

Utilities

|

Past performance does not predict future returns. For illustrative purposes only. This information shouldn't be considered as a recommendation to invest in the specific sectors mentioned.

The strategic advantages of Infrastructure Equity

Getting to know Infrastructure Equity

Want to know more about Infrastructure Equity as an asset class? Hear from Portfolio Manager Giuseppe Corona on the distinct benefits of our Infrastructure Equity capability and the philosophy that sets it apart.

Outlook for Infrastructure Equity sector

Discover why Infrastructure Equity can offer investors a defensive building block in the current market landscape. Joe Little, Global Chief Strategist, explores the benefits of the asset class including its lower correlation to global equities, and steady income potential.

Dislocation between price and value – Causes and implications

Since 2022, Infrastructure Equity has shown a marked dislocation between price and value. While companies have continued to deliver solid earnings and income, valuations have been muted, particularly in comparison to private infrastructure markets. Giuseppe Corona, Head of Listed Real Assets, explores the causes and implications of this divergence in our latest video.

Resources

|

HSBC’s approach to Infrastructure Investing

|

Read time: |

|

|

Powering AI

|

Read time: |

|

|

Why invest in Infrastructure Equity

|

Read time: |

|

|

Tariffs, Taxes, Trump and Transmission

|

Read time: |

|

|

Deep-dive into Infrastructure Equity strategy

|

Read time: |

|

|

Global Infrastructure Equity – A defensive building block

|

Read time: |

Why HSBC Asset Management?

Strong experience

|

Dual research hub – London and Sydney

|

||||||||

|

Source: HSBC Asset Management as of March 2025. The investment team may change from time to time without notice. |

|||||||||

Investment team

|

Giuseppe Corona Head of Listed Real Assets Giuseppe Corona is the Head of Listed Real Assets at HSBC Asset Management, based in the London office. He joined the financial industry in 1999 and began portfolio management across long only and long/short products in 2008. Giuseppe moved to HSBC Asset Management in March 2022, to launch its Infrastructure Equity capability. Prior to joining HSBC Asset Management, he has worked across roles covering multi-utilities and infrastructure companies, including managing long/short market neutral portfolios, a US large cap value fund and a European hedge fund. Giuseppe holds a Bachelor of Economics and Business Administration from the University of Palermo in Italy and a Master of Business Administration in International Finance from St. John's University in Italy. He is also a CFA charterholder. |

Speak with our sales team today to learn more

James Gavin

Head of UK Wholesale FIG and UK Sub Advisory

Tel: +44 203 2683996

Simon Page

Director, Business Development, North and Scotland

Mobile: +44 (0)7584 401171

Matthew Fraser-Sage

Director, Business Development, London and South UK

Tel: +44 (0)20 7024 0435

Mobile: +44 (0)7920 021461

Key Risks

- Equity Risk: Portfolios that invest in securities listed on a stock exchange or market could be affected by general changes in the stock market. The value of investments can go down as well as up due to equity markets movements.

- Interest Rate Risk: As interest rates rise debt securities will fall in value. The value of debt is inversely proportional to interest rate movements.

- Counterparty Risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations.

- Derivatives Risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset.

- Emerging Markets Risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

- Exchange Rate Risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly.

- Investment Leverage Risk: Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

- Liquidity Risk: Liquidity Risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors.

- Operational Risk: Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things.

- Style Risk: Different investment styles typically go in and out of favour depending on market conditions and investor sentiment.

- Model Risk: Model risk occurs when a financial model used in the portfolio management or valuation processes does not perform the tasks or capture the risks it was designed to. It is considered a subset of operational risk, as model risk mostly affects the portfolio that uses the model.

- Alternatives: Alternative investments include Private Equity, Commodities, Hedge Funds and Property. They may be difficult to sell in a timely manner or at a reasonable price. It may be difficult to obtain reliable information about their value.

- Sustainability Risk: Sustainability risk means an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment.

Important Information

For Professional Clients only and should not be distributed to or relied upon by Retail Clients.

Issued and approved in the UK by HSBC Global Asset Management (UK) Limited (“AMEU”), which is authorised and regulated by the Financial Conduct Authority. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. HSBC Asset Management is the brand name for the asset management business of the HSBC Group.

The material contained herein is for marketing purposes and is for your information only. This document is not contractually binding nor are we required to provide this to you by any legislative provision. It does not constitute legal, tax or investment advice or a recommendation to any reader of this material to buy or sell investments. You must not, therefore, rely on the content of this document when making any investment decisions. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe to any investment. The contents are confidential and may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This document is intended for discussion only and shall not be capable of creating any contractual or other legal obligations on the part of AMEU or any other HSBC Group company. This document is based on information obtained from sources believed to be reliable, but which have not been independently verified. AMEU and HSBC Group accept no responsibility as to its accuracy or completeness. Care has been taken to ensure the accuracy of this presentation, but AMEU accepts no responsibility for any errors or omissions contained therein.

This document and any issues or disputes arising out of or in connection with it (whether such disputes are contractual or non-contractual in nature, such as claims in tort, for breach of statute or regulation or otherwise) shall be governed by and construed in accordance with English law.

Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. AMEU accepts no liability for any failure to meet such forecast, projection, or target. The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Any performance information shown refers to the past and should not be seen as an indication of future returns.

Recipients of this communication who intend to acquire an investment in a Fund are reminded that any such acquisition may only be made on the basis of the final form of the Offering Memorandum or Prospectus, fund legal documentation, and on satisfaction of the requirements of the applicable Subscription Document. It is the responsibility of prospective investors to satisfy themselves as to full compliance with the relevant laws and regulations of any territory in connection with any application to participate in the Fund.

Detailed information for article 8 and 9 sustainable investment products, as categorised under the Sustainable Finance Disclosure Regulation (SFDR), including; description of the environmental or social characteristics or the sustainable investment objective; methodologies used to assess, measure and monitor the environmental or social characteristics and the impact of the selected sustainable investments and; objectives and benchmark information, can be found at: ESG and Sustainable Investing range

To help improve our service and in the interests of security we may record and/or monitor your communication with us. AMEU provides information to Institutions, Professional Advisers and their clients on the investment products and services of the HSBC Group.

www.assetmanagement.hsbc.co.uk

Copyright © HSBC Global Asset Management (UK) Limited 2025. All rights reserved.

Content ID: D053920; Expiry Date: 31.03.2026