HSBC Global Responsible Multi-Asset Portfolios

Investing for a more Responsible world

The state of our planet, wellbeing of society and behaviour of corporations are all related issues with significant consequences. We believe that company performance can be positively influenced by good responsible investment practices.

As the global economy evolves to address environmental, social and governance (ESG) issues, it creates opportunities and risks for companies. Some will stand to gain from the adaptation of new standards and technologies. Companies that most effectively manage opportunities and risks related to ESG should logically find long-term success.

The HSBC Global Responsible Multi-Asset Portfolios aim to maximise investment returns aligned to set risk levels, whilst also delivering on three responsible investment objectives:

- Lower carbon intensity than the broader investment universe*

- Higher ESG score than the broader investment universe*

- Invest in assets focused on themes (“thematic assets”) that seek to contribute towards positive environmental and/or social outcomes

*The broader investment universe provides a comparison to what each of the Funds might have achieved if they did not have responsible investment aims. The broader investment universe is represented by a reference comparator, which is a combination of market indices, such as the FTSE World Index.

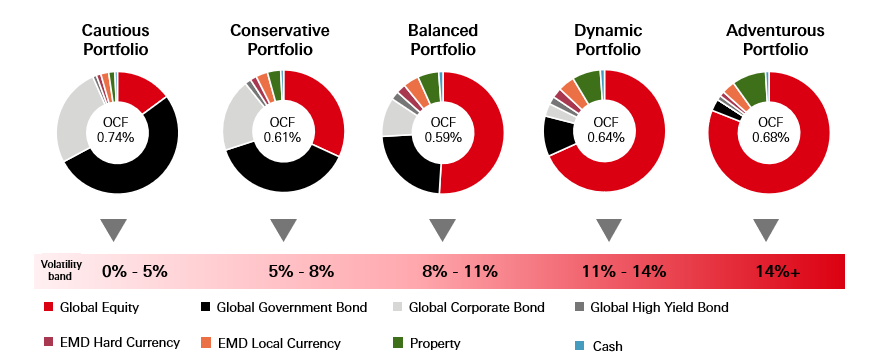

Portfolio asset-allocations

Source: HSBC Asset Management, April 2025. Pie charts for illustrative purposes only. Allocations may change without prior notice. Ongoing charges figure (OCFs) from ‘C Acc share class’ of the relevant fund as at April 2025.

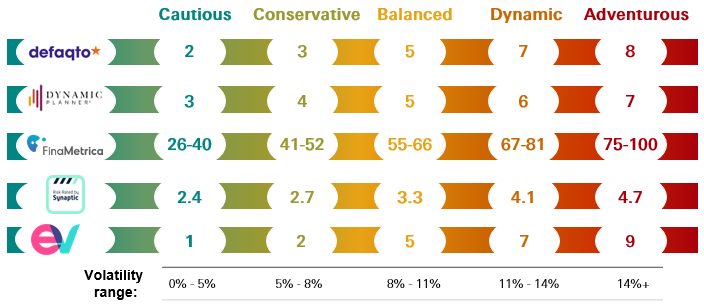

Portfolio risk ratings

Ratings should not be taken as a recommendation. All risk ratings as at August 2025. The Defaqto 5 diamond logo relates to the Cautious, Conservative, Balanced, Dynamic and Adventurous portfolios. The FinaMetrica score refers to their ‘ok risk’ range. The Synaptic score refers to their 1-5 scale SAA rating. The EValue Risk Ratings is based on 1-10 scale data generated by Fund Risk Assessor on a 25 year time horizon.

Why choose the HSBC Global Responsible Multi-Asset Portfolios?

- Five risk-managed multi-asset portfolios, globally diversified across equities, bonds, alternatives and currencies

- Focus on responsible investment alongside financial returns through a range of approaches: ESG scores, carbon intensity and thematic investing

- Active asset allocation that can adapt to changing market conditions

- Established track record since launch in 2018 with £1bn+ in assets

SDR Update

FCA’s Sustainability Disclosure Requirements and labelling regime

The FCA has brought in a new set of Sustainability Disclosure Requirements (known as “SDR”), which introduce four new voluntary labels for UK funds that meet certain sustainability criteria, together with disclosure, naming and marketing requirements for funds that have sustainability characteristics, including those funds that do not use a label. More information on SDR is available on the FCA website here:

Sustainable investment labels and anti-greenwashing | FCA

The initial deadline for compliance with these elements of SDR was 2 December 2024. However the FCA later introduced a temporary flexibility* into this deadline that gave firms until 2 April 2025 to comply provided conditions specified by the FCA were met.

HSBC’s UK funds in scope of these elements of SDR that use the ‘sustainable’, ‘sustainability’ or ‘impact’ terms in their names and are yet to comply are in the process of being reviewed and updated in line with the 2 April 2025 deadline. More information on the funds’ approach to the new requirements will be provided to investors and made available on this website in due course.

*More information on this is available on the FCA website here:

FCA sets out temporary measures for firms on ‘naming and marketing’ sustainability rules

| Resources for professionals | Resources for your clients |

|

HSBC Global Responsible Multi-Asset Portfolios At a glance |

HSBC Multi-Asset Solutions Brochure |

|

HSBC Global Responsible Multi-Asset Reasons Why |

How long should I stay invested? |

|

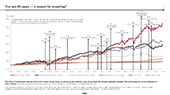

The long term history of market returns |

|

|

What is in our portfolios and why? |

|

|

HSBC Global Responsible Multi-Asset Portfolios Brochure |

|

|

A reason for investing |

|

Importance of asset diversification |

Key risks

It is important to remember that the value of investments and any income from them can go down as well as up and is not guaranteed.

Counterparty Risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations.

Credit Risk: A bond or money market security could lose value if the issuer’s financial health deteriorates.

Default Risk: The issuers of certain bonds could become unwilling or unable to make payments on their bonds.

Derivatives Risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset.

Emerging Markets Risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

Exchange Rate Risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly.

Interest Rate Risk: When interest rates rise, bond values generally fall. This risk is generally greater the longer the maturity of a bond investment and the higher its credit quality.

Investment Leverage Risk: Investment Leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

Liquidity Risk: Liquidity Risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors.

Operational Risk: Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things.

Further information on the potential risks can be found in the Key Investor Information Document (KIID) and/or the Prospectus.

Important information

The HSBC Global Responsible Multi-Asset Portfolios are sub-funds of HSBC OpenFunds an Open Ended Investment Company that is authorised in the UK by the Financial Conduct Authority. The Authorised Corporate Director is HSBC Asset Management (Fund Services UK) Limited and the Investment Manager is HSBC Global Asset Management (UK) Limited. All applications are made on the basis of the prospectus, Key Investor Information Document (KIID), Supplementary Information Document (SID) and most recent annual and semiannual report, which can be obtained upon request free of charge from HSBC Global Asset Management (UK) Limited, 8, Canada Square, Canary Wharf, London, E14 5HQ, UK, or the local distributors. Investors and potential investors should read and note the risk warnings in the prospectus and relevant KIID and additionally, in the case of retail clients, the information contained in the supporting SID.

HSBC Global Responsible Multi-Asset Portfolios are actively managed.

The funds may use derivatives for the purposes of efficient portfolio management i.e. to meet the investment objective of the Fund and it is not intended that their use will raise the overall risk profile of the Fund. Please note derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of an underlying security or benchmark may result in disproportionately large movement; unfavourable or favourable in the price of the derivative instrument; the risk of default by counterparty; and the risk that transactions may not be liquid.

There are additional risks associated with specific alternative investments within the portfolios; these investments may be less readily realisable than others and it may therefore be difficult to sell in a timely manner at a reasonable price or to obtain reliable information about their value; there may also be greater potential for significant price movements.

The long term nature of investment in property and the income generated tend to make this type of investment less volatile than equities although it can be difficult to buy and/or sell quickly. Where the underlying funds invest directly in property, the property in the fund may not be readily realisable, and the Manager of the fund may apply a deferral on redemption requests. The value of property is generally a matter of the valuer’s opinion rather than fact.

y

y