HSBC World Selection Portfolios

Risk-managed multi-asset portfolios, blended from a wide-ranging investment universe

Diversification is at the core of our World Selection Portfolios. Built from a broad set of asset classes, the portfolios aim to deliver steady, long-term returns across market cycles.

The portfolios include

- Global Equities

- Global Government Bonds

- Global Inflation Linked Bonds

- Global Corporate Bonds

- Global High Yield Bonds

- Emerging Market Debt

- Securitised Credit

- Listed Real Estate

- Listed Infrastructure

- Commodities

- Liquid Alternatives

- Currencies

- Cash

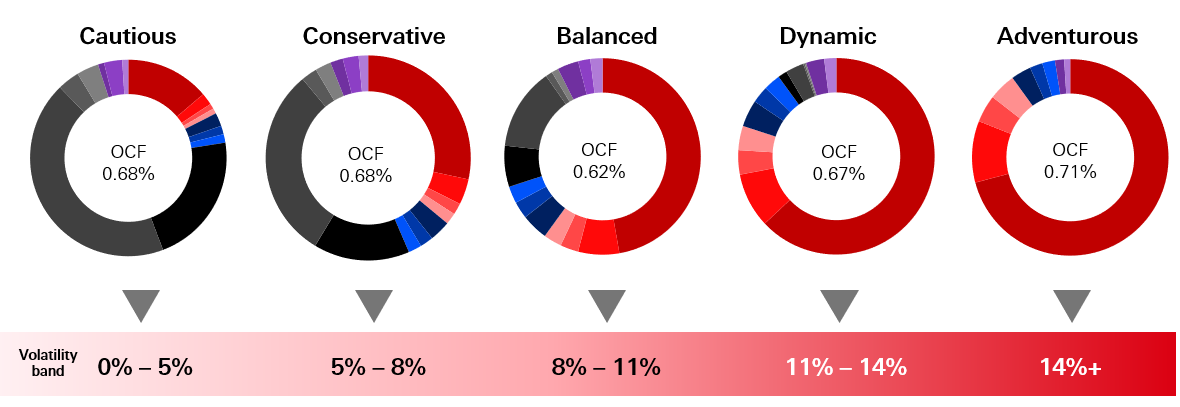

Portfolio asset-allocations

The range consists of five risk-managed portfolios, designed to match different client investment objectives.We use the fixed income and cash allocations within our portfolios to increase their 'defensive' characteristics; equity and alternatives are 'growth' focused assets within the portfolios.

Source: HSBC Asset Management, March 2025. Pie charts for illustrative purposes only. Ongoing charges figure (OCFs) from ‘C Acc share class’ of the relevant fund, as of March 2025.

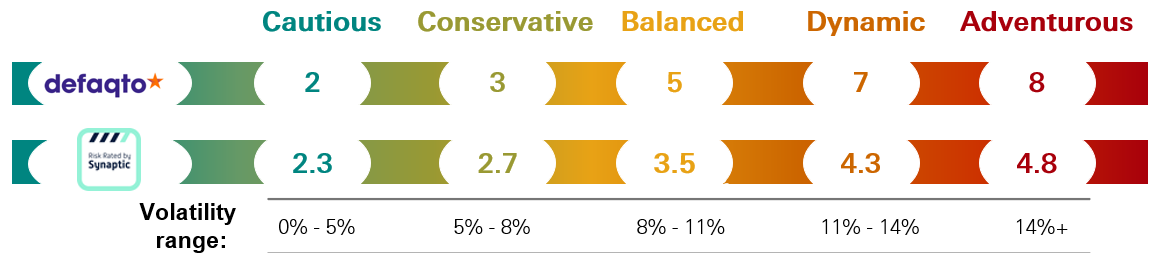

Portfolio risk ratings

Ratings should not be taken as a recommendation. All risk ratings as at August 2025. The Defaqto 5 diamond logo relates to the Cautious, Conservative, Balanced, Dynamic and Adventurous portfolios. The Synaptic score refers to their 1-5 scale SAA rating.

Our Process

We adopt a dynamic approach to asset allocation. The World Selection portfolios are constructed using a three stage process

Why choose the HSBC World Selection Portfolios?

- Five risk-managed portfolios, suitable for investors across a range of risk and return objectives

- Multi asset approach designed to deliver attractive performance in a range of economic environments

- Global portfolio, with access to equities, fixed income and alternatives, providing access to opportunities regardless of where they appear in the world

- Active asset allocation, aiming to enhance growth as markets rise, and limit losses if they fall

- Security selection in markets where it is needed; management style varies by asset class, to balance alpha generation with cost control

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested.

| Resources for your clients |

|

HSBC Multi-Asset Solutions Brochure |

|

HSBC World Selection Portfolios Brochure |

|

HSBC Global World Selection Portfolios Reasons Why |

|

How long should I stay invested? |

|

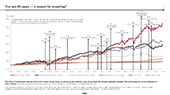

The long term history of market returns |

|

What is in our portfolios and why? |

|

A reason for investing |

Importance of asset diversification |

Key risks

It is important to remember that the value of investments and any income from them can go down as well as up and is not guaranteed.

Counterparty risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations

Credit Risk: A bond or money market security could lose value if the issuer’s financial health deteriorates.

Default Risk: The issuers of certain bonds could become unwilling or unable to make payments on their bonds.

Derivatives Risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset

Emerging Markets Risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

Exchange Rate Risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly.

Interest Rate Risk: When interest rates rise, bond values generally fall. This risk is generally greater the longer the maturity of a bond investment and the higher its credit quality.

Investment Fund Risk: Investing in other funds involves certain risks an investor would not face if investing in markets directly. Governance of underlying assets can be the responsibility of third-party managers.

Investment Leverage Risk: Investment leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

Liquidity Risk: Liquidity risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors.

Operational Risk: Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things.

For more detailed information on the risks associated with this fund, investors should refer to the prospectus of the fund.

Important information

HSBC World Selection Portfolios are sub-funds of HSBC OpenFunds, an Open Ended Investment Company that is authorised in the UK by the Financial Conduct Authority. The Authorised Corporate Director is HSBC Asset Management (Fund Services UK) Limited and the Investment Manager is HSBC Global Asset Management (UK) Limited. All applications are made on the basis of the OpenFunds prospectus, Key Investor Information Document (KIID), Supplementary Information Document (SID) and most recent annual and semi annual report, which can be obtained upon request free of charge from HSBC Global Asset Management (UK) Limited, 8 Canada Square, Canary Wharf, London E14 5HQ UK, or the local distributors. Investors and potential investors should read and note the risk warnings in the prospectus and relevant KIID and additionally, in the case of retail clients, the information contained in the supporting SID.

This fund is actively managed and is not managed in reference to any benchmark index. The fund may use derivatives for the purposes of efficient portfolio management i.e. to meet the investment objective of the Fund and it is not intended that their use will raise the overall risk profile of the Fund. Please note derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of an underlying security or benchmark may result in disproportionately large movement; unfavourable or favourable in the price of the derivative instrument; the risk of default by counterparty; and the risk that transactions may not be liquid.

There are additional risks associated with specific alternative investments within the portfolios; these investments may be less readily realisable than others and it may therefore be difficult to sell in a timely manner at a reasonable price or to obtain reliable information about their value; there may also be greater potential for significant price movements.

Investments in commodities may be subject to greater volatility than investments in traditional investment types. They may be affected by disease, climatic changes and international economic and political developments, which may cause individual commodity prices to rise or fall sharply.

The long term nature of investment in property and the income generated tend to make this type of investment less volatile than equities although it can be difficult to buy and/or sell quickly. Where the underlying funds invest directly in property, the property in the fund may not be readily realisable, and the Manager of the fund may apply a deferral on redemption requests. The value of property is generally a matter of the valuer’s opinion rather than fact.

y

y