Sustainable Emerging Market Debt

The lack of financing for sustainability transition across companies in emerging markets (EMs) has created a critical gap. With EM corporates facing limited access to dedicated funding pools, it is vital to channel capital into companies that are actively implementing ambitious, measurable sustainability initiatives. By supporting businesses on their journey towards sustainable practices, investors may catalyse positive environmental and social change while generating long-term financial returns.

Introduction

Over the last decade, EMs and developing economies (EMDEs) have accounted for two-thirds of the world’s energy-related carbon-dioxide (CO2) emissions and 95 per cent of the increase in emissions. Many emerging governments now have decarbonisation goals and are pursuing increasingly credible and ambitious policies to achieve them, but they are held back by an acute shortage of finance. Recognising that investors in EM corporates can make an outsize contribution to global sustainability, HSBC Asset Management has created the GEM Corporate Sustainable Bond Strategy to help fill this funding gap.

Our strategy enables the difference-makers

We believe that sustainable investing will provide improved outcomes for both investors and the planet, so we have invested significant time and resources in establishing ourselves as a sustainable leader in managing EM corporates. Our innovative strategy aims to deliver positive environmental impact through integrated sustainability analysis and continuous engagement with EM issuers.

Through a rigorous bottom-up approach, we evaluate an issuer’s sustainability plans, its progress towards achieving specific ESG goals, and its alignment with SDG themes. The credit-intensive strategy aims to generate positive environmental and social outcomes and deliver long-term financial returns for investors. The strategy should appeal to a broad investor base, given that investors have the option to gain exposure through the UCITs fund, RAIF fund or managed accounts, depending on their specific requirements.

Key differentiators

- Unlike traditional EM ESG funds, which tend to focus on use-of-proceeds and labelled bonds (e.g. green, social or sustainability-linked bonds), we have created a strategy that takes a broader and more flexible approach, targeting companies with transformative sustainability goals and have demonstrable business plans and ambitions. We evaluate the company, rather than the bond, to determine sustainability-ness

- The strategy not only targets companies that meet our stringent sustainability and ESG criteria but also aims to create a diversified portfolio in terms of industries, regions and ratings. This diversification tends to be broader than that of other EM sustainable or impact funds and captures smaller companies and more private companies that might otherwise go uncovered

- We invest in companies at various stages of their sustainability lifecycle and then reallocate capital as they achieve their goals. Our aim is to invest in issuers before their sustainability improvements are incorporated into market prices. Then, we can harvest the potential price appreciation achieved through these improvements and invest in new opportunities for sustainable co-investment

- Ongoing engagement with EM corporate issuers is central to our strategy. We engage with EM issuers to assess their ESG plans and progress, their challenges and the gaps, with the ultimate goal of driving positive change

- The fact that we focus only on EMs, while other offerings may include investments situated outside EMs, also sets our strategy apart. In addition, we evaluate companies at the issuer level, not at the security level. Thus, we analyse the broad profile of the company, including its plans and ambitions to transform into a sustainable business, rather than simply investigating the bond that is being issued

- The strategy exclusively targets corporate bonds that meet the high standards of SFDR Article 9, ensuring transparency, accountability and alignment with the UN’s SDGs

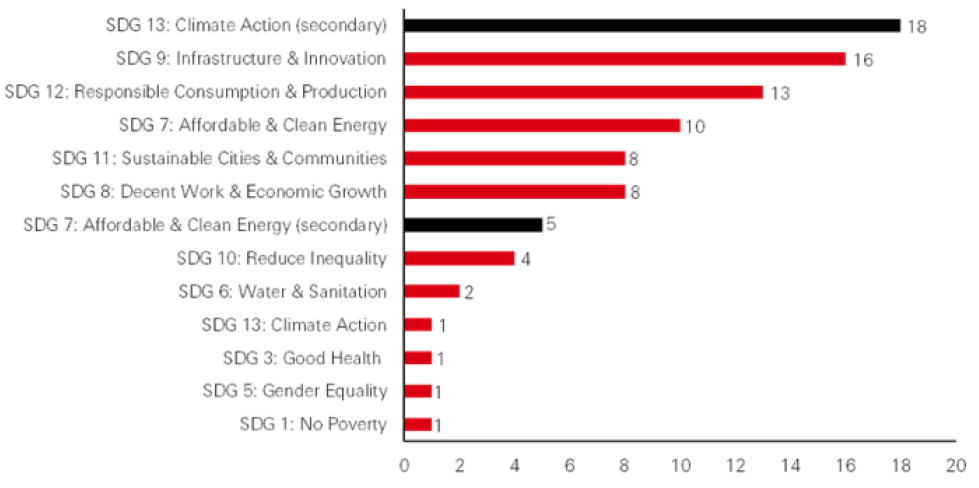

- We do not have a singular thematic focus. We look for sustainable transition and potential impact everywhere and anywhere we can; therefore, our bottom-up issuer selection process and engagement results in a portfolio that is well diversified globally and can express a range of sustainability investments. The SDGs captured in our portfolio include Climate Action (13), Affordable and Clean Energy (7), Clean Water and Sanitation (6), Good Health and Well Being (3) and Reduced Inequalities (10), across a diversified set of regions and sectors

Figure 1: HSBC GEM Corporate Sustainable Strategy distribution by UN SDG

SDGs (# issuers in the Whitelist)

Click image to enlarge

Source: HSBC Asset Management, March 2025

How we execute the strategy

We follow a robust, repeatable process. HSBC Asset Management has over 40 senior credit analysts who specialise in sustainability analysis. Our sovereign analysts doubly provide country and macro risk perspectives to portfolio construction. Our stringent internal and regulatory standards ensure compliance with SFDR Article 9 requirements, with each investment considered and approved by a committee representing investments, risk, and responsible investment teams. The bottom-up investment process selects corporate issuers based on rigorous fundamental analysis and a forward-looking, integrated sustainability assessment, which aims to:

- Evaluate an issuer’s current sustainability plans and challenges

- Track the issuer’s progress, based on ESG data and engagement

- Measure the issuer’s positive change and impact achievements

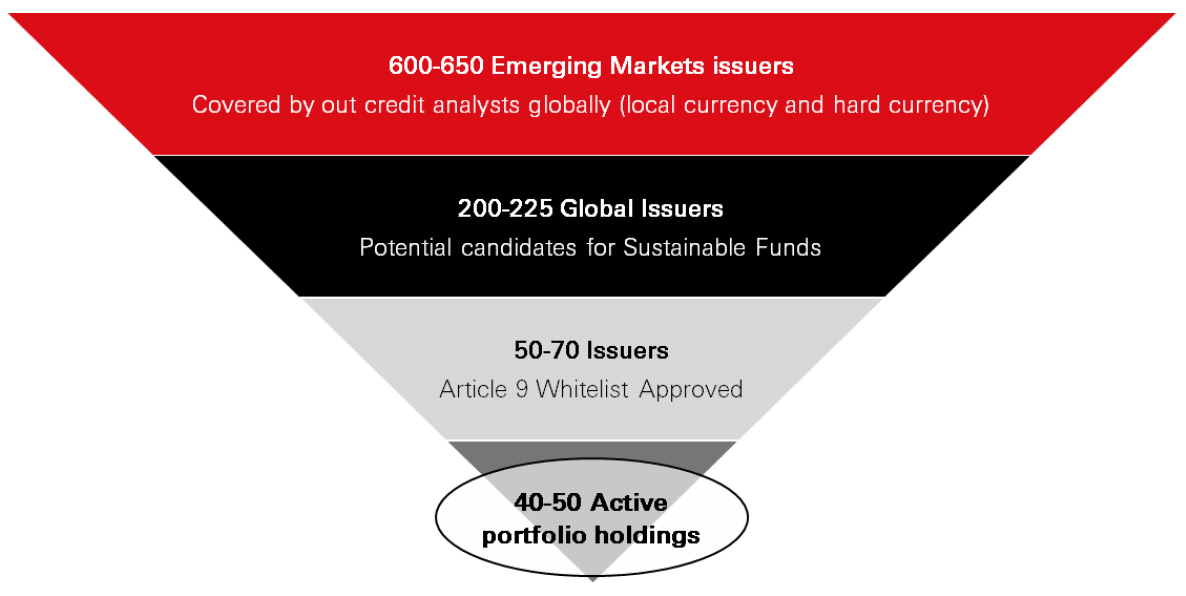

Our deliberative, deep-dive analytical process for evaluating portfolio candidates implicitly excludes in the order of 90 per cent of the issuers across the EM corporate bond universe.

Figure 2: Portfolio construction process

Click image to enlarge

Source: HSBC Asset Management, July 2025

Engagement critical to success

Standards of corporate governance in EMs have improved sharply in recent years, but they still tend to be lower than in the advanced economies. That’s why continuing engagement with EM corporate issuers is central to our strategy.

We engage with all companies that we approve for investment, helping with lighter-touch sustainability improvements or providing higher-pressure conditional criteria for achieving measurable impact. Our analysts collaborate closely with corporate management teams to foster transparency, encourage ESG data disclosure, and track progress against sustainability milestones. This continuing dialogue with issuers enhances our fundamental credit research process and ensures the strategy remains aligned with SFDR Article 9 standards.

Where to invest?

The strategy channels capital into promising EM issuers that we believe to be future winners of global transition and change. With robust credit research, active engagement and strategic capital allocation, we aim to drive meaningful and measurable impact in these markets. Examples include a business that invests in a diversified portfolio of renewables – hydro, solar and wind – in the poorest regions of Central America, while also driving social progress by investing in electrification, schools and infrastructure in rural areas. Another example is a telecoms company that operates in some of the most underprivileged parts of Africa. Around half of all sub-Saharan Africans do not have access to the internet, so gaining access to telecoms – especially in rural areas – can bring major social benefits in terms of jobs, innovation and financial inclusion.

The investment case for sustainable EM corporates

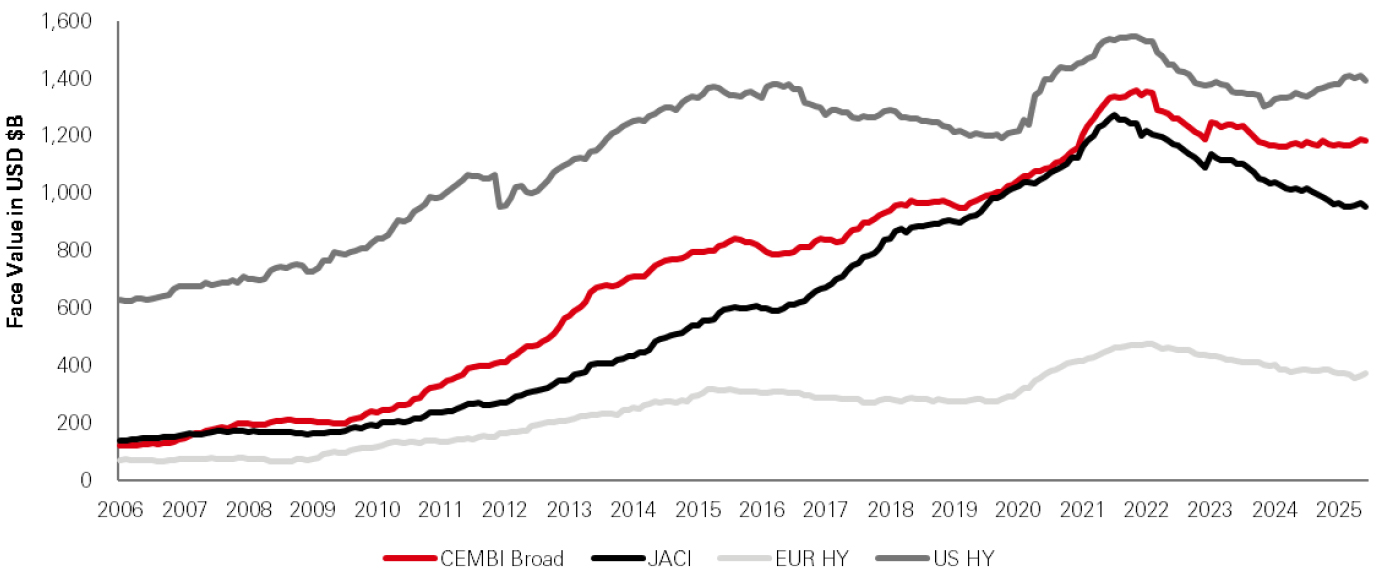

EM corporates have matured and developed into their own robust asset class. Looking at the market capitalisation as represented by the JP Morgan indices, EM corporates were just 25 per cent of the size of the US high-yield bonds asset class 15 years ago, but they have closed the gap and now stand at nearly the same size as the US high yield bond market today.

Figure 3: Evolution of the asset class

Click image to enlarge

Source: JP Morgan, ICE BofA, as of 30 June 2025 based on daily returns.

Yet EM corporates remain underappreciated by investors, despite the attractive attributes of the asset class. These include:

- Diversification: The universe provides exposure to a diversified set of countries and industries that are not dependent on a single economic cycle or central bank policy. The asset class is also hybrid, composed of both investment-grade and high-yield issuers, from every EMDE region

- Robust risk management: EM companies tend to be better managed than their developed-market counterparts, even on a ratings-adjusted basis. They generally have lower leverage levels, are more prudent in taking on debt, implement more consistent currency hedging strategies, and are better able to withstand periods when markets are closed, holding their value regardless of the interest-rate environment

- Resilient yields: The most widely used EM corporate bond index (the JPM CEMBI BD) has delivered higher carry and lower volatility than other credit asset classes over the longer term – especially during periods of drawdown

- Technical support: Technical factors such as supply (market issuance) and positioning are favourable for investments in the asset class. EM debt has only just begun to experience inflows, following other fixed-income assets. We expect more rotations into EM bonds – especially from shorter-duration fixed income – as the rate-cut cycle unfolds

Outlook for EM corporate bonds

The performance of EM corporates is not primarily driven by flows and is also less correlated with US Treasuries than other asset classes. Relatively low correlations, higher yields and lower duration, and differences in the characteristics of the investor base mean that EM corporates can help to diversify and stabilise risk-adjusted returns over the longer term.

The outlook is encouraging, based on the macroeconomic cycle, country fundamentals, bottom-up company strength, and technical factors. The yield advantage of EM corporates may be compounded by the capital-gain effect of cyclically declining interest rates, providing an opportunity for strong returns.

Our ambition

We aim to institutionalise sustainable investing in EM corporates and draw attention, resources and capital to EM issuers that are on a path to achieving specific sustainability goals. By channelling capital into companies that are actively implementing ambitious, measurable sustainability plans and practices, the strategy seeks to catalyse environmental and social change while delivering long-term financial returns for investors.

We believe that our investment approach – prioritising sustainability improvements as a driver of financial returns – can help redefine investing in EMs. Through robust research, active engagement and strategic capital allocation, we seek to support future winners of global transition and change. The strong governance around our selection and approval process for investments helps ensure the highest standards of credit quality and sustainability are met.

We anticipate that the need for private financing to achieve progress in EM sustainability will only grow. We believe that our strategy, today, provides a scalable and impactful solution to that future need, helping investors align their portfolios with the transition to a greener, more sustainable world.