HSBC Global Managed Portfolio Service

A globally diversified managed portfolio service, from a world leading asset manager*

The HSBC Global Managed Portfolio Service provides a global, broadly diversified investment solution from a world leading asset manager at a competitive price*.

Offering ‘global reach’ is one thing, but what does that really mean for financial advisers in the UK? When you work with HSBC, it means investment experts, based locally – in key locations throughout the world. Local expertise makes it easier for us to discover potential opportunities. Plus, our considerable resources give us the buying power to deliver these opportunities more cost-effectively.

Your clients can choose from five globally diversified managed portfolios – each intended for a different risk profile. And since you don’t need to worry about managing portfolios or rebalancing asset allocation, you can focus your attention on your clients and attracting new business.

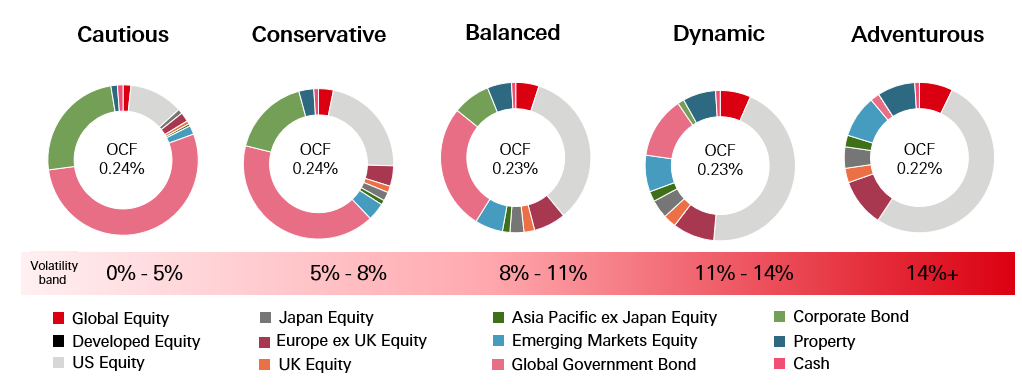

Portfolio asset-allocations

Source: HSBC Asset Management, June 2025. Pie charts for illustrative purposes only. Ongoing charges figure (OCFs) as at June 2025.

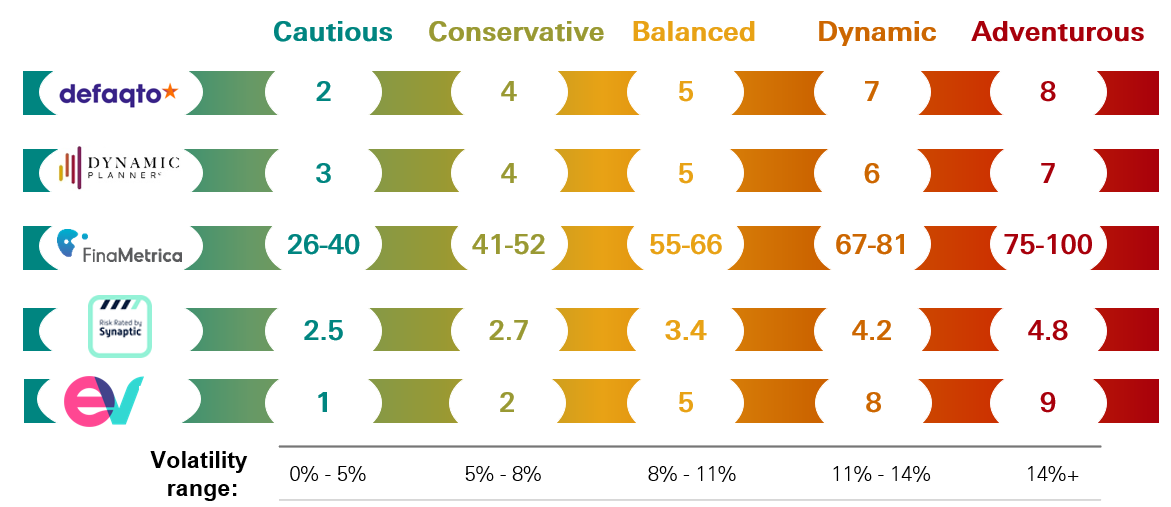

Portfolio risk ratings

Ratings should not be taken as a recommendation. All risk ratings as at September 2025. The Defaqto 5 diamond logo relates to the Cautious, Conservative, Balanced, Dynamic and Adventurous portfolios. The Dynamic Planner Premium logo relates to the Balanced portfolio only. The FinaMetrica score refers to their ‘ok risk’ range. The Synaptic score refers to their 1-5 scale SAA rating. The EValue Risk Ratings is based on 1-10 scale data generated by Fund Risk Assessor on a 25 year time horizon.

Why choose the HSBC Global Managed Portfolio Service?

- A choice of five easy-to-understand risk-managed portfolios

- Globally diversified to balance fluctuating asset prices

- Focus on cost*

- Transparent charges, fees and underlying holdings

- Performance driven by an experienced investment team

- Proven institutional investment processes from a world-leading asset manager*

- Service-driven with access to regional specialists, as well as comprehensive insights and materials

- Portfolios are actively managed

The service is now available on the following major platforms

- Aviva

- Abrdn Wrap

- Fidelity Adviser Solutions

- Fundment

- Morningstar Wealth

- M&G Wealth

- Nucleus

- Novia

- Parmenion

- Quilter

- Scottish Widows Platform

- Transact

- Wealthtime

- 7IM

*OCF’s range between 0.21 per cent and 0.24 per cent. The Top 500 Asset Managers 2022 Special Report, Investment & Pensions Europe – HSBC Asset Management ranked 47th.

| Resources for professionals | Resources for your clients |

|

HSBC Global Managed Portfolio |

HSBC Multi-Asset Solutions Brochure |

|

HSBC GSP vs MPS |

HSBC Global Managed Portfolio Service Brochure |

|

HSBC Global Managed Portfolio |

|

|

HSBC Global Managed Portfolio Service Quarterly Report |

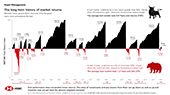

The long term history of market returns |

|

What is in our portfolios and why? |

|

|

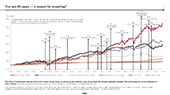

A reason for investing |

|

Importance of asset diversification |

Key risks

It is important to remember that the value of investments and any income from them can go down as well as up and is not guaranteed.

Counterparty risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations

Credit Risk: A bond or money market security could lose value if the issuer’s financial health deteriorates.

Default Risk: The issuers of certain bonds could become unwilling or unable to make payments on their bonds.

Derivatives Risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset

Emerging Markets Risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

Exchange Rate Risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly.

Interest Rate Risk: When interest rates rise, bond values generally fall. This risk of this happening is generally greater the longer the maturity of a bond investment and the higher its credit quality.

Investment Fund Risk: Investing in other funds involves certain risks an investor would not face if investing in markets directly. Governance of underlying assets can be the responsibility of third-party managers.

Investment Leverage Risk: Investment leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

Liquidity Risk: Liquidity risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors.

Operational Risk: Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things.

y

y